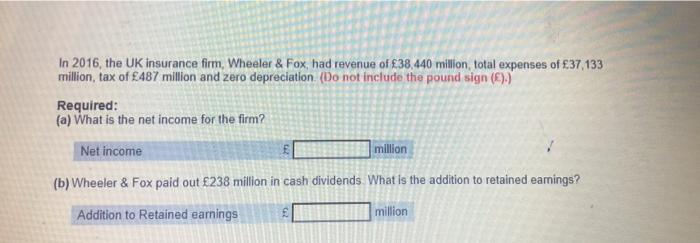

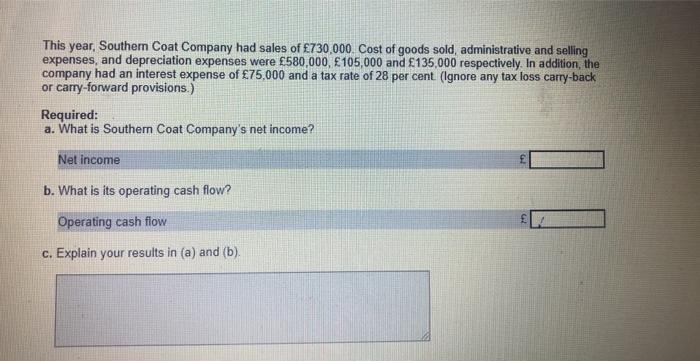

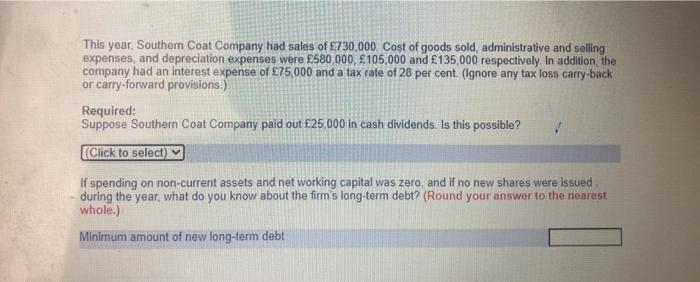

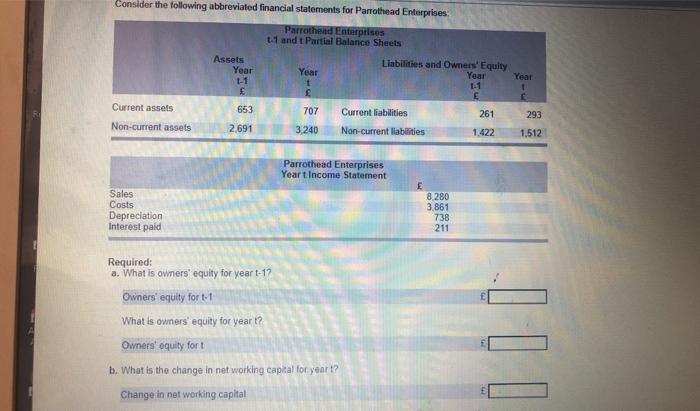

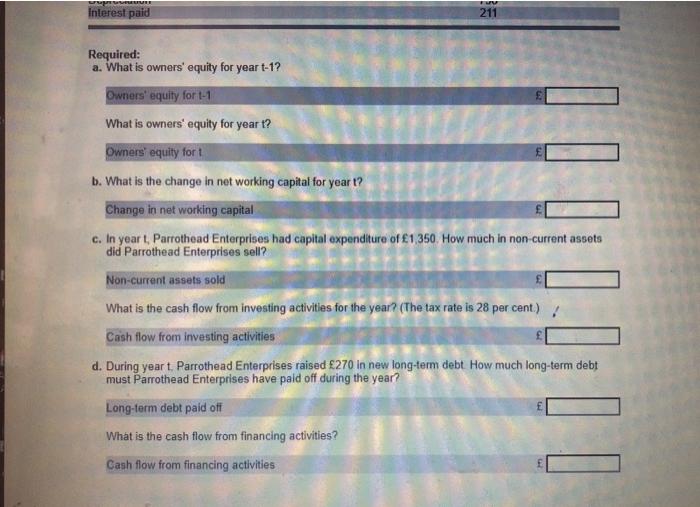

In 2016, the UK insurance firm, Wheeler & Fox, had revenue of 38,440 million total expenses of 37,133 million, tax of 487 million and zero depreciation (Do not include the pound sign (E).) Required: (a) What is the net income for the firm? Net income million (b) Wheeler & Fox paid out 238 million in cash dividends. What is the addition to retained eamings? Addition to Retained earnings million This year, Southern Coat Company had sales of 730,000 Cost of goods sold, administrative and selling expenses, and depreciation expenses were 580,000, 105,000 and 135,000 respectively. In addition, the company had an interest expense of 75,000 and a tax rate of 28 per cent (Ignore any tax loss carry-back or carry-forward provisions.) Required: a. What is Southern Coat Company's net income? Net income b. What is its operating cash flow? I ! Operating cash flow c. Explain your results in (a) and (b). This year, Southern Coat Company had sales of E730,000 Cost of goods sold, administrative and selling expenses, and depreciation expenses were 580,000, 105,000 and 135,000 respectively. In addition, the company had an interest expense of 75,000 and a tax rate of 28 per cent. (Ignore any tax loss carry-back or carry-forward provisions.) Required: Suppose Southern Coat Company paid out 25,000 in cash dividends. Is this possible? (Click to select) If spending on non-current assets and networking capital was zero, and if no new shares were issued during the year, what do you know about the firm's long-term debt? (Round your answer to the nearest whole.) Minimum amount of new long-term debt Consider the following abbreviated financial statements for Parrothead Enterprises Parrothiad Enterprises 1.1 and t Partial Balance Sheets Assets Year 1-1 Year t Liabilities and Owners' Equity Year 141 E Year 1 Current assets 653 707 Current liabilities 261 293 Non-current assets 2,691 3.240 Non-current liabilities 1.422 1,512 Parrothead Enterprises Yeart Income Statement Sales Costs Depreciation Interest paid E 8.280 3861 738 211 Required: a. What is owners' equity for yeart-17 Owners' equity for t-1 What is owners' equity for yeart? Owners' equity for t b. What is the change in net working capital for yeart? Change in net working capital 110 Interest paid 211 yeart-17 Required: a. What is owners' equity for Owners' equity for t-1 What is owners' equity for yeart? Owners' equity for t b. What is the change in net working capital for yeart? Change in net working capital c. In yeart, Parrothead Enterprises had capital expenditure of 1,350 How much In non current assets did Parrothead Enterprises sell? Non-current assets sold What is the cash flow from investing activities for the year? (The tax rate is 28 per cent.) / Cash flow from investing activities d. During yeart Parrothead Enterprises raised $270 in new long-term debt How much long-term debt must Parrothead Enterprises have paid off during the year? Long-term debt paid off What is the cash flow from financing activities? 1110 f 11 Cash flow from financing activities