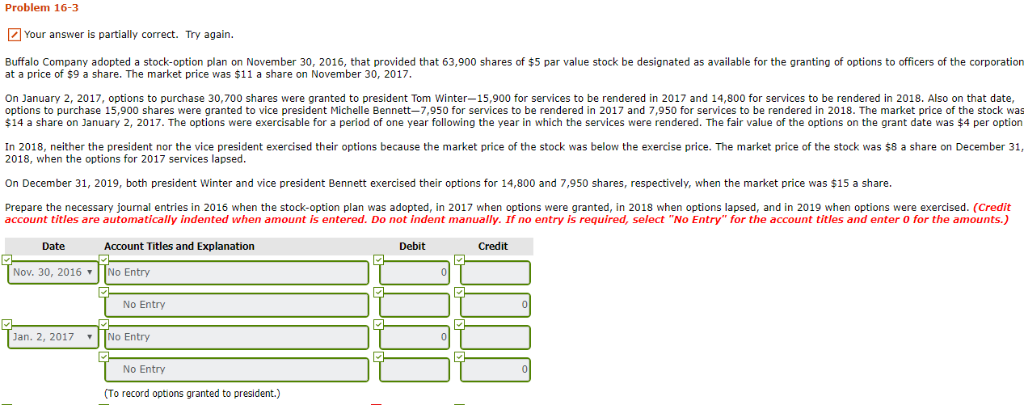

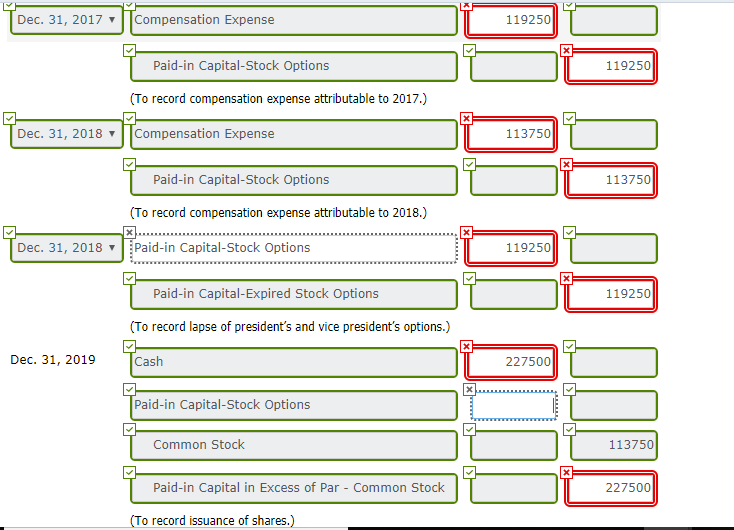

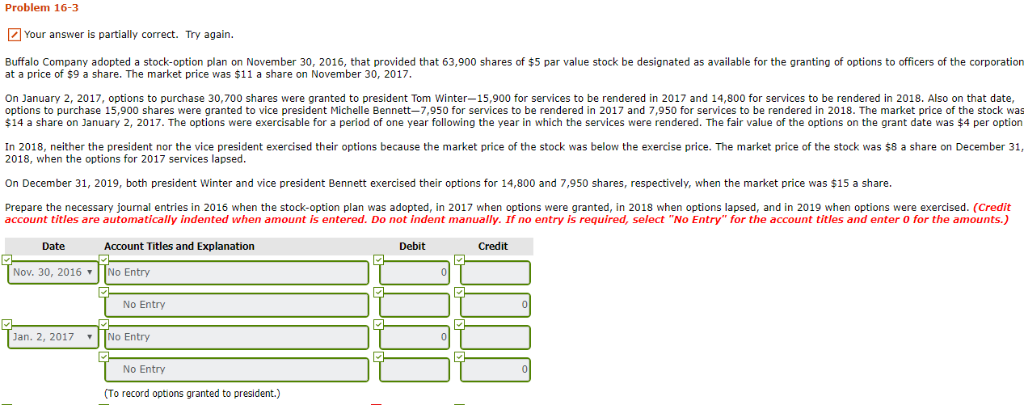

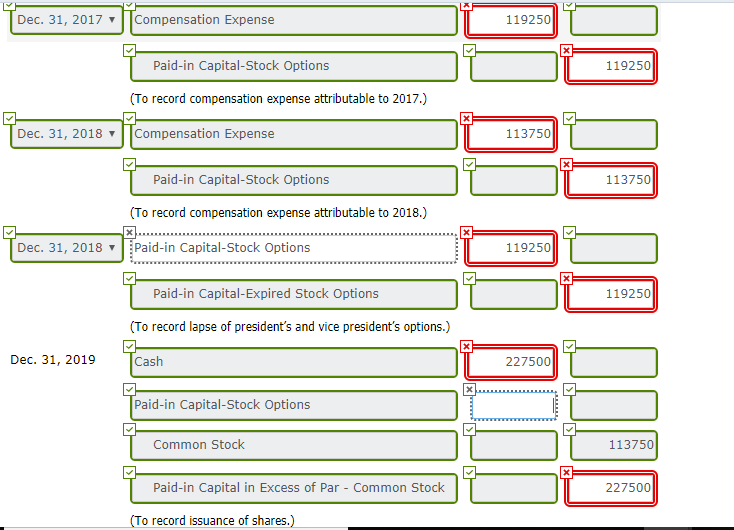

Problem 16-3 Your answer is partially correct. Try again. Buffalo Company adopted a stock-option plan on November 30, 2016, that provided that 63,900 shares of $5 par value stock be designated as available for the granting of options to officers of the corporation at a price of $9 a share. The market price was $11 a share on November 30, 2017. On January 2, 2017, options to purchase 30,700 shares were granted to president Tom Winter-15,900 for services to be rendered in 2017 and 14,800 for services to be rendered in 2018. Also on that date options to purchase 15,900 shares were granted to vice president Michelle Bennett 7,950 for services to be rendered in 2017 and 7,950 for services to be rendered in 2018. The market price of the stock was $14 a share on January 2, 2017-The options were exercisable for a period of one year following the year in which the services were rendered. The fair value of the options on the grant date was $4 per option In 2018, neither the president nor the vice president exercised their options because he market price of the stock as bel 2018, when the options for 2017 services lapsed. the exer e p Th market e of the k as hreon December 31, On December 31, 2019, both president Winter and vice president Bennett exercised their options for 14,800 and 7,950 shares, respectively, when the market price was $15 a share. Prepare the necessary journal entries in 2016 when the stock-option plan was adopted, in 2017 when options were granted, in 2018 when options lapsed, and in 2019 when options were exercised. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Nov. 30, 2016 No Entry No Entry Jan. 2, 2017 No Entry No Entry (To record options granted to president.) Dec. 31, 2017 Compensation Expense 119250 Paid-in Capital-Stock Options 119250 To record compensation expense attributable to 2017.) Dec. 31, 2018Compensation Expense 113750 Paid-in Capital-Stock Options To record compensation expense attributable to 2018.) Paid-in Capital-Stock Options 113750 Dec. 31, 2018 119250 Paid-in Capital-Expired Stock Options (To record lapse of president's and vice president's options.) Cash 119250 Dec. 31, 2019 227500 Paid-in Capital-Stock Options Common Stock 113750 Paid-in Capital in Excess of Par - Common Stock 227500 (To record issuance of shares.)