Answered step by step

Verified Expert Solution

Question

1 Approved Answer

in 2018 marilyn had total nonbusiness income of $1,250. her 2018 adjustments and deductio As an du For the carryover or carryforward year Mark for

in 2018 marilyn had total nonbusiness income of $1,250. her 2018 adjustments and deductio

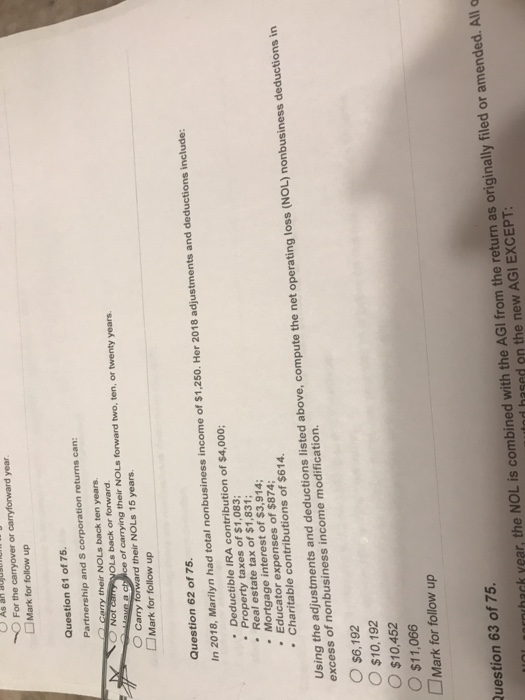

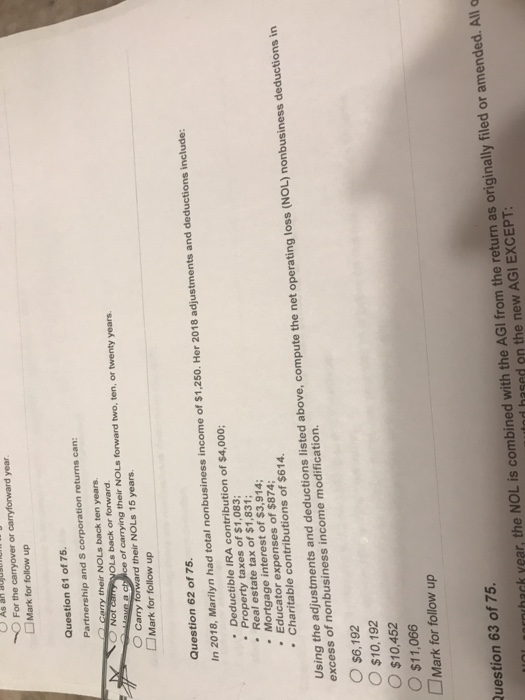

As an du For the carryover or carryforward year Mark for follow up Question 61 of 75. Partnership and S corporation returns can: Carry their NOLS back ten years. No cury VOLS back or forward wave a chce of carrying their NOLS forward two, ten, or twenty years. O Carry forward their NOLS 15 years. O Mark for follow up Question 62 of 75. In 2018, Marilyn had total nonbusiness income of $1,250. Her 2018 adjustments and deductions include: Deductible IRA contribution of $4,000; Property taxes of $1,083; Real estate tax of $1,831; Mortgage interest of $3,914; Educator expenses of $874; Charitable contributions of $614. Using the adjustments and deductions listed above, compute the net operating loss (NOL) nonbusiness deductions in excess of nonbusiness income modification. O $6,192 O $10,192 $10,452 O $11,066 Mark for follow up Question 63 of 75. arnthack vear, the NOL is combined with the AGI from the return as originally filed or amended. All utod based on the new AGI EXCEPT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started