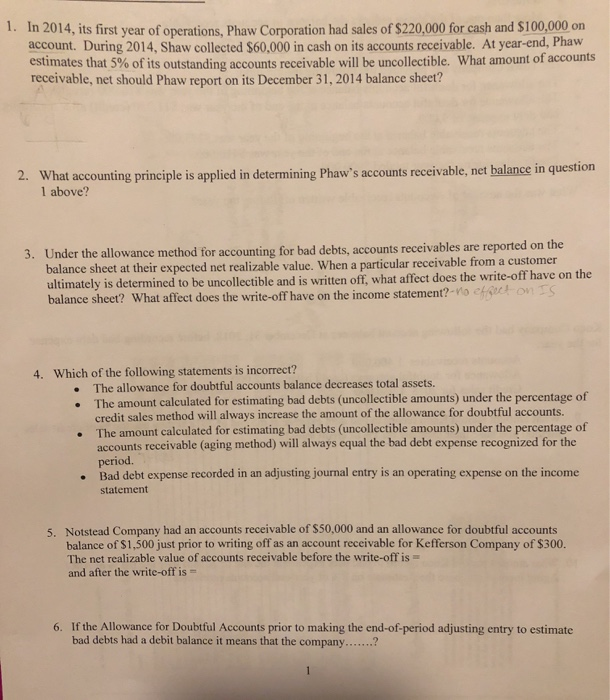

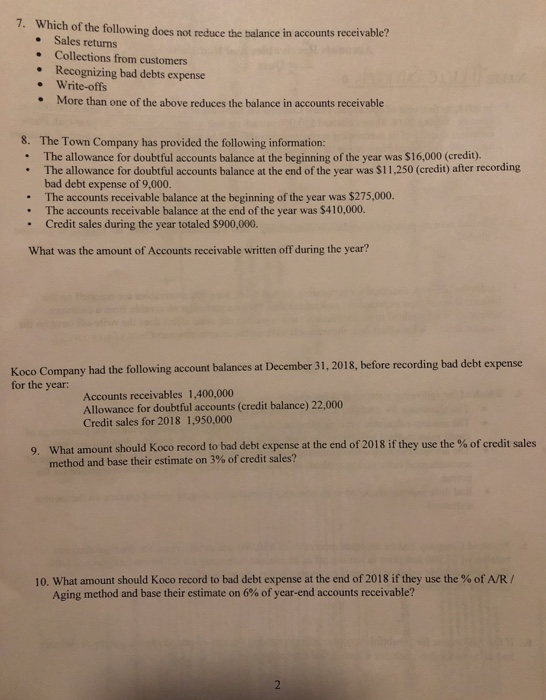

In 2014, its first year of operations, Phaw Corporation had sales of $220,000 for cash and $100,000 on account. During 2014, Shaw collected $60,000 in cash on its accounts receivable. At year-end, Phaw estimates that 5% of its outstanding accounts receivable will be uncollectible. What amount of accounts receivable, net should Phaw report on its December 31, 2014 balance sheet? 2. What accounting principle is applied in determining Phaw's accounts receivable, net balance in question 1 above? 3. Under the allowance method for accounting for bad debts, accounts receivables are reported on the balance sheet at their expected net realizable value. When a particular receivable from a customer ultimately is determined to be uncollectible and is written off, what affect does the write-off have on the balance sheet? What affect does the write-off have on the income statement? Vo ch o ns 4. Which of the following statements is incorrect? The allowance for doubtful accounts balance decreases total assets. The amount calculated for estimating bad debts (uncollectible amounts) under the percentage of credit sales method will always increase the amount of the allowance for doubtful accounts. The amount calculated for estimating bad debts (uncollectible amounts) under the percentage of accounts receivable (aging method) will always equal the bad debt expense recognized for the period. Bad debt expense recorded in an adjusting journal entry is an operating expense on the income statement 5. Notstead Company had an accounts receivable of $50,000 and an allowance for doubtful accounts balance of $1,500 just prior to writing off as an account receivable for Kefferson Company of $300. The net realizable value of accounts receivable before the write-off is and after the write-off is- 6. If the Allowance for Doubtful Accounts prior to making the end-of-period adjusting entry to estimate bad debts had a debit balance it means that the company..... 7. Which of the following does not reduce the balance in accounts receivable? Sales returns Collections from customers Recognizing bad debts expense Write-offs More than one of the above reduces the balance in accounts receivable 8. The Town Company has provided the following information: The allowance for doubtful accounts balance at the beginning of the year was $16,000 (credit). The allowance for doubtful accounts balance at the end of the year was $11,250 (credit) after recording bad debt expense of 9,000. The accounts receivable balance at the beginning of the year was $275,000. . The accounts receivable balance at the end of the year was $410,000. Credit sales during the year totaled $900,000. What was the amount of Accounts receivable written off during the year? Koco Company had the following account balances at December 31, 2018, before recording bad debt expense for the year: Accounts receivables 1.400,000 Allowance for doubtful accounts (credit balance) 22,000 Credit sales for 2018 1,950,000 9. What amount should Koco record to bad debt expense at the end of 2018 if they use the % of credit sales method and base their estimate on 3% of credit sales? 10. What amount should Koco record to bad debt expense at the end of 2018 if they use the % of A/R/ Aging method and base their estimate on 6% of year-end accounts receivable