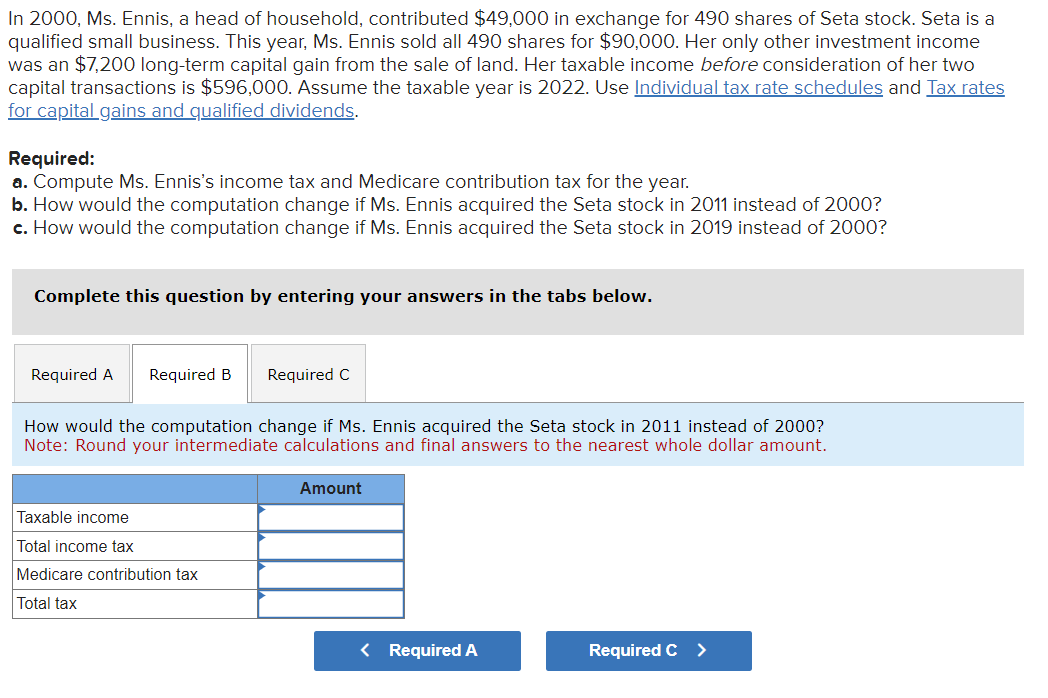

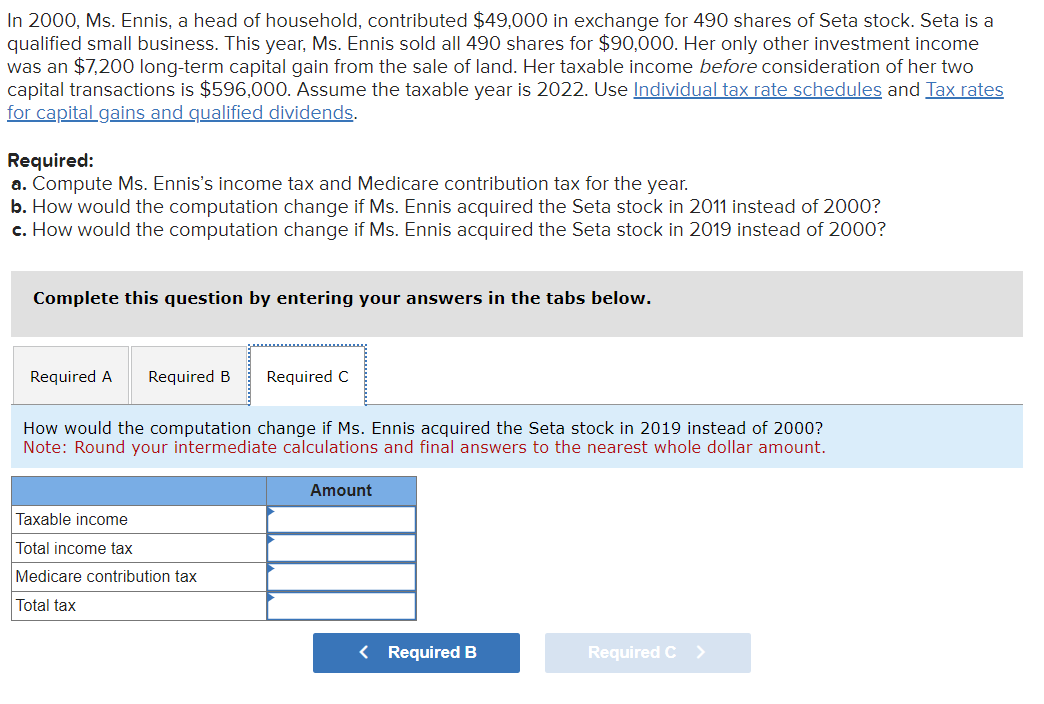

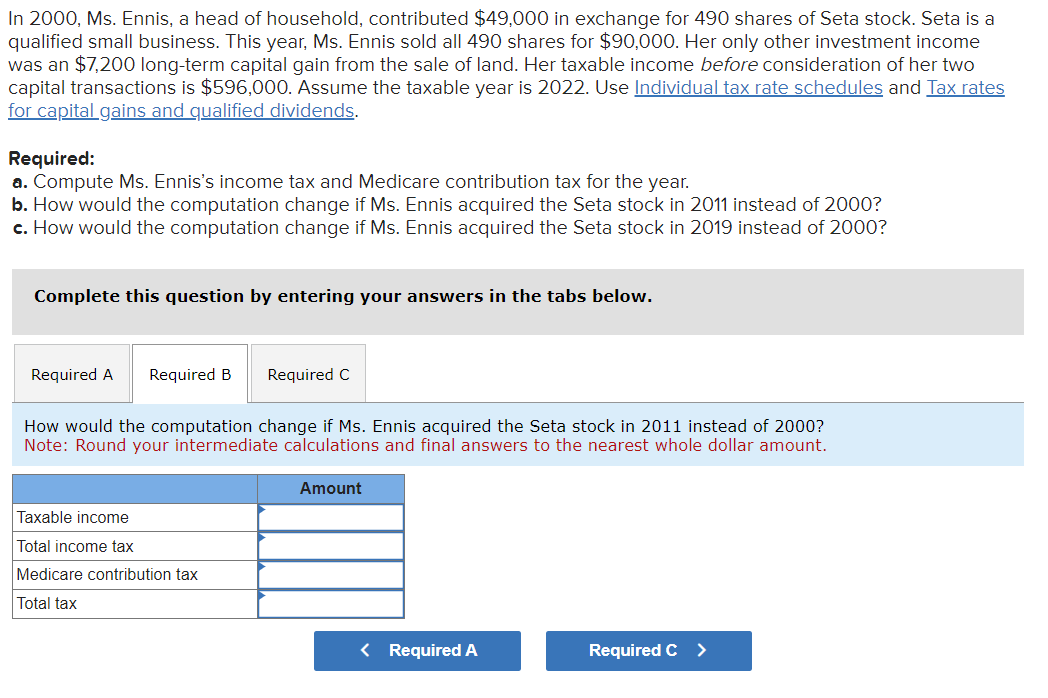

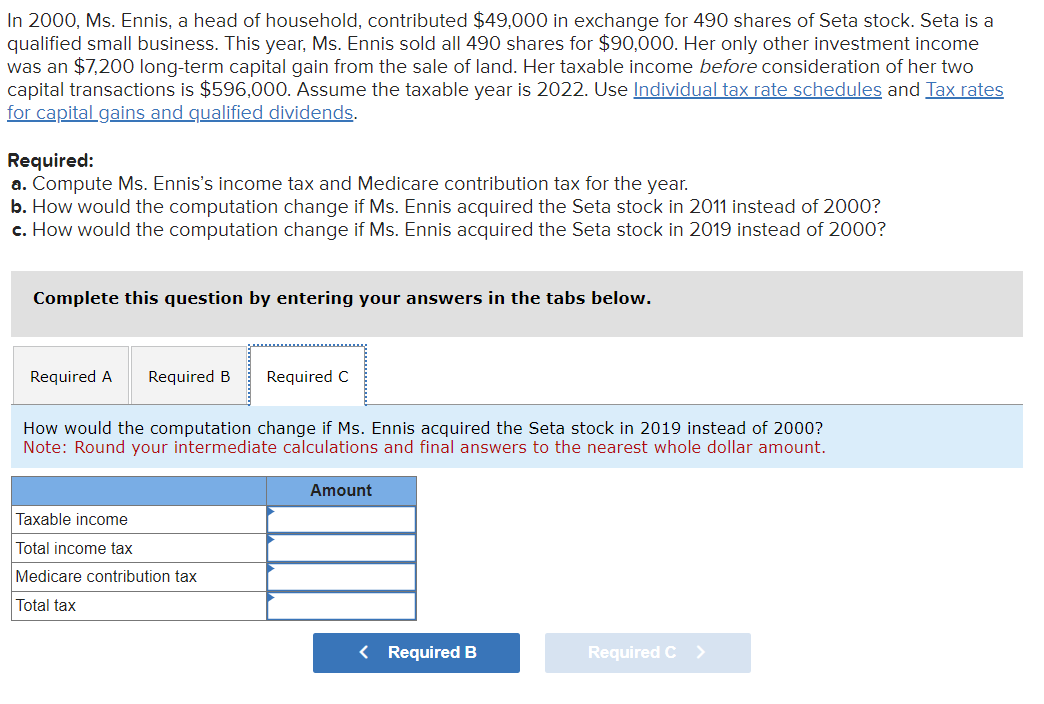

In 2000 , Ms. Ennis, a head of household, contributed $49,000 in exchange for 490 shares of Seta stock. Seta is a qualified small business. This year, Ms. Ennis sold all 490 shares for $90,000. Her only other investment income was an $7,200 long-term capital gain from the sale of land. Her taxable income before consideration of her two capital transactions is $596,000. Assume the taxable year is 2022. Use Individual tax rate schedules and Tax rates for capital gains and qualified dividends. Required: a. Compute Ms. Ennis's income tax and Medicare contribution tax for the year. b. How would the computation change if Ms. Ennis acquired the Seta stock in 2011 instead of 2000 ? c. How would the computation change if Ms. Ennis acquired the Seta stock in 2019 instead of 2000 ? Complete this question by entering your answers in the tabs below. How would the computation change if Ms. Ennis acquired the Seta stock in 2011 instead of 2000? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. In 2000, Ms. Ennis, a head of household, contributed $49,000 in exchange for 490 shares of Seta stock. Seta is a qualified small business. This year, Ms. Ennis sold all 490 shares for $90,000. Her only other investment income was an $7,200 long-term capital gain from the sale of land. Her taxable income before consideration of her two capital transactions is $596,000. Assume the taxable year is 2022 . Use IndividualtaxrateschedulesandTaxrates for capital gains and qualified dividends. Required: a. Compute Ms. Ennis's income tax and Medicare contribution tax for the year. b. How would the computation change if Ms. Ennis acquired the Seta stock in 2011 instead of 2000 ? c. How would the computation change if Ms. Ennis acquired the Seta stock in 2019 instead of 2000 ? Complete this question by entering your answers in the tabs below. How would the computation change if Ms. Ennis acquired the Seta stock in 2019 instead of 2000 ? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount