Answered step by step

Verified Expert Solution

Question

1 Approved Answer

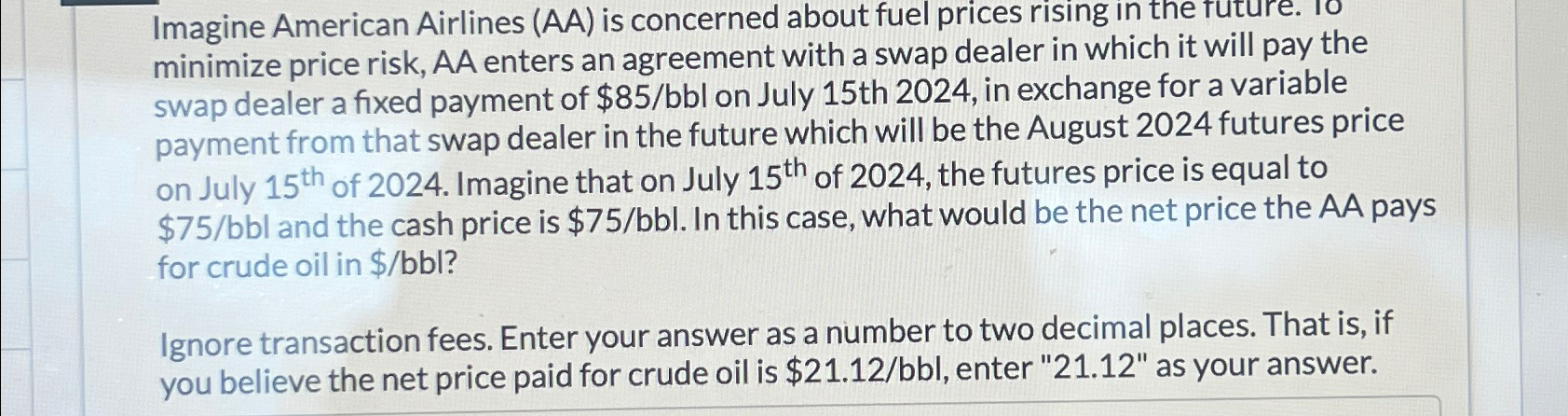

Imagine American Airlines ( AA ) is concerned about fuel prices rising in the future. To minimize price risk, AA enters an agreement with a

Imagine American Airlines AA is concerned about fuel prices rising in the future. To minimize price risk, AA enters an agreement with a swap dealer in which it will pay the swap dealer a fixed payment of $bbl on July th in exchange for a variable payment from that swap dealer in the future which will be the August futures price on July th of Imagine that on July th of the futures price is equal to $bbl and the cash price is $bbl In this case, what would be the net price the AA pays for crude oil in $bbl

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started