Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Imagine you are a CFP, and you must advise two clients regarding retirement planning using retirement plans based on the current year's tax and regulatory

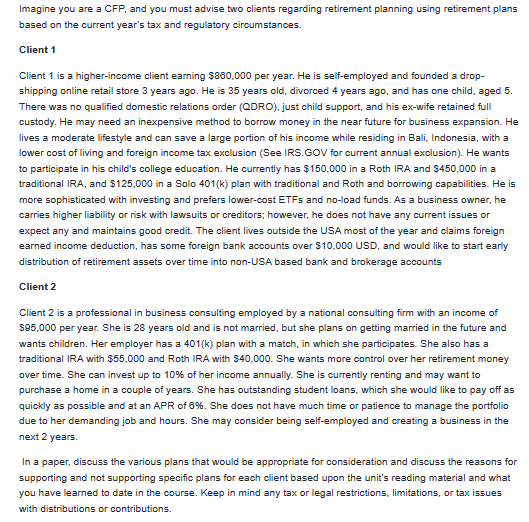

Imagine you are a CFP, and you must advise two clients regarding retirement planning using retirement plans based on the current year's tax and regulatory circumstances. Client 1 Client 1 is a higher-income client earning $860,000 per year. He is self-employed and founded a dropshipping online retail store 3 years ago. He is 35 years old, divorced 4 years ago, and has one child, aged 5 . There was no qualified domestic relations order (QDRO), just child support, and his ex-wife retained full custody. He may need an inexpensive method to borrow money in the near future for business expansion. He lives a moderate lifestyle and can save a large portion of his income while residing in Bali, Indonesia, with a lower cost of living and foreign income tax exclusion (See IRS.GOV for current annual exclusion). He wants to participate in his child's college education. He currently has $150,000 in a Roth IRA and $450,000 in a traditional IRA, and $125,000 in a Solo 401(k) plan with traditional and Roth and borrowing capabilities. He is more sophisticated with investing and prefers lower-cost ETFs and no-load funds. As a business owner, he carries higher liability or risk with lawsuits or creditors; however, he does not have any current issues or expect any and maintains good credit. The client lives outside the USA most of the year and claims foreign earned income deduction, has some foreign bank accounts over \$10,000 USD, and would like to start early distribution of retirement assets over time into non-USA based bank and brokerage accounts Client 2 Client 2 is a professional in business consulting employed by a national consulting firm with an income of $95,000 per year. She is 28 years old and is not married, but she plans on getting married in the future and wants children. Her employer has a 401(k) plan with a match, in which she participates. She also has a traditional IRA with $55,000 and Roth IRA with $40,000. She wants more control over her retirement money over time. She can invest up to 10% of her income annually. She is currently renting and may want to purchase a home in a couple of years. She has outstanding student loans, which she would like to pay off as quickly as possible and at an APR of 6%. She does not have much time or patience to manage the portfolio due to her demanding job and hours. She may consider being self-employed and creating a business in the next 2 years. In a paper, discuss the various plans that would be appropriate for consideration and discuss the reasons for supporting and not supporting specific plans for each client based upon the unit's reading material and what you have learned to date in the course. Keep in mind any tax or legal restrictions, limitations, or tax issues with distributions or contributions

Imagine you are a CFP, and you must advise two clients regarding retirement planning using retirement plans based on the current year's tax and regulatory circumstances. Client 1 Client 1 is a higher-income client earning $860,000 per year. He is self-employed and founded a dropshipping online retail store 3 years ago. He is 35 years old, divorced 4 years ago, and has one child, aged 5 . There was no qualified domestic relations order (QDRO), just child support, and his ex-wife retained full custody. He may need an inexpensive method to borrow money in the near future for business expansion. He lives a moderate lifestyle and can save a large portion of his income while residing in Bali, Indonesia, with a lower cost of living and foreign income tax exclusion (See IRS.GOV for current annual exclusion). He wants to participate in his child's college education. He currently has $150,000 in a Roth IRA and $450,000 in a traditional IRA, and $125,000 in a Solo 401(k) plan with traditional and Roth and borrowing capabilities. He is more sophisticated with investing and prefers lower-cost ETFs and no-load funds. As a business owner, he carries higher liability or risk with lawsuits or creditors; however, he does not have any current issues or expect any and maintains good credit. The client lives outside the USA most of the year and claims foreign earned income deduction, has some foreign bank accounts over \$10,000 USD, and would like to start early distribution of retirement assets over time into non-USA based bank and brokerage accounts Client 2 Client 2 is a professional in business consulting employed by a national consulting firm with an income of $95,000 per year. She is 28 years old and is not married, but she plans on getting married in the future and wants children. Her employer has a 401(k) plan with a match, in which she participates. She also has a traditional IRA with $55,000 and Roth IRA with $40,000. She wants more control over her retirement money over time. She can invest up to 10% of her income annually. She is currently renting and may want to purchase a home in a couple of years. She has outstanding student loans, which she would like to pay off as quickly as possible and at an APR of 6%. She does not have much time or patience to manage the portfolio due to her demanding job and hours. She may consider being self-employed and creating a business in the next 2 years. In a paper, discuss the various plans that would be appropriate for consideration and discuss the reasons for supporting and not supporting specific plans for each client based upon the unit's reading material and what you have learned to date in the course. Keep in mind any tax or legal restrictions, limitations, or tax issues with distributions or contributions Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started