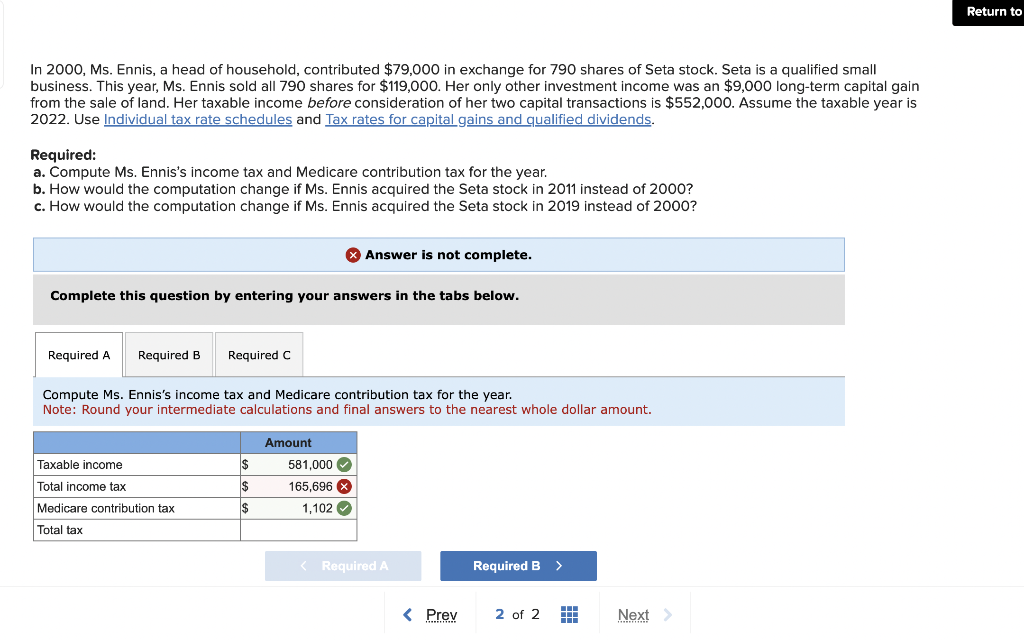

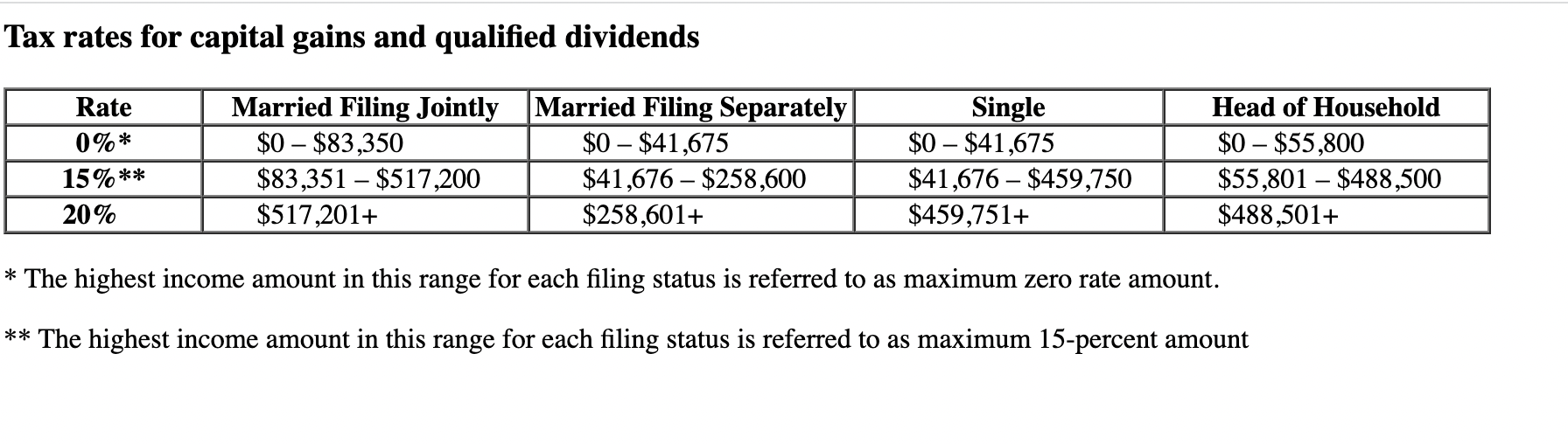

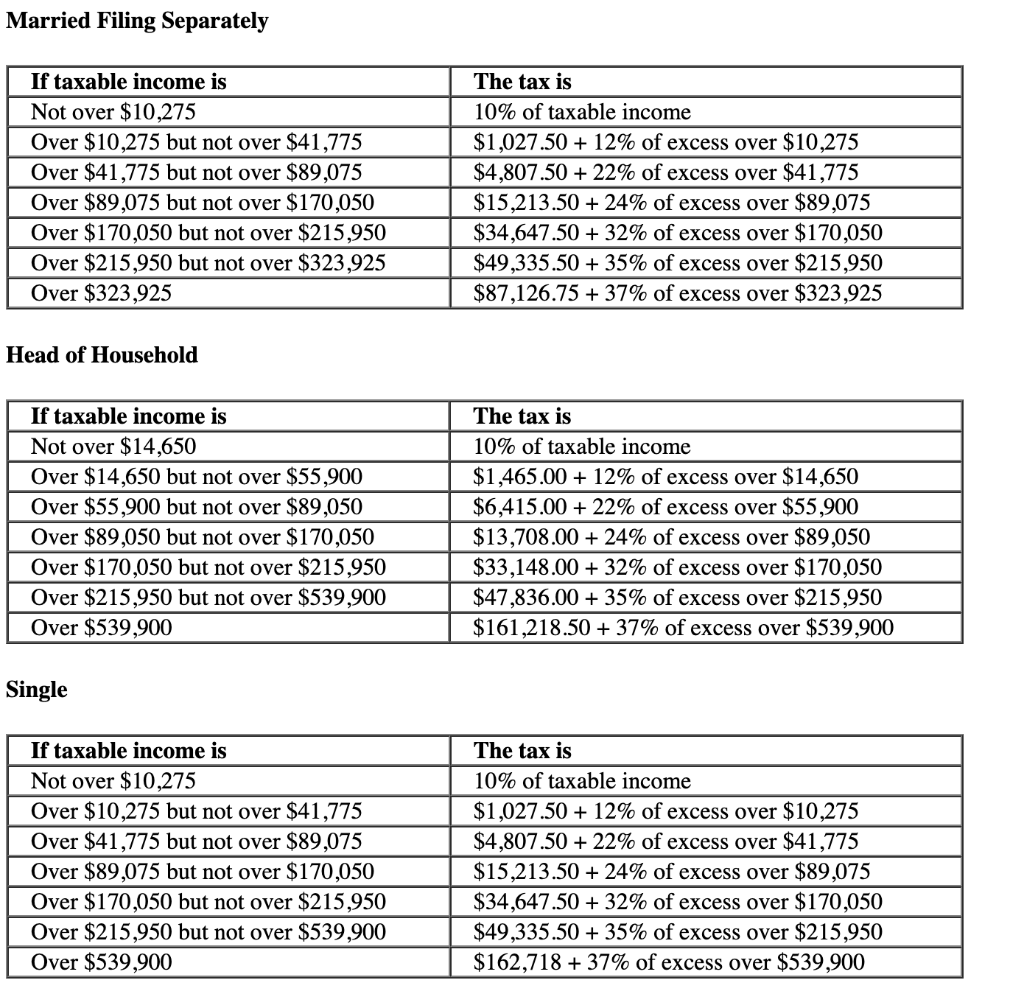

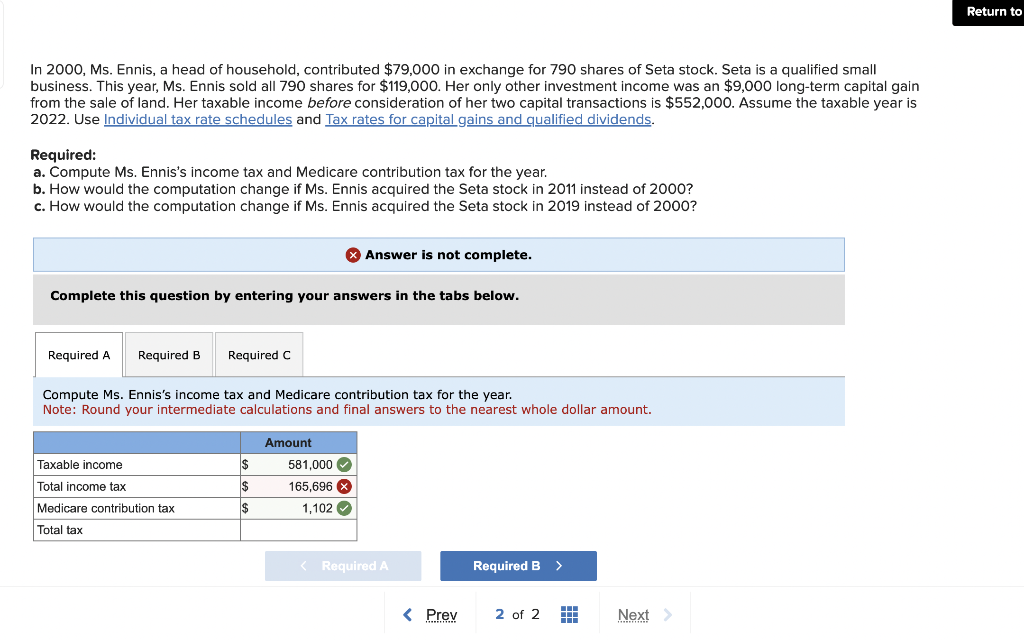

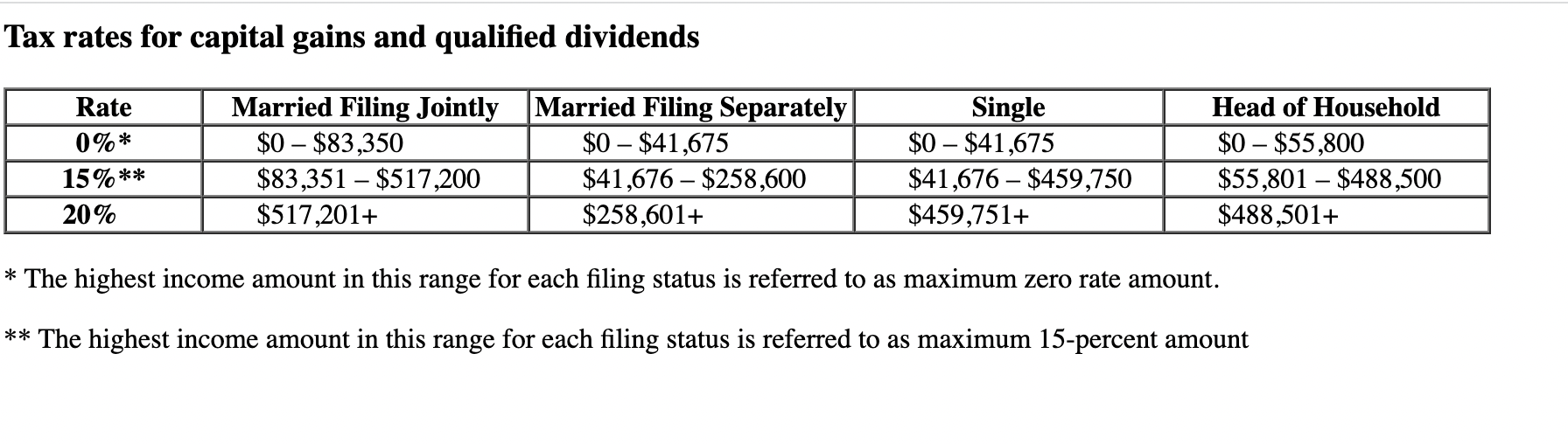

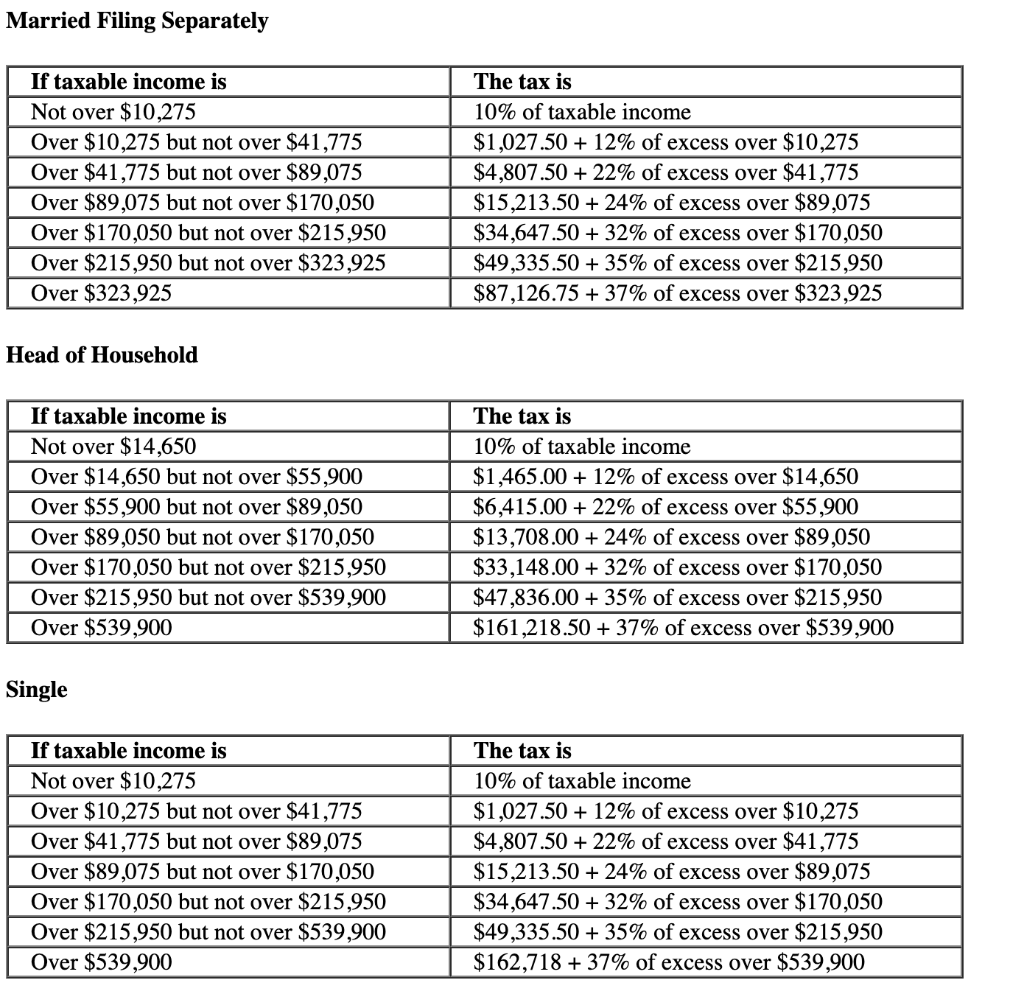

In 2000, Ms. Ennis, a head of household, contributed $79,000 in exchange for 790 shares of Seta stock. Seta is a qualified small business. This year, Ms. Ennis sold all 790 shares for $119,000. Her only other investment income was an $9,000 long-term capital gain from the sale of land. Her taxable income before consideration of her two capital transactions is $552,000. Assume the taxable year is 2022. Use and Tax rates for capital gains and qualified dividends. Required: a. Compute Ms. Ennis's income tax and Medicare contribution tax for the year. b. How would the computation change if Ms. Ennis acquired the Seta stock in 2011 instead of 2000 ? c. How would the computation change if Ms. Ennis acquired the Seta stock in 2019 instead of 2000 ? Answer is not complete. Complete this question by entering your answers in the tabs below. Compute Ms. Ennis's income tax and Medicare contribution tax for the year. Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Tax rates for capital gains and qualified dividends * The highest income amount in this range for each filing status is referred to as maximum zero rate amount. ** The highest income amount in this range for each filing status is referred to as maximum 15 -percent amount Married Filing Separately Head of Household Single In 2000, Ms. Ennis, a head of household, contributed $79,000 in exchange for 790 shares of Seta stock. Seta is a qualified small business. This year, Ms. Ennis sold all 790 shares for $119,000. Her only other investment income was an $9,000 long-term capital gain from the sale of land. Her taxable income before consideration of her two capital transactions is $552,000. Assume the taxable year is 2022. Use and Tax rates for capital gains and qualified dividends. Required: a. Compute Ms. Ennis's income tax and Medicare contribution tax for the year. b. How would the computation change if Ms. Ennis acquired the Seta stock in 2011 instead of 2000 ? c. How would the computation change if Ms. Ennis acquired the Seta stock in 2019 instead of 2000 ? Answer is not complete. Complete this question by entering your answers in the tabs below. Compute Ms. Ennis's income tax and Medicare contribution tax for the year. Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Tax rates for capital gains and qualified dividends * The highest income amount in this range for each filing status is referred to as maximum zero rate amount. ** The highest income amount in this range for each filing status is referred to as maximum 15 -percent amount Married Filing Separately Head of Household Single