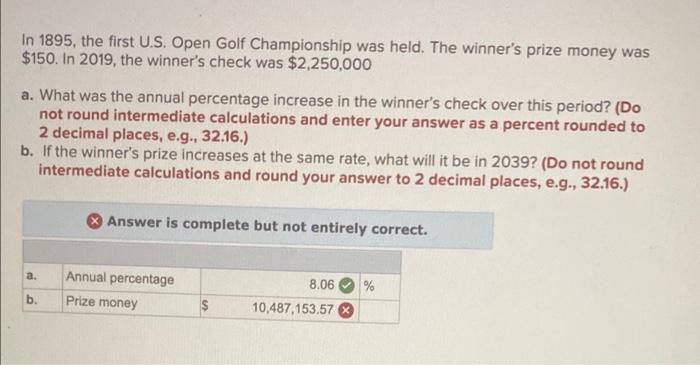

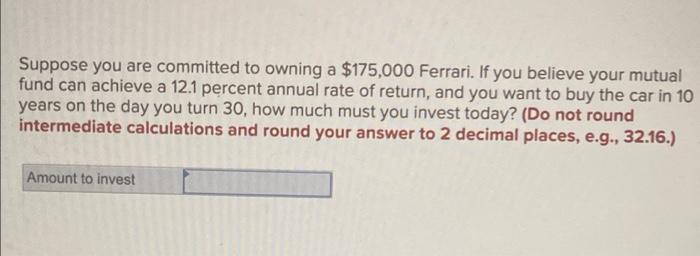

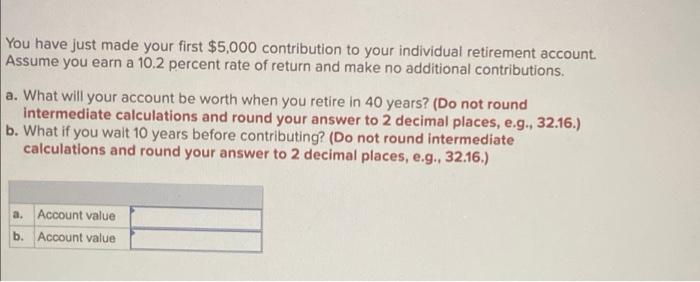

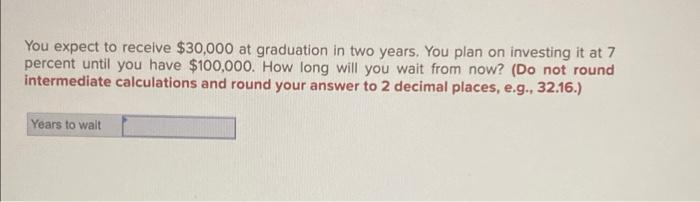

In 1895, the first U.S. Open Golf Championship was held. The winner's prize money was $150. In 2019, the winner's check was $2,250,000 a. What was the annual percentage increase in the winner's check over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If the winner's prize increases at the same rate, what will it be in 2039? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. b. Answer is complete but not entirely correct. Annual percentage Prize money 8.06 10,487,153.57 % Suppose you are committed to owning a $175,000 Ferrari. If you believe your mutual fund can achieve a 12.1 percent annual rate of return, and you want to buy the car in 10 years on the day you turn 30, how much must you invest today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Amount to invest You have just made your first $5,000 contribution to your individual retirement account. Assume you earn a 10.2 percent rate of return and make no additional contributions. a. What will your account be worth when you retire in 40 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What if you wait 10 years before contributing? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Account value b. Account value You expect to receive $30,000 at graduation in two years. You plan on investing it at 7 percent until you have $100,000. How long will you wait from now? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Years to wait You have decided that you want to be a millionaire when you retire in 40 years. a. If you can earn an annual return of 11.4 percent, how much do you have to invest today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What if you can earn 5.7 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Investment b. Investment You have $20,000 you want to invest for the next 40 years. You are offered an investment plan that will pay you 6 percent per year for the next 20 years and 12 percent per year for the last 20 years. a. How much will you have at the end of the 40 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. If the investment plan pays you 12 percent per year for the first 20 years and 6 percent per year for the next 20 years, how much will you have at the end of the 40 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Amount b. Amount