Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2015, Lebron Jones decided to start his own business and incurred $54,000 in start-up costs. On August 15th, 2015, Lebron starts up his

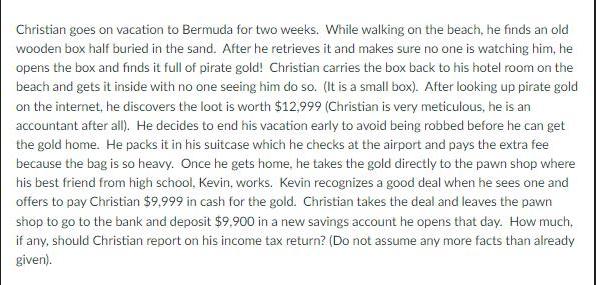

In 2015, Lebron Jones decided to start his own business and incurred $54,000 in start-up costs. On August 15th, 2015, Lebron starts up his business. What will be Lebron's total deductions related to start-up costs in 2015 and how much, if any, can be amortized over 15 years? Christian goes on vacation to Bermuda for two weeks. While walking on the beach, he finds an old wooden box half buried in the sand. After he retrieves it and makes sure no one is watching him, he opens the box and finds it full of pirate gold! Christian carries the box back to his hotel room on the beach and gets it inside with no one seeing him do so. (It is a small box). After looking up pirate gold on the internet, he discovers the loot is worth $12,999 (Christian is very meticulous, he is an accountant after all). He decides to end his vacation early to avoid being robbed before he can get the gold home. He packs it in his suitcase which he checks at the airport and pays the extra fee because the bag is so heavy. Once he gets home, he takes the gold directly to the pawn shop where his best friend from high school, Kevin, works. Kevin recognizes a good deal when he sees one and offers to pay Christian $9,999 in cash for the gold. Christian takes the deal and leaves the pawn shop to go to the bank and deposit $9.900 in a new savings account he opens that day. How much, if any, should Christian report on his income tax return? (Do not assume any more facts than already given).

Step by Step Solution

★★★★★

3.40 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Lebrons Total Deductions Related to Startup Costs in 2015 Under the US tax rules startup costs incur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started