Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Imagine you are an accountant advising the Board of Directors of Harvey Norman (ASX: HVN.AX). Utilising 2019, 2020, 2021, and 2022 financial statements contained in

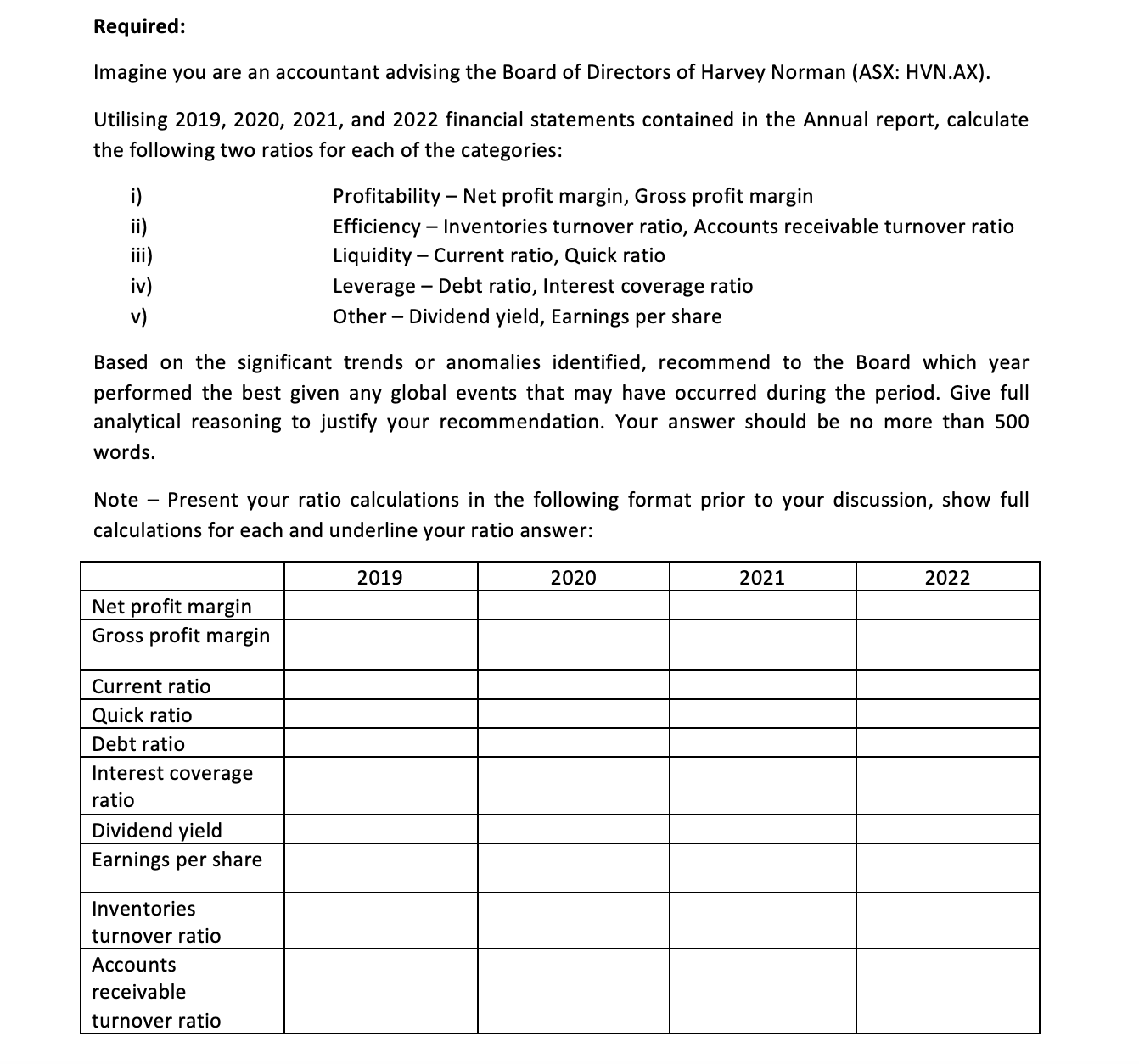

Imagine you are an accountant advising the Board of Directors of Harvey Norman (ASX: HVN.AX). Utilising 2019, 2020, 2021, and 2022 financial statements contained in the Annual report, calculate the following two ratios for each of the categories: i)ii)iii)iv)v)Profitability-Netprofitmargin,GrossprofitmarginEfficiency-Inventoriesturnoverratio,AccountsreceivableturnoverratioLiquidity-Currentratio,QuickratioLeverage-Debtratio,InterestcoverageratioOther-Dividendyield,Earningspershare Based on the significant trends or anomalies identified, recommend to the Board which year performed the best given any global events that may have occurred during the period. Give full analytical reasoning to justify your recommendation. Your answer should be no more than 500 words. Note - Present your ratio calculations in the following format prior to your discussion, show full calculations for each and underline your ratio answer: Imagine you are an accountant advising the Board of Directors of Harvey Norman (ASX: HVN.AX). Utilising 2019, 2020, 2021, and 2022 financial statements contained in the Annual report, calculate the following two ratios for each of the categories: i)ii)iii)iv)v)Profitability-Netprofitmargin,GrossprofitmarginEfficiency-Inventoriesturnoverratio,AccountsreceivableturnoverratioLiquidity-Currentratio,QuickratioLeverage-Debtratio,InterestcoverageratioOther-Dividendyield,Earningspershare Based on the significant trends or anomalies identified, recommend to the Board which year performed the best given any global events that may have occurred during the period. Give full analytical reasoning to justify your recommendation. Your answer should be no more than 500 words. Note - Present your ratio calculations in the following format prior to your discussion, show full calculations for each and underline your ratio

Imagine you are an accountant advising the Board of Directors of Harvey Norman (ASX: HVN.AX). Utilising 2019, 2020, 2021, and 2022 financial statements contained in the Annual report, calculate the following two ratios for each of the categories: i)ii)iii)iv)v)Profitability-Netprofitmargin,GrossprofitmarginEfficiency-Inventoriesturnoverratio,AccountsreceivableturnoverratioLiquidity-Currentratio,QuickratioLeverage-Debtratio,InterestcoverageratioOther-Dividendyield,Earningspershare Based on the significant trends or anomalies identified, recommend to the Board which year performed the best given any global events that may have occurred during the period. Give full analytical reasoning to justify your recommendation. Your answer should be no more than 500 words. Note - Present your ratio calculations in the following format prior to your discussion, show full calculations for each and underline your ratio answer: Imagine you are an accountant advising the Board of Directors of Harvey Norman (ASX: HVN.AX). Utilising 2019, 2020, 2021, and 2022 financial statements contained in the Annual report, calculate the following two ratios for each of the categories: i)ii)iii)iv)v)Profitability-Netprofitmargin,GrossprofitmarginEfficiency-Inventoriesturnoverratio,AccountsreceivableturnoverratioLiquidity-Currentratio,QuickratioLeverage-Debtratio,InterestcoverageratioOther-Dividendyield,Earningspershare Based on the significant trends or anomalies identified, recommend to the Board which year performed the best given any global events that may have occurred during the period. Give full analytical reasoning to justify your recommendation. Your answer should be no more than 500 words. Note - Present your ratio calculations in the following format prior to your discussion, show full calculations for each and underline your ratio Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started