Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2010 Casey made a taxable gift of $5.5 million to both Stephanie and Linda (a total of $11.0 million in taxable gifts). Calculate

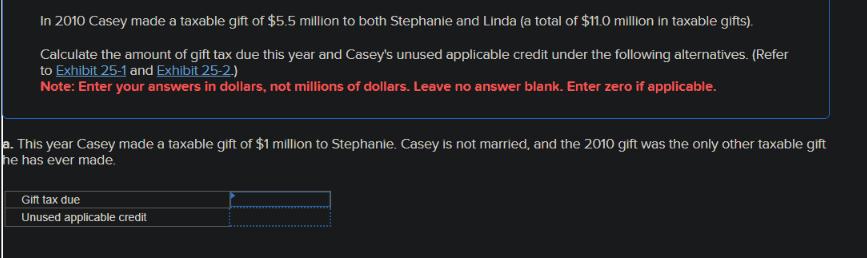

In 2010 Casey made a taxable gift of $5.5 million to both Stephanie and Linda (a total of $11.0 million in taxable gifts). Calculate the amount of gift tax due this year and Casey's unused applicable credit under the following alternatives. (Refer to Exhibit 25-1 and Exhibit 25-2) Note: Enter your answers in dollars, not millions of dollars. Leave no answer blank. Enter zero if applicable. a. This year Casey made a taxable gift of $1 million to Stephanie. Casey is not married, and the 2010 gift was the only other taxable gift he has ever made. Gift tax due Unused applicable credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The gift tax due can be calculated using the following formula textGift Tax Due textTaxa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d6cc196c39_967164.pdf

180 KBs PDF File

663d6cc196c39_967164.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started