Question

Imran owns a business that operates from rented premises. He has a 10-year lease on the premises and he paid a premium of 7,000 on

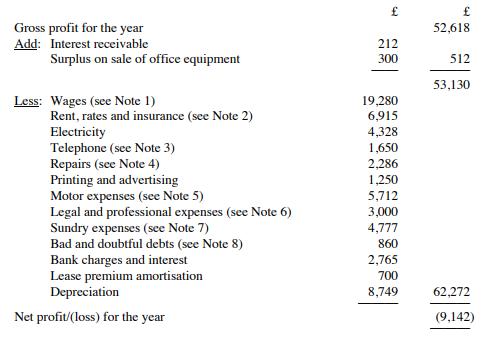

Imran owns a business that operates from rented premises. He has a 10-year lease on the premises and he paid a premium of £7,000 on 1 January 2020 in order to renew this lease. His income statement for the year to 31 December 2020 is as follows:

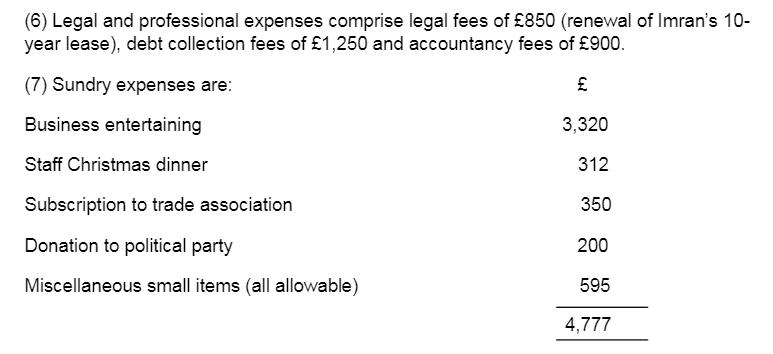

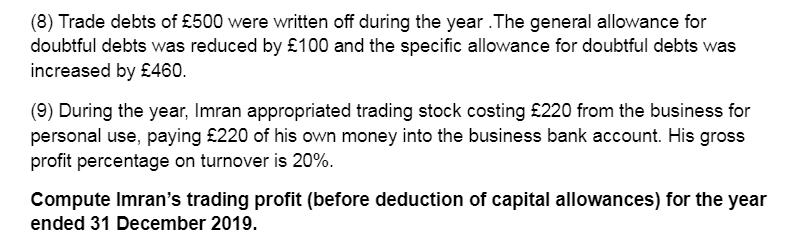

Notes:

1. Wages include £5,800 for Imran's wife (who works part-time for the business) and £1,000 for his son (a student who does not work for the business at all). Also included in wages are Imran's personal income tax and personal National Insurance contributions totaling £3,524.

2. Insurance includes Imran's private medical insurance premium of £405.

3. It has been agreed that one-sixth of telephone costs relate to private use.

4. Repairs include £750 for the cost of essential repairs to a newly-acquired secondhand forklift truck which could not be used until the repairs had been carried out.

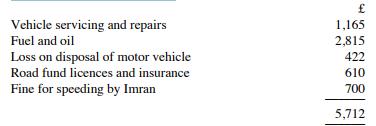

5. Motor expenses are as follows:

It has been agreed that one-tenth of motor expenses relate to private use.

It has been agreed that one-tenth of motor expenses relate to private use.

Gross profit for the year Add: Interest receivable Surplus on sale of office equipment Less: Wages (see Note 1) Rent, rates and insurance (see Note 2) Electricity Telephone (see Note 3) Repairs (see Note 4) Printing and advertising Motor expenses (see Note 5) Legal and professional expenses (see Note 6) Sundry expenses (see Note 7) Bad and doubtful debts (see Note 8) Bank charges and interest Lease premium amortisation Depreciation Net profit/(loss) for the year 1. 212 300 19,280 6,915 4,328 1,650 2,286 1,250 5,712 3,000 4,777 860 2,765 700 8,749 52,618 512 53,130 62,272 (9,142)

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Imrans trading profit for the year ended 31 December 2019 is 40818 Gross profit for the year is 5261...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started