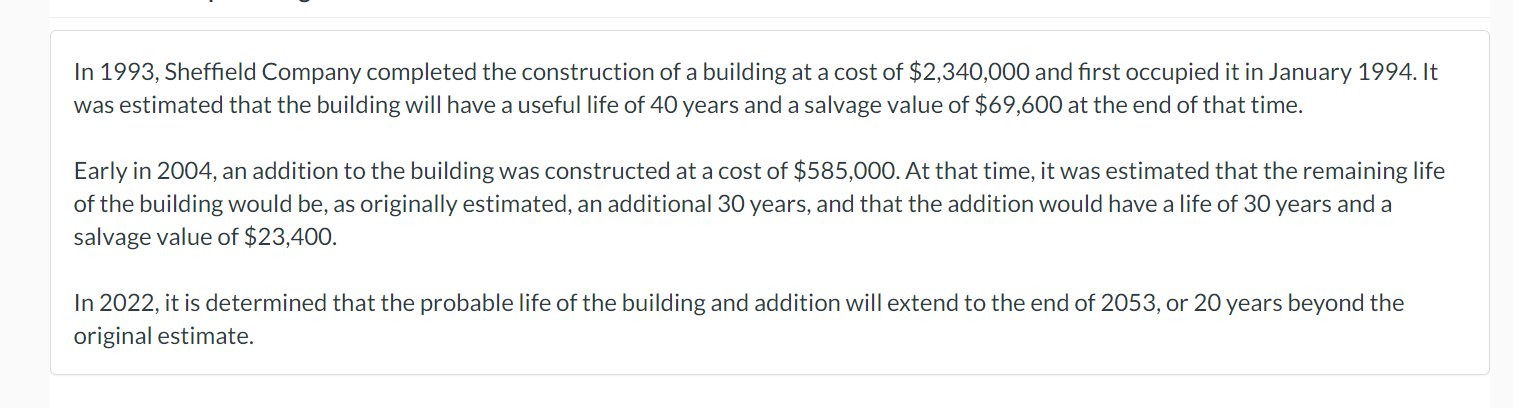

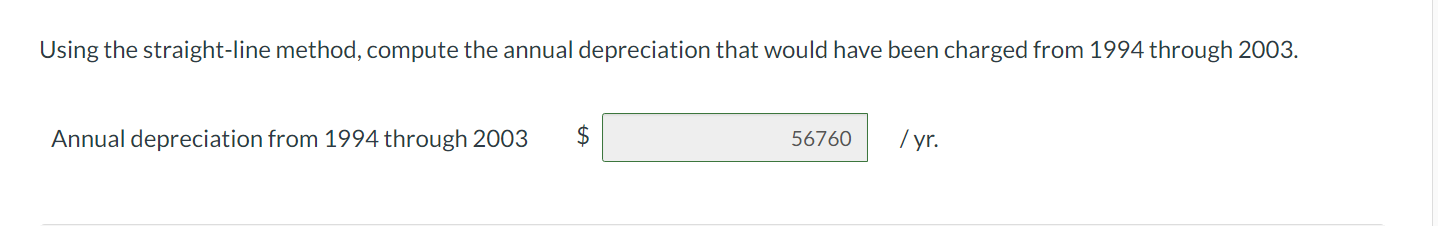

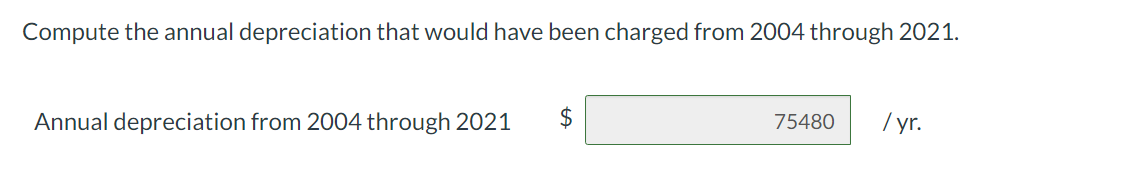

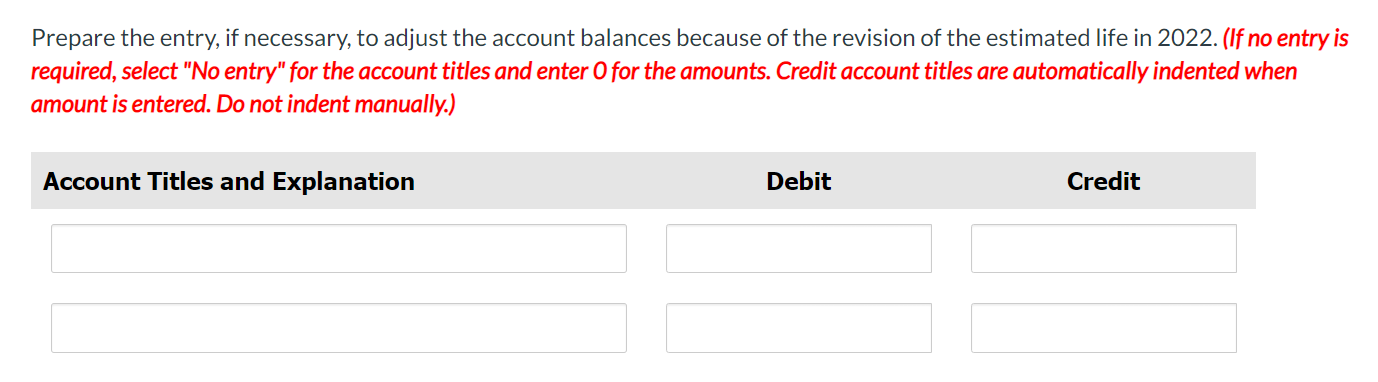

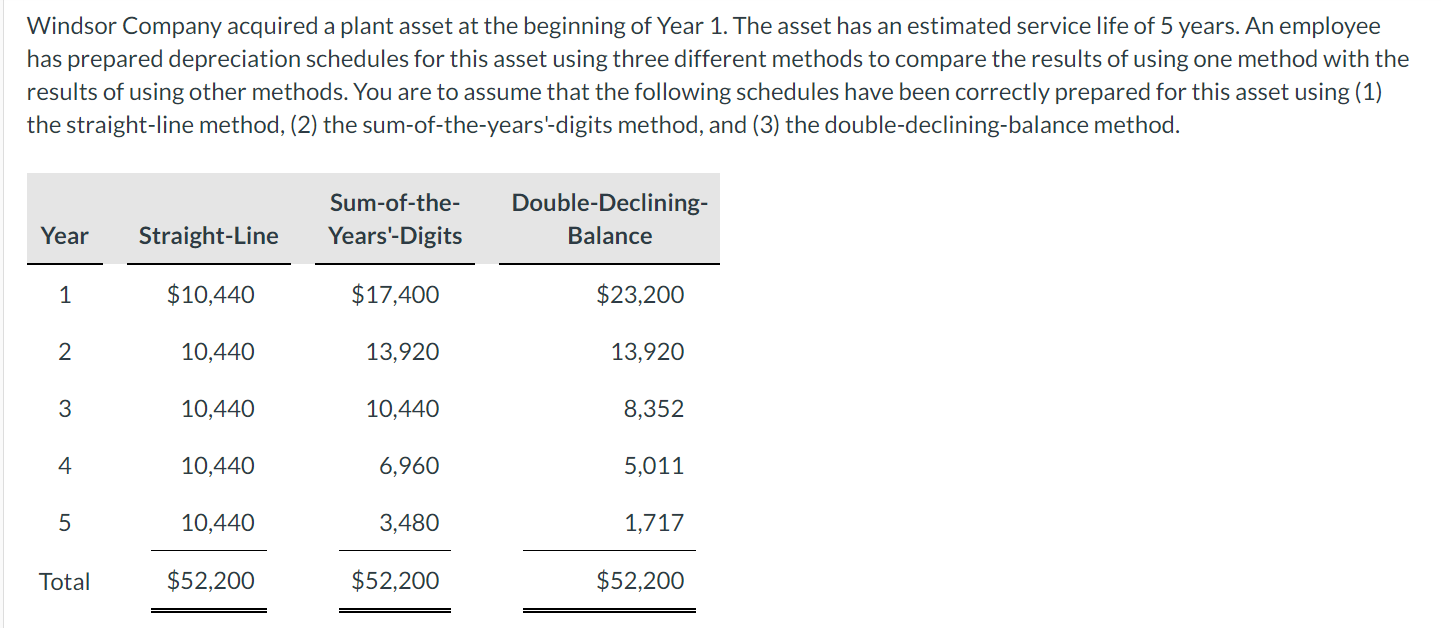

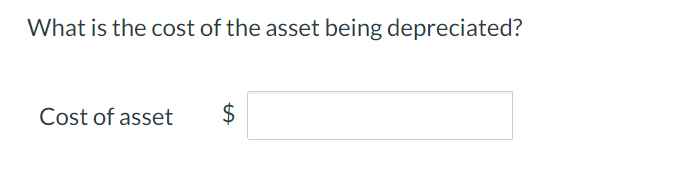

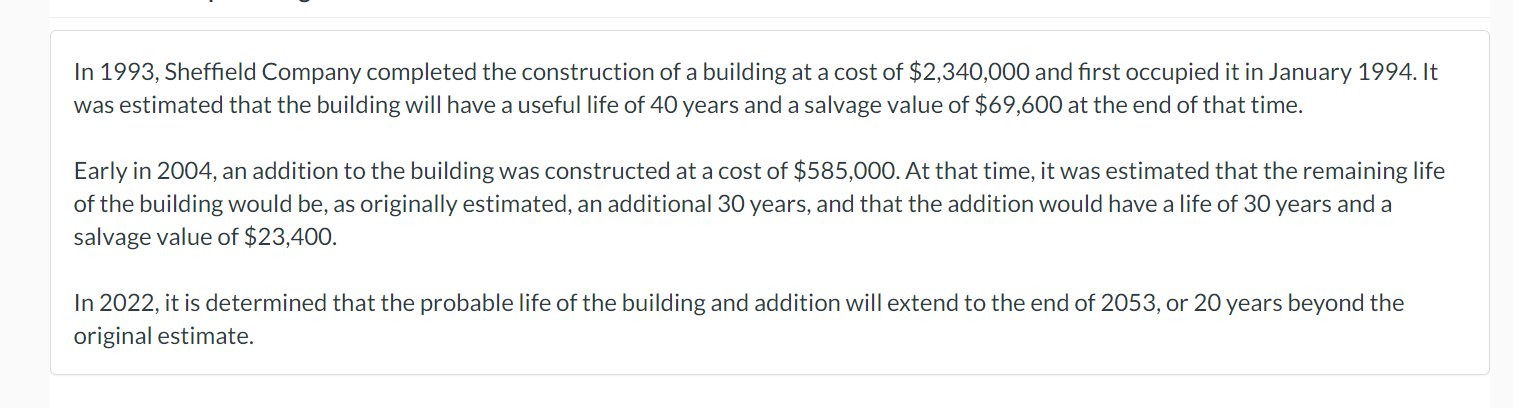

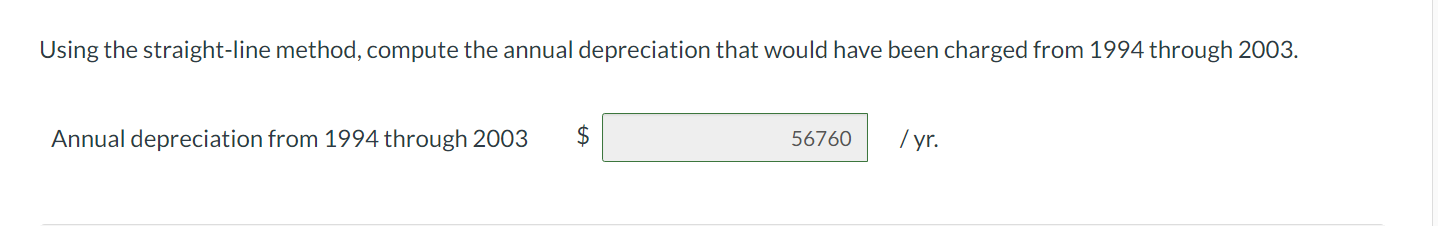

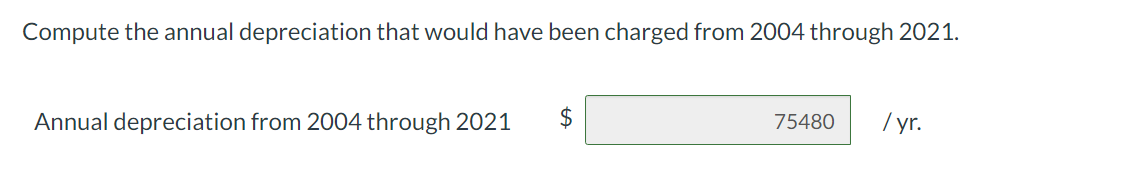

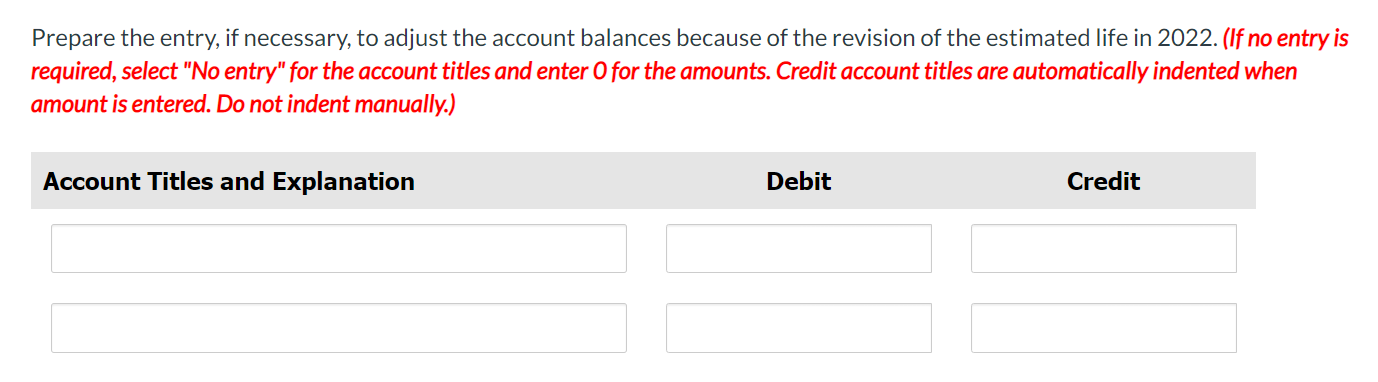

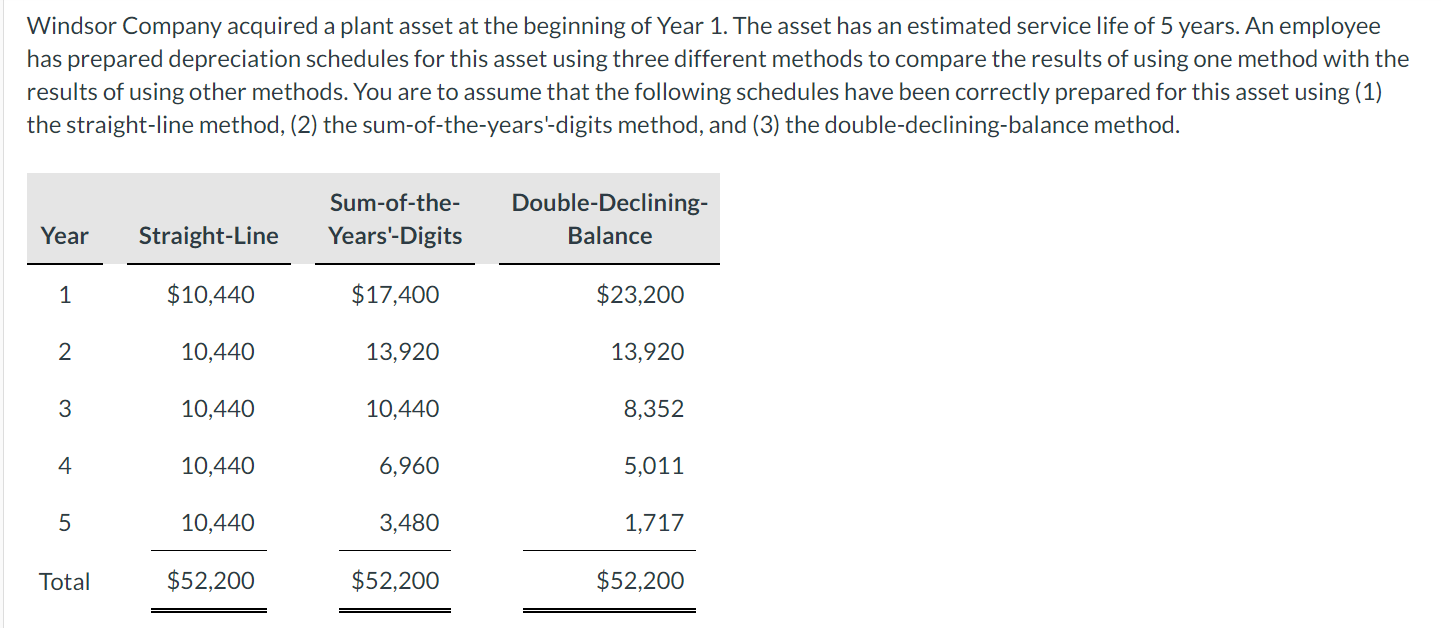

In 1993, Sheffield Company completed the construction of a building at a cost of $2,340,000 and first occupied it in January 1994. It was estimated that the building will have a useful life of 40 years and a salvage value of $69,600 at the end of that time. Early in 2004, an addition to the building was constructed at a cost of $585,000. At that time, it was estimated that the remaining life of the building would be, as originally estimated, an additional 30 years, and that the addition would have a life of 30 years and a salvage value of $23,400. In 2022, it is determined that the probable life of the building and addition will extend to the end of 2053, or 20 years beyond the original estimate. Using the straight-line method, compute the annual depreciation that would have been charged from 1994 through 2003. Annual depreciation from 1994 through 2003 $ 56760 / yr. Compute the annual depreciation that would have been charged from 2004 through 2021. Annual depreciation from 2004 through 2021 $ 75480 /yr. Prepare the entry, if necessary, to adjust the account balances because of the revision of the estimated life in 2022. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Windsor Company acquired a plant asset at the beginning of Year 1. The asset has an estimated service life of 5 years. An employee has prepared depreciation schedules for this asset using three different methods to compare the results of using one method with the results of using other methods. You are to assume that the following schedules have been correctly prepared for this asset using (1) the straight-line method, (2) the sum-of-the-years'-digits method, and (3) the double-declining-balance method. Sum-of-the- Years'-Digits Double-Declining- Balance Year Straight-Line 1 $10,440 $17,400 $23,200 2 10,440 13,920 13,920 3 10,440 10,440 8,352 4. 10,440 6,960 5,011 5 10,440 3,480 1,717 Total $52,200 $52,200 $52,200 What is the cost of the asset being depreciated? Cost of asset ta $