Answered step by step

Verified Expert Solution

Question

1 Approved Answer

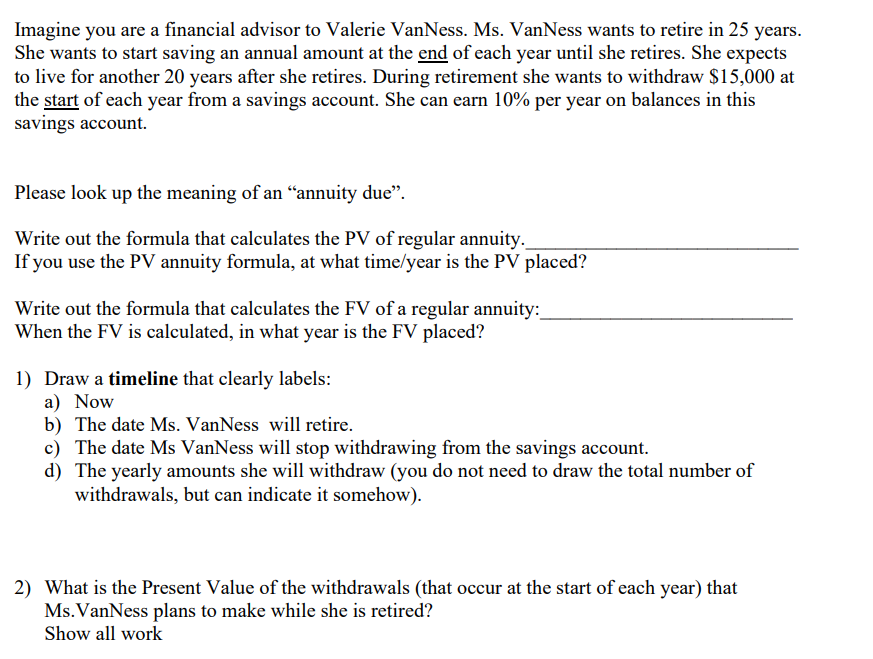

Imagine you are a financial advisor to Valerie VanNess. Ms . VanNess wants to retire in 2 5 years. She wants to start saving an

Imagine you are a financial advisor to Valerie VanNess. Ms VanNess wants to retire in years.

She wants to start saving an annual amount at the end of each year until she retires. She expects

to live for another years after she retires. During retirement she wants to withdraw $ at

the start of each year from a savings account. She can earn per year on balances in this

savings account.

Please look up the meaning of an "annuity due".

Write out the formula that calculates the PV of regular annuity.

If you use the PV annuity formula, at what timeyear is the PV placea!

Write out the formula that calculates the FV of a regular annuity:

When the FV is calculated, in what year is the FV placed?

Draw a timeline that clearly labels:

a Now

b The date Ms VanNess will retire.

c The date Ms VanNess will stop withdrawing from the savings account.

d The yearly amounts she will withdraw you do not need to draw the total number of

withdrawals, but can indicate it somehow

What is the Present Value of the withdrawals that occur at the start of each year that

MsVanNess plans to make while she is retired?

Show all work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started