Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE SHOW UR WORK ON HOW TO GET HER INTEREST RATE TODAY all the options are either 1. over the limit charges 2. late payment

PLEASE SHOW UR WORK ON HOW TO GET HER INTEREST RATE TODAY

PLEASE SHOW UR WORK ON HOW TO GET HER INTEREST RATE TODAY

all the options are either

all the options are either

1. over the limit charges

2. late payment fees

3. balance transfer fees

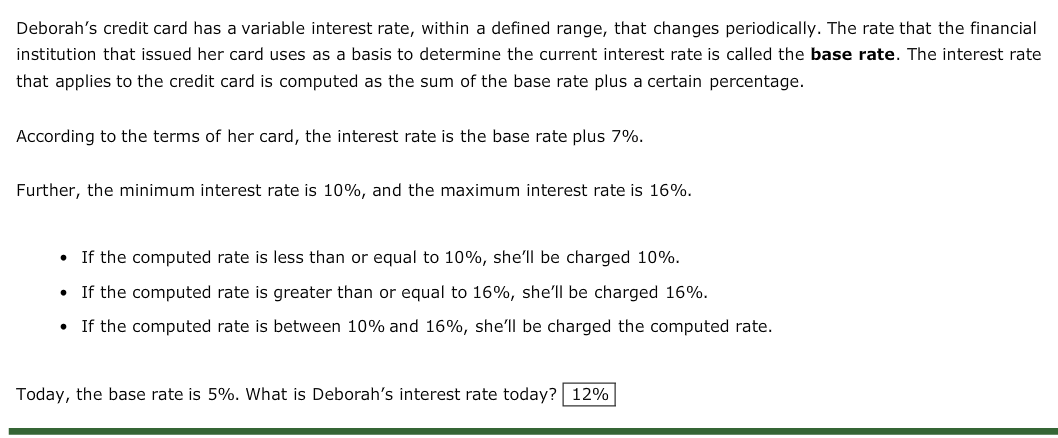

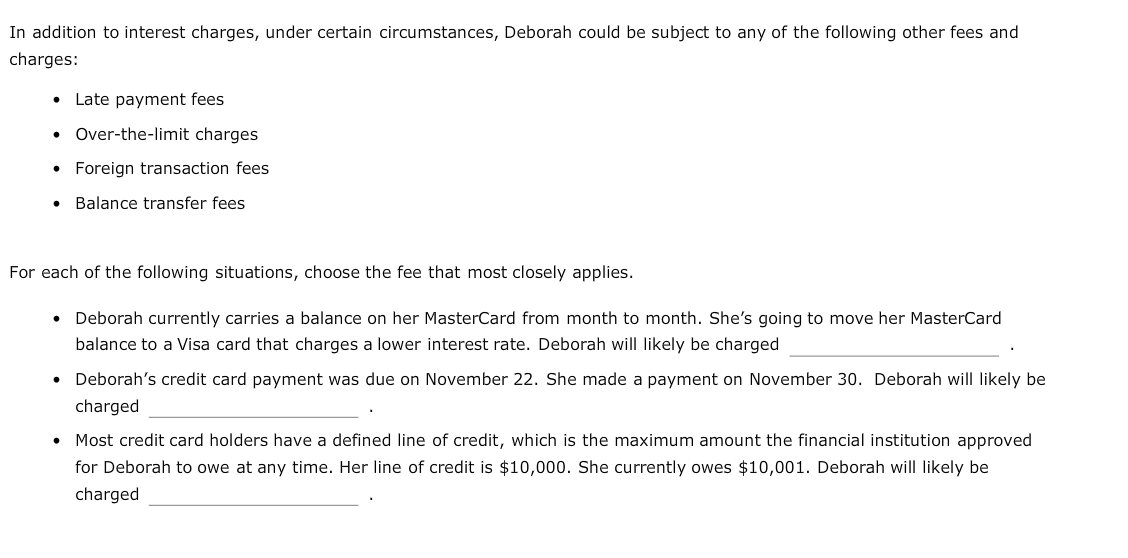

Deborah's credit card has a variable interest rate, within a defined range, that changes periodically. The rate that the financial institution that issued her card uses as a basis to determine the current interest rate is called the base rate. The interest rate that applies to the credit card is computed as the sum of the base rate plus a certain percentage. According to the terms of her card, the interest rate is the base rate plus 7%. Further, the minimum interest rate is 10%, and the maximum interest rate is 16%. If the computed rate is less than or equal to 10%, she'll be charged 10%. If the computed rate is greater than or equal to 16%, she'll be charged 16%. If the computed rate is between 10% and 16%, she'll be charged the computed rate. Today, the base rate is 5%. What is Deborah's interest rate today? 12% In addition to interest charges, under certain circumstances, Deborah could be subject to any of the following other fees and charges: Late payment fees Over-the-limit charges Foreign transaction fees Balance transfer fees For each of the following situations, choose the fee that most closely applies. Deborah currently carries a balance on her MasterCard from month to month. She's going to move her MasterCard balance to a Visa card that charges a lower interest rate. Deborah will likely be charged Deborah's credit card payment was due on November 22. She made a payment on November 30. Deborah will likely be charged Most credit card holders have a defined line of credit, which is the maximum amount the financial institution approved for Deborah to owe at any time. Her line of credit is $10,000. She currently owes $10,001. Deborah will likely be charged Deborah's credit card has a variable interest rate, within a defined range, that changes periodically. The rate that the financial institution that issued her card uses as a basis to determine the current interest rate is called the base rate. The interest rate that applies to the credit card is computed as the sum of the base rate plus a certain percentage. According to the terms of her card, the interest rate is the base rate plus 7%. Further, the minimum interest rate is 10%, and the maximum interest rate is 16%. If the computed rate is less than or equal to 10%, she'll be charged 10%. If the computed rate is greater than or equal to 16%, she'll be charged 16%. If the computed rate is between 10% and 16%, she'll be charged the computed rate. Today, the base rate is 5%. What is Deborah's interest rate today? 12% In addition to interest charges, under certain circumstances, Deborah could be subject to any of the following other fees and charges: Late payment fees Over-the-limit charges Foreign transaction fees Balance transfer fees For each of the following situations, choose the fee that most closely applies. Deborah currently carries a balance on her MasterCard from month to month. She's going to move her MasterCard balance to a Visa card that charges a lower interest rate. Deborah will likely be charged Deborah's credit card payment was due on November 22. She made a payment on November 30. Deborah will likely be charged Most credit card holders have a defined line of credit, which is the maximum amount the financial institution approved for Deborah to owe at any time. Her line of credit is $10,000. She currently owes $10,001. Deborah will likely be chargedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started