Answered step by step

Verified Expert Solution

Question

1 Approved Answer

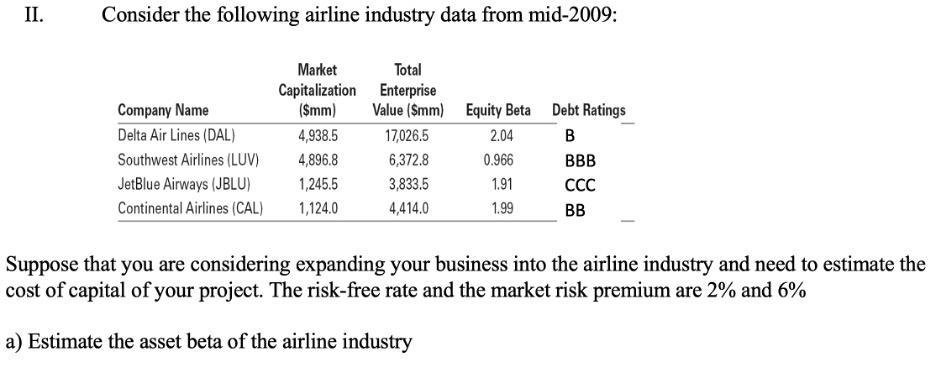

II. Consider the following airline industry data from mid-2009: Company Name Delta Air Lines (DAL) Southwest Airlines (LUV) JetBlue Airways (JBLU) Continental Airlines (CAL)

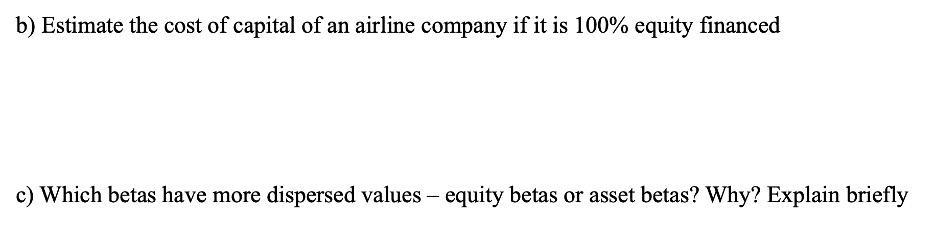

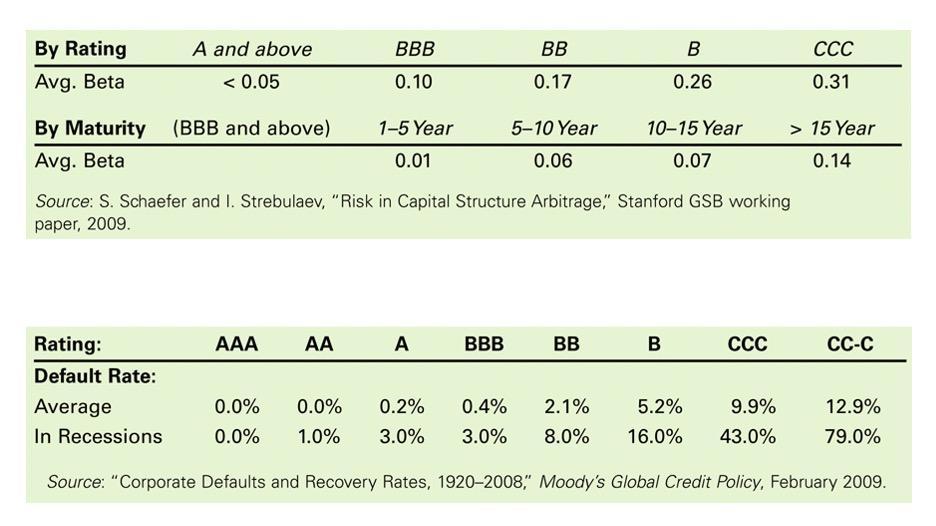

II. Consider the following airline industry data from mid-2009: Company Name Delta Air Lines (DAL) Southwest Airlines (LUV) JetBlue Airways (JBLU) Continental Airlines (CAL) Market Capitalization ($mm) 4,938.5 4,896.8 1,245.5 1,124.0 Total Enterprise Value ($mm) Equity Beta 17,026.5 6,372.8 3,833.5 4,414.0 2.04 0.966 1.91 1.99 Debt Ratings B BBB CCC BB Suppose that you are considering expanding your business into the airline industry and need to estimate the cost of capital of your project. The risk-free rate and the market risk premium are 2% and 6% a) Estimate the asset beta of the airline industry b) Estimate the cost of capital of an airline company if it is 100% equity financed c) Which betas have more dispersed values - equity betas or asset betas? Why? Explain briefly By Rating Avg. Beta By Maturity Avg. Beta A and above < 0.05 (BBB and above) Rating: Default Rate: Average In Recessions BBB 0.10 AAA AA 1-5 Year 0.01 BB 0.17 A 5-10 Year 0.06 Source: S. Schaefer and I. Strebulaev, "Risk in Capital Structure Arbitrage, Stanford GSB working paper, 2009. B 0.26 10-15 Year 0.07 BBB BB B CCC CCC 0.31 > 15 Year 0.14 CC-C 0.2% 0.4% 2.1% 5.2% 9.9% 0.0% 0.0% 0.0% 1.0% 3.0% 3.0% 8.0% 16.0% 43.0% Source: "Corporate Defaults and Recovery Rates, 1920-2008," Moody's Global Credit Policy, February 2009. 12.9% 79.0%

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Question c Asset beta Unlevered beta and Livered beta equity beta Leveraged and un...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started