Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2018, Partner Millwrights purchased a milling machine for $4,500, debiting Milling Equipment During 2018 and 2019. Partner recorded total amortization of $2,700 on the

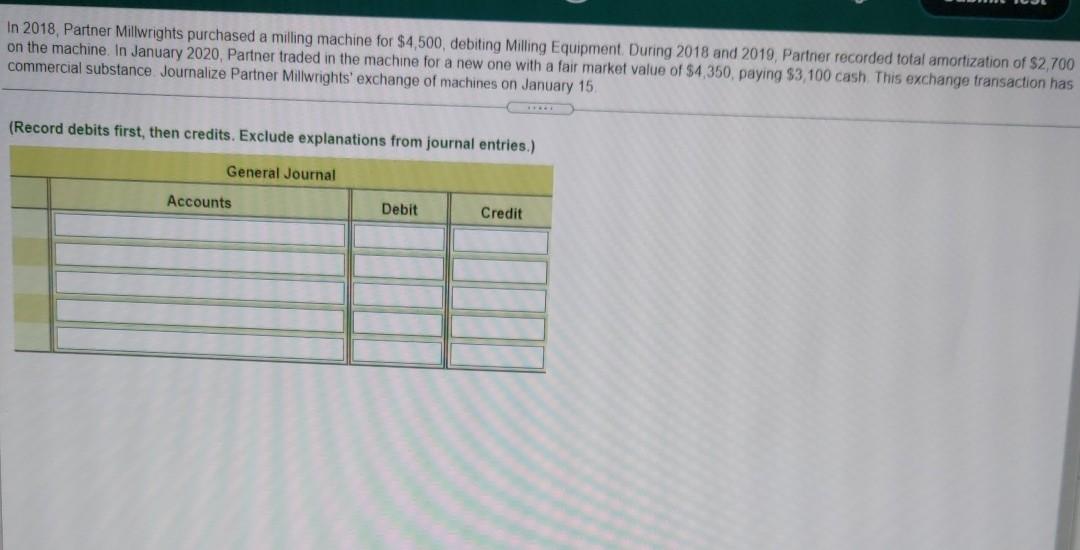

In 2018, Partner Millwrights purchased a milling machine for $4,500, debiting Milling Equipment During 2018 and 2019. Partner recorded total amortization of $2,700 on the machine. In January 2020, Partner traded in the machine for a new one with a fair market value of $4,350, paying $3100 cash This exchange transaction has commercial substance Journalize Partner Millwrights' exchange of machines on January 15 (Record debits first, then credits. Exclude explanations from journal entries.) General Journal Accounts Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started