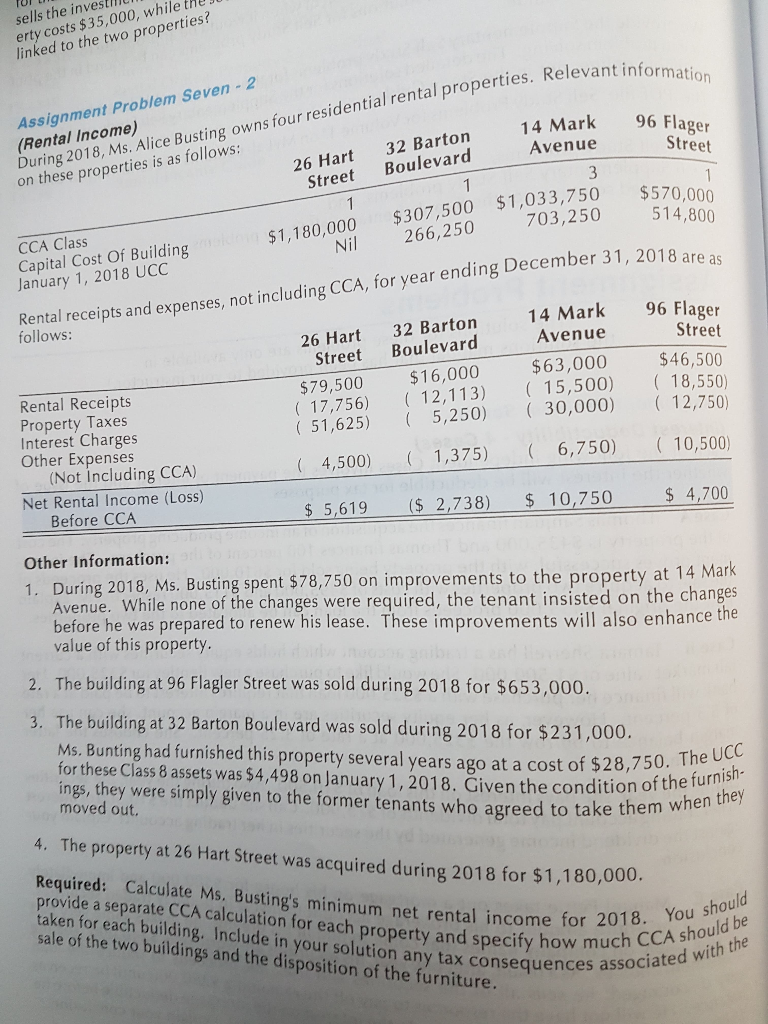

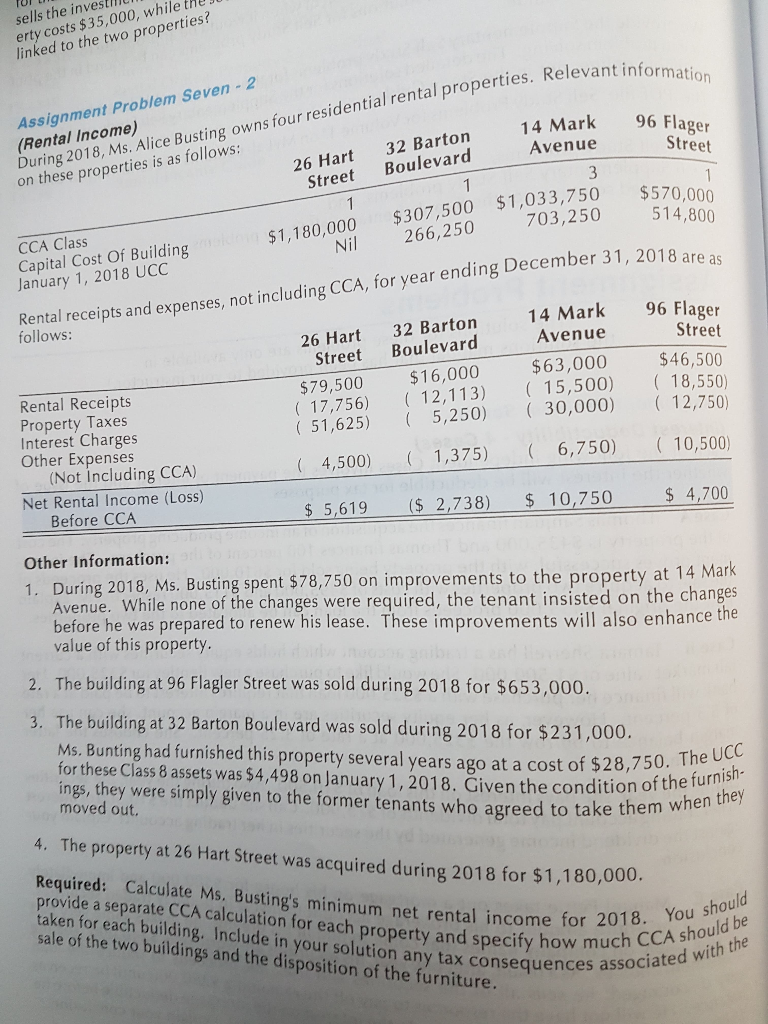

sells the invest erty costs $35,000, while t linked to the two properties? Assignment Problem Seven-2 (Rental Income) During 2018, Ms. Alice Busting owns four residential rental properties. Relevantinformation 14 Mark Avenue 96 Flager Street 32 Barton Boulevard 26 Hart Street on these properties is as follows: 1 1 $570,000 514,800 1 $1,033,750 703,250 $307,500 266,250 $1,180,000 Nil CCA Class Capital Cost Of Building January 1, 2018 UCC Rental receipts and expenses, not including CCA, for year ending December 31, 2018 are as follows: 96 Flager 14 Mark Avenue 32 Barton Boulevard 26 Hart Street Street $63,000 ( 15,500) ( 30,000) $46,500 ( 18,550) ( 12,750) $16,000 (12,113) 5,250) $79,500 ( 17,756) ( 51,625) Rental Receipts Property Taxes Interest Charges Other Expenses (Not Including CCA) ( 4,50 1,375) 6,750) ( 10,500) Net Rental Income (Loss) Before CCA $ 5,619 ($ 2,738) $ 10,750 $4,700 Other Information: 1. During 2018, Ms. Busting spent $78,750 on improvements to the property at 14 Mark Avenue. While none of the changes were required, the tenant insisted on the changes before he was prepared to renew his lease. These improvements will also enhance the value of this property. 2. The building at 96 Flagler Street was sold during 2018 for $653,000. 3. The building at 32 Barton Boulevard was sold during 2018 for $231,000. Ms,Bunting had furnished this property several years ago at a cost of $28,750. The UCC for these Class 8 assets was $4,498 on January 1,2018. Given the condition of the furnish- ings,they were simply given to the former tenants who agreed to take them when they moved out. 4, The property at 26 Hart Street was acquired during 2018 for $1,180,000. Required: Calculate Ms. Busting's minimum net rental income for 2018. You should taken for each building. Include in your solution any tax consequences associated with the provide a separate CCA calculation for each property and specify how much CCA should be sale of the two buildings and the disposition of the furniture. sells the invest erty costs $35,000, while t linked to the two properties? Assignment Problem Seven-2 (Rental Income) During 2018, Ms. Alice Busting owns four residential rental properties. Relevantinformation 14 Mark Avenue 96 Flager Street 32 Barton Boulevard 26 Hart Street on these properties is as follows: 1 1 $570,000 514,800 1 $1,033,750 703,250 $307,500 266,250 $1,180,000 Nil CCA Class Capital Cost Of Building January 1, 2018 UCC Rental receipts and expenses, not including CCA, for year ending December 31, 2018 are as follows: 96 Flager 14 Mark Avenue 32 Barton Boulevard 26 Hart Street Street $63,000 ( 15,500) ( 30,000) $46,500 ( 18,550) ( 12,750) $16,000 (12,113) 5,250) $79,500 ( 17,756) ( 51,625) Rental Receipts Property Taxes Interest Charges Other Expenses (Not Including CCA) ( 4,50 1,375) 6,750) ( 10,500) Net Rental Income (Loss) Before CCA $ 5,619 ($ 2,738) $ 10,750 $4,700 Other Information: 1. During 2018, Ms. Busting spent $78,750 on improvements to the property at 14 Mark Avenue. While none of the changes were required, the tenant insisted on the changes before he was prepared to renew his lease. These improvements will also enhance the value of this property. 2. The building at 96 Flagler Street was sold during 2018 for $653,000. 3. The building at 32 Barton Boulevard was sold during 2018 for $231,000. Ms,Bunting had furnished this property several years ago at a cost of $28,750. The UCC for these Class 8 assets was $4,498 on January 1,2018. Given the condition of the furnish- ings,they were simply given to the former tenants who agreed to take them when they moved out. 4, The property at 26 Hart Street was acquired during 2018 for $1,180,000. Required: Calculate Ms. Busting's minimum net rental income for 2018. You should taken for each building. Include in your solution any tax consequences associated with the provide a separate CCA calculation for each property and specify how much CCA should be sale of the two buildings and the disposition of the furniture