Answered step by step

Verified Expert Solution

Question

1 Approved Answer

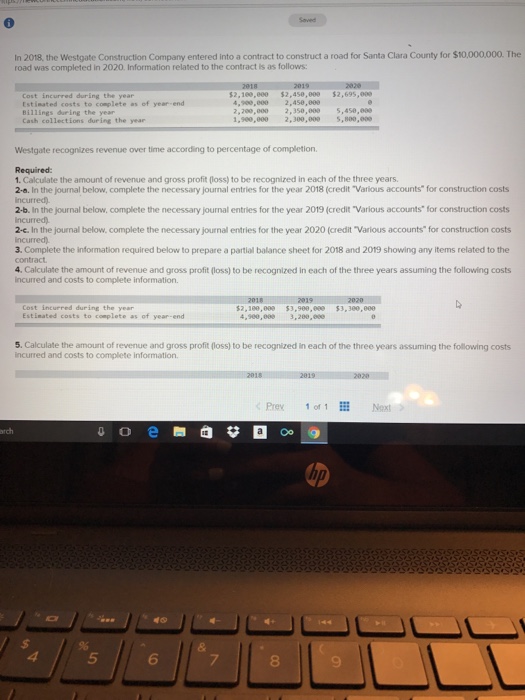

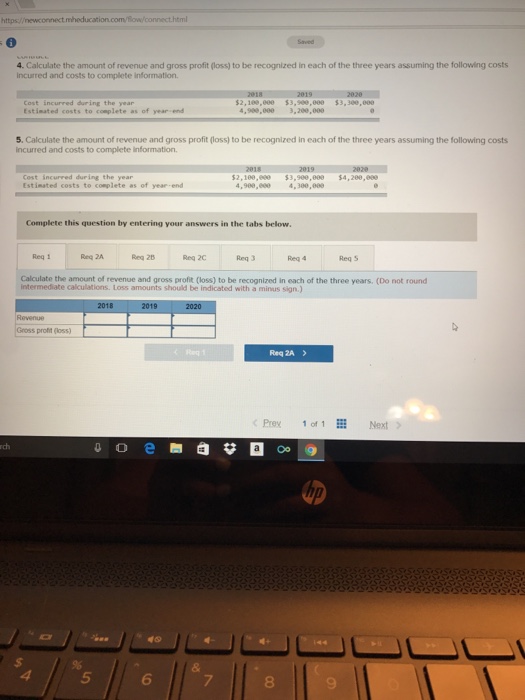

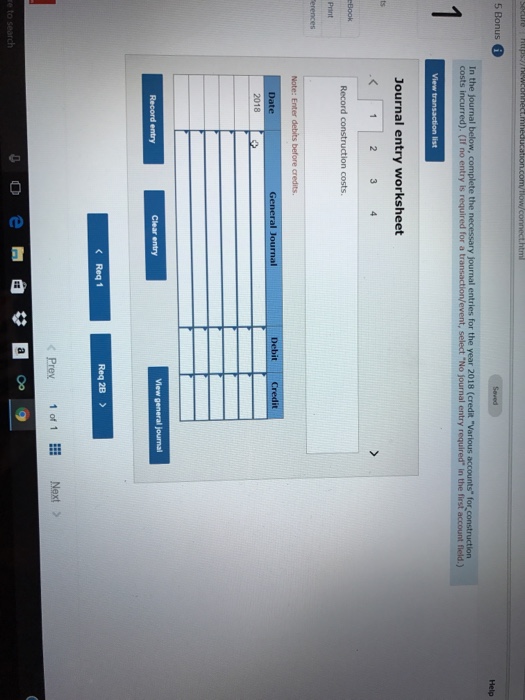

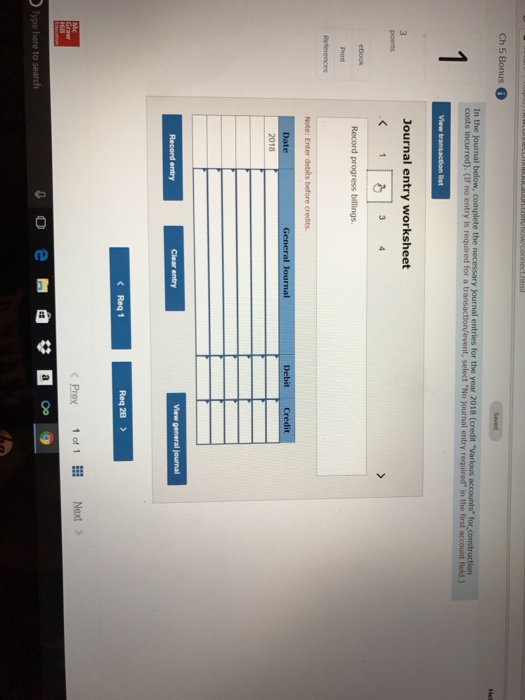

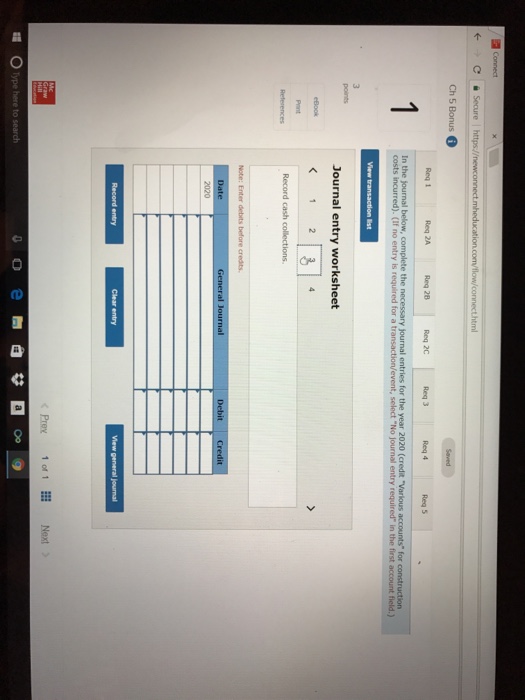

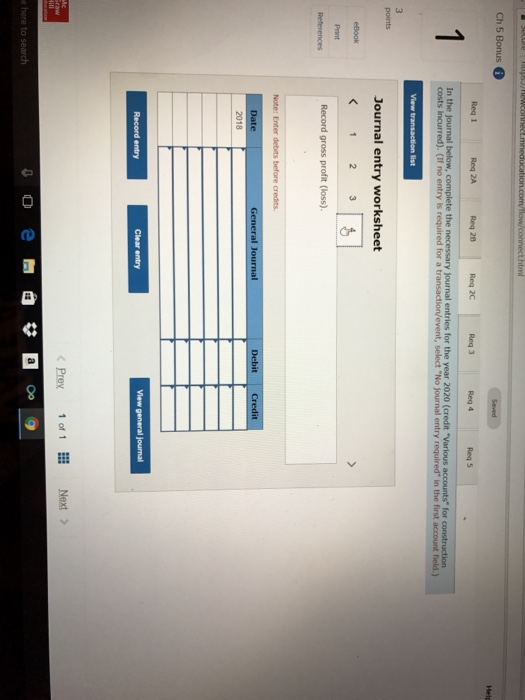

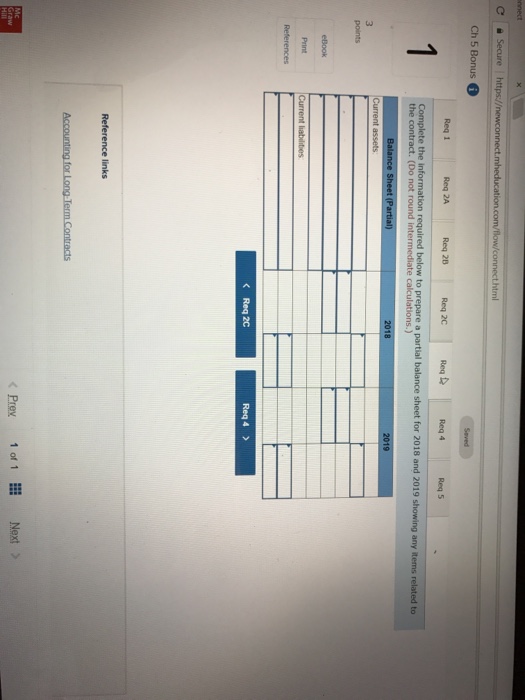

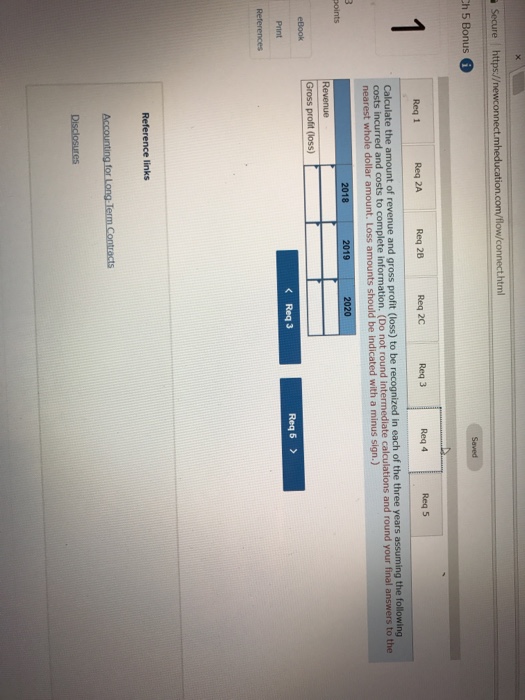

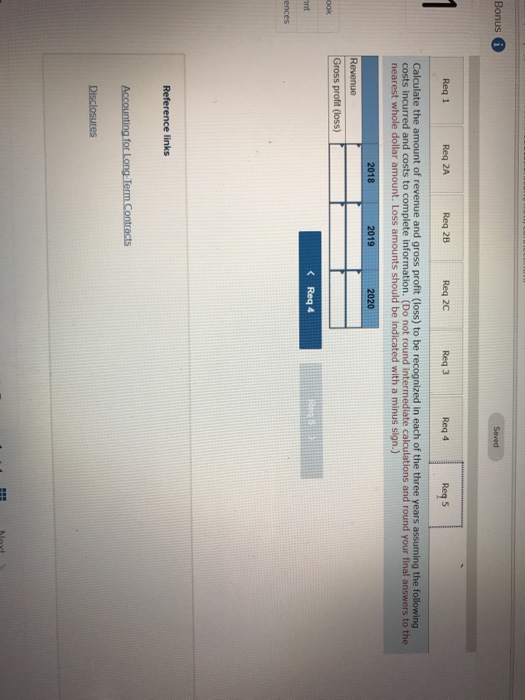

In 2018, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in

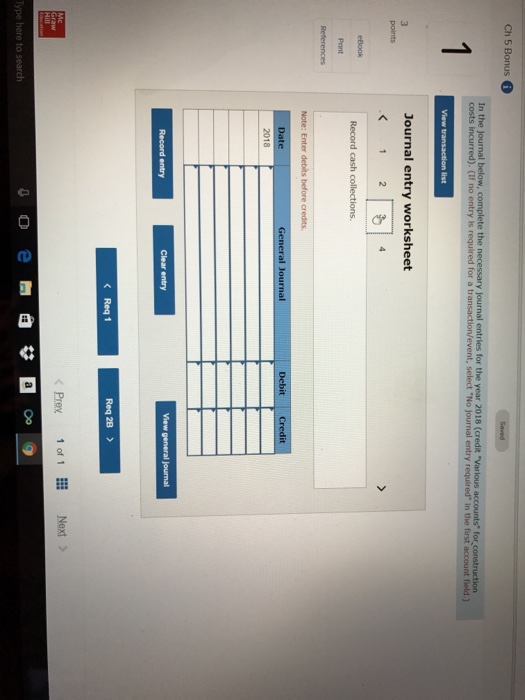

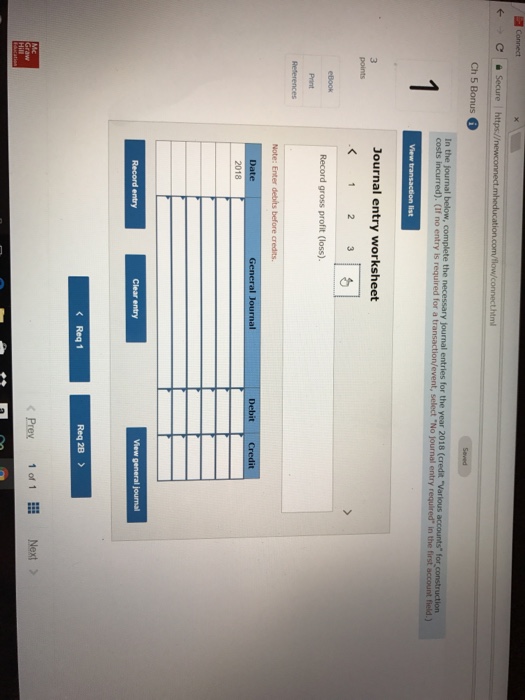

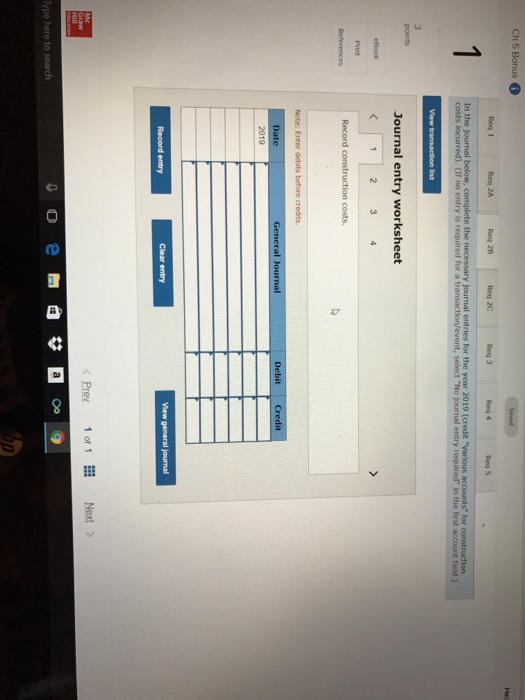

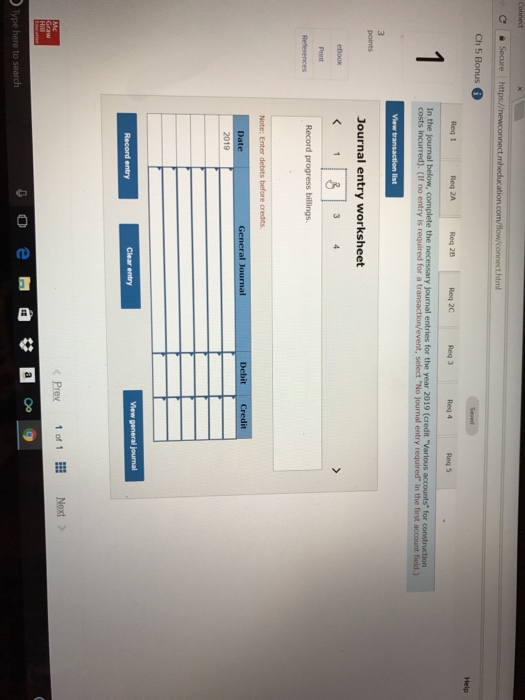

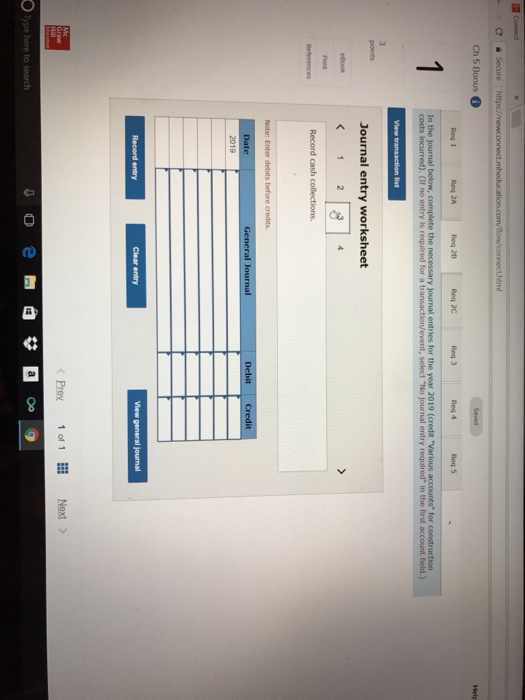

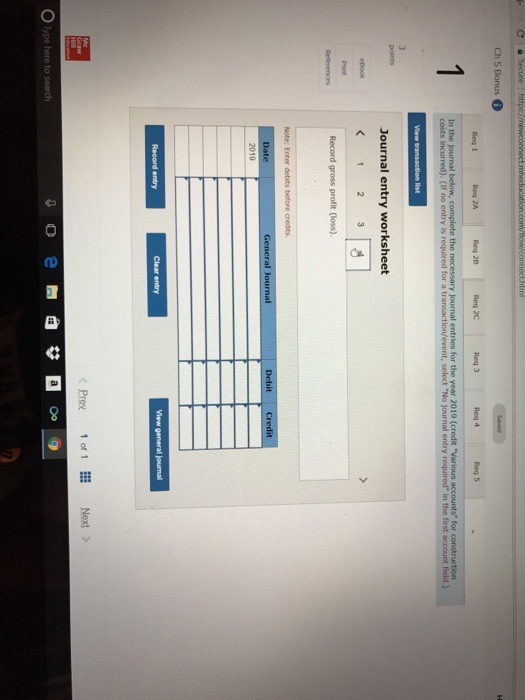

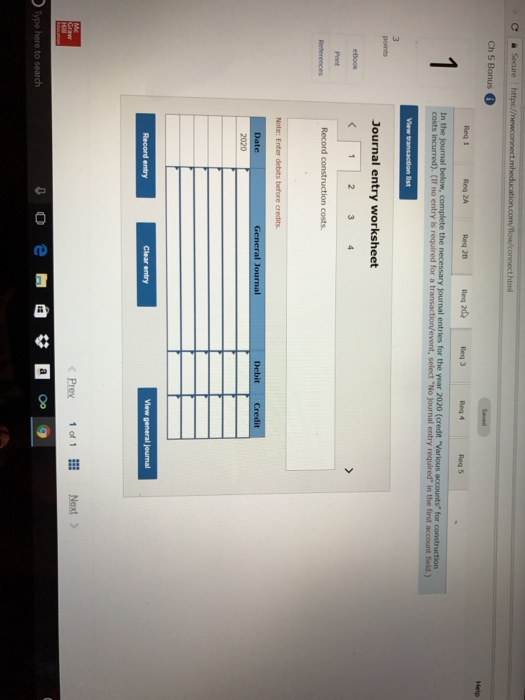

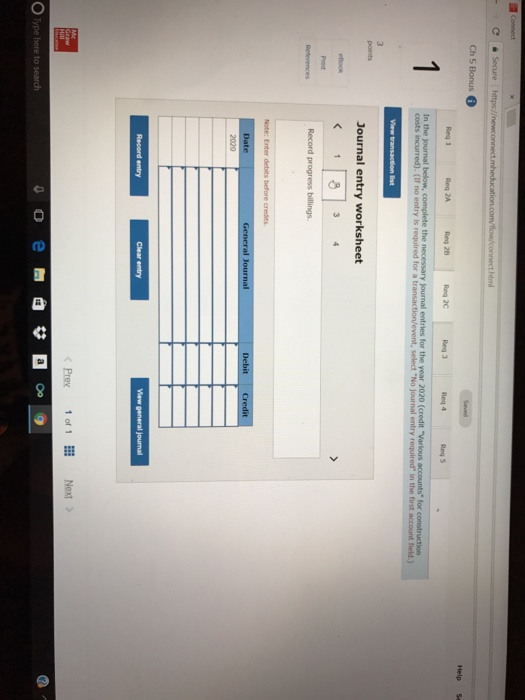

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started