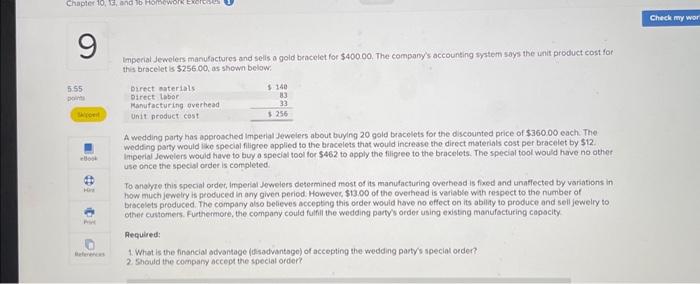

Imperial Jewelers manufactures and selis o gold beacelet for $40000. The company's accounsing systern says the unit product cost for this bracelet is $25600, as shown below. A wedding party has approsched Impetial Jewelers about buylng 20 gold bracolets for the discounted price of $360.00 each. The wedding party would ise special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $12. use once the special arder is completed To anoyge this spocial ordet, Imperial Jewelers defermined most of its manufacturing overhesd is fixed and unatlected by variations in how much jewelry is produced in any givea peried. However, $13.00 of the overhead is vatiable with respect to the number of brbcelets produced. The compary also betieves accepting this order would have no offect on its ability to produce and sell jeweiry to othet cutomers. Furthermore, the company could fulfill the wedding party's order using existing manufocturing copocity. Aequired: 1. What is the financial advantage (disadvantogo) of accepting the wedding partys speciat order? 2 Should the compary accept the speciat ordere Imperial Jewelers manufactures and selis o gold beacelet for $40000. The company's accounsing systern says the unit product cost for this bracelet is $25600, as shown below. A wedding party has approsched Impetial Jewelers about buylng 20 gold bracolets for the discounted price of $360.00 each. The wedding party would ise special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $12. use once the special arder is completed To anoyge this spocial ordet, Imperial Jewelers defermined most of its manufacturing overhesd is fixed and unatlected by variations in how much jewelry is produced in any givea peried. However, $13.00 of the overhead is vatiable with respect to the number of brbcelets produced. The compary also betieves accepting this order would have no offect on its ability to produce and sell jeweiry to othet cutomers. Furthermore, the company could fulfill the wedding party's order using existing manufocturing copocity. Aequired: 1. What is the financial advantage (disadvantogo) of accepting the wedding partys speciat order? 2 Should the compary accept the speciat ordere