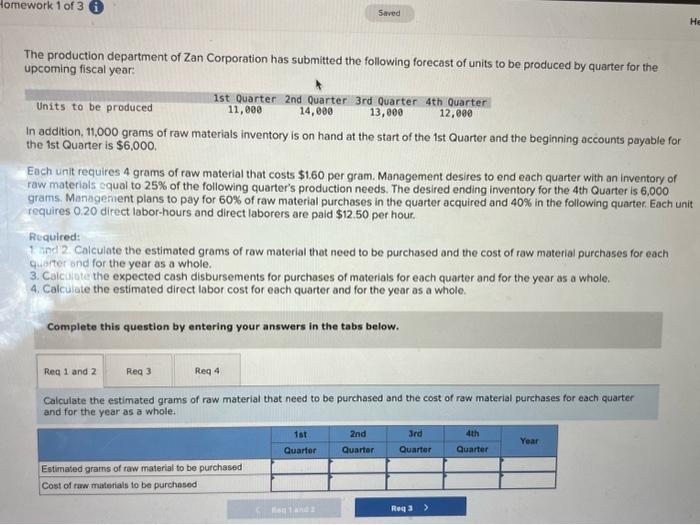

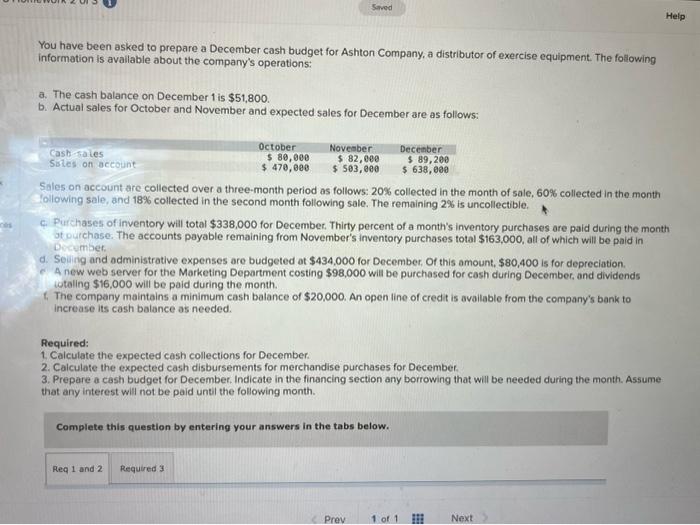

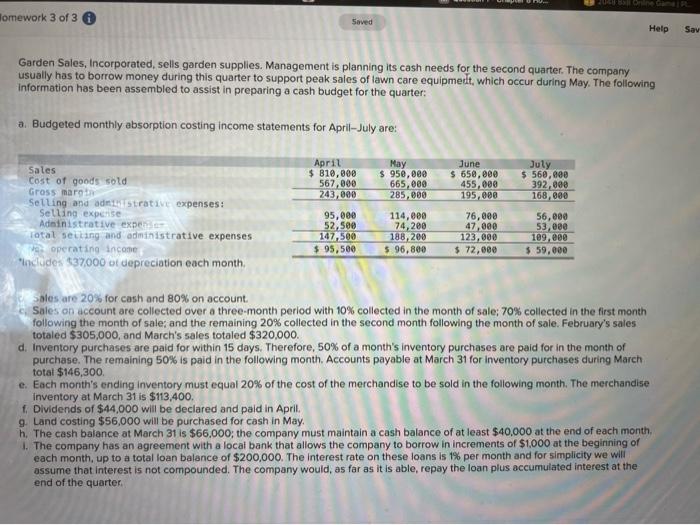

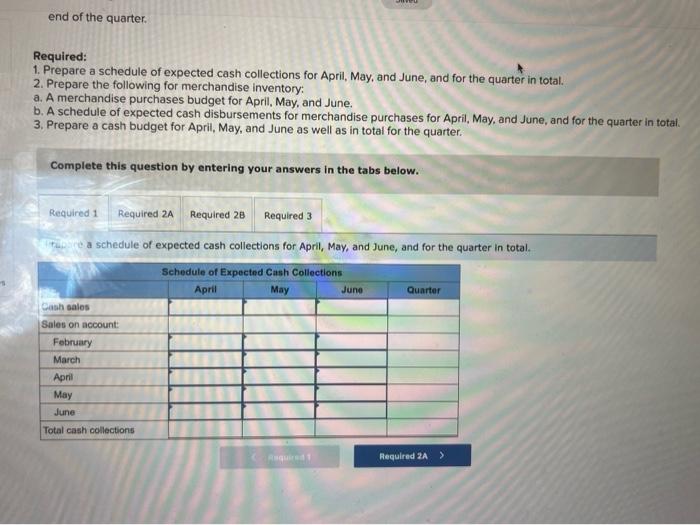

The production department of Zan Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year In addition, 11,000 grams of raw materials inventory is on hand at the start of the 1st Quarter and the beginning accounts payable for the 1st Quarter is $6,000. Each unit requires 4 grams of raw material that costs $1.60 per gram. Management desires to end each quarter with an inventory of raw materials cqual to 25% of the following quarter's production needs. The desired ending inventory for the 4 th Quarter is 6,000 grams. Management plans to pay for 60% of raw material purchases in the quarter acquired and 40% in the following quarter. Each un requires 0.20 direct labor-hours and direct laborers are paid $12.50 per hour. Required: 1. ind 2. Calculate the estimated grams of raw material that need to be purchased and the cost of raw material purchases for each quarter and for the year as a whole. 3. Calcuiate the expected cash disbursements for purchases of materials for each quarter and for the year as a whole. 4. Calculate the estimated direct labor cost for each quarter and for the year as a whole. Complete this question by entering your answers in the tabs below. Calculate the estimated grams of raw material that need to be purchased and the cost of raw material purchases for each quarter and for the year as a whole. You have been asked to prepare a December cash budget for Ashton Company, a distributor of exercise equipment. The following information is avallable about the company's operations: a. The cash balance on December 1 is $51,800. b. Actual sales for October and November and expected sales for December are as follows: Sales on account are collected over a three-month period as follows: 20% collected in the month of sale, 60% collected in the month following sale, and 18% collected in the second month following sale. The remaining 2% is uncollectible. c. Purchases of inventory will total $338,000 for December. Thirty percent of a month's inventory purchases are paid during the month of purchase. The accounts payable remaining from November's inventory purchases total $163,000, all of which will be paid in Decumber. d. Seiling and administrative expenses are budgeted ot $434,000 for December, Of this amount, $80,400 is for depreciation. C. A new web server for the Marketing Department costing $98,000 will be purchased for cash during December, and dividends iotaling $16,000 will be paid during the month. t. The company maintains a minimum cash balance of $20.000. An open line of credit is available from the company's bank to increase its cash balance as needed. Required: 1. Calculate the expected cash collections for December. 2. Calculate the expected cash disbursements for merchandise purchases for December. 3. Prepare a cash budget for December. Indicate in the financing section any borrowing that will be needed during the month. Assume that any interest will not be paid until the following month. Complete this question by entering your answers in the tabs below. Garden Sales, Incorporated, sells garden supplies. Management is planning its cash needs for the second quarter. The company usually has to borrow money during this quarter to support peak sales of lawn care equipmect, which occur during May. The following information has been assembled to assist in preparing a cash budget for the quarter: a. Budgeted monthly absorption costing income statements for April-July are: Sales are 20% for cash and 80% on account. c. Sales on account are collected over a three-month period with 10% collected in the month of sale; 70% collected in the first month following the month of sale; and the remaining 20% collected in the second month following the month of sale. February's sales totaled $305,000, and March's sales totaled $320,000. d. Inventory purchases are paid for within 15 days. Therefore, 50% of a month's inventory purchases are paid for in the month of purchase. The remaining 50% is paid in the following month. Accounts payable at March 31 for inventory purchases during March totat $146,300. e. Each month's ending inventory must equal 20% of the cost of the merchandise to be sold in the following month. The merchandise inventory at March31 is $113,400. f. Dividends of $44,000 will be declared and paid in April. 9. Land costing $56,000 will be purchased for cash in May. h. The cash balance at March 31 is $66.000; the company must maintain a cash balance of at least $40,000 at the end of each month. 1. The company has an agreement with a locai bank that allows the company to borrow in increments of $1.000 at the beginning of each month, up to a total loan balance of $200,000. The interest rate on these loans is 1% per month and for simplicity we wili assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the quarter. Required: 1. Prepare a schedule of expected cash collections for April, May, and June, and for the quarter in total. 2. Prepare the following for merchandise inventory: a. A merchandise purchases budget for April, May, and June. b. A schedule of expected cash disbursements for merchandise purchases for April, May, and June, and for the quarter in total. 3. Prepare a cash budget for April, May, and June as well as in total for the quarter. Complete this question by entering your answers in the tabs below. a schedule of expected cash collections for April, May, and June, and for the quarter in total