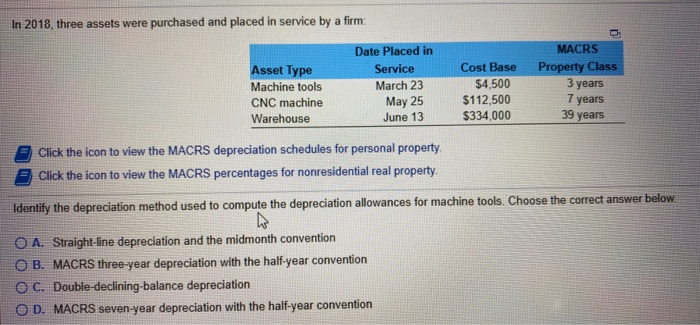

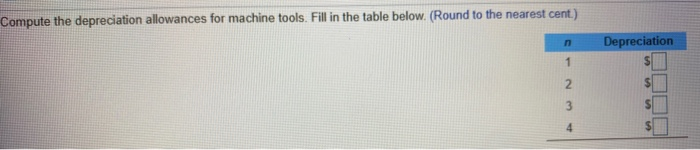

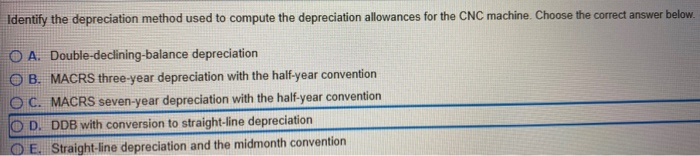

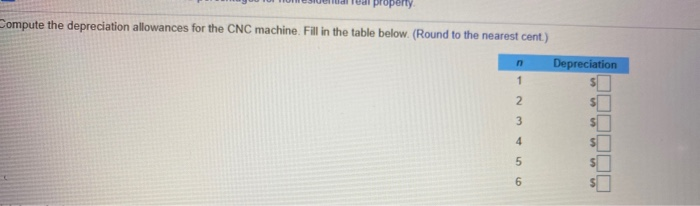

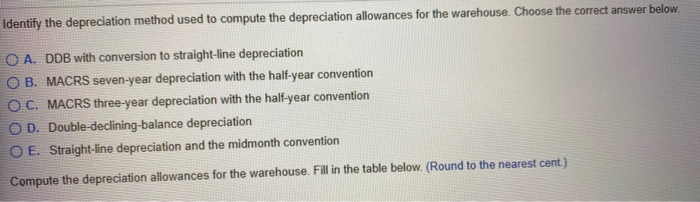

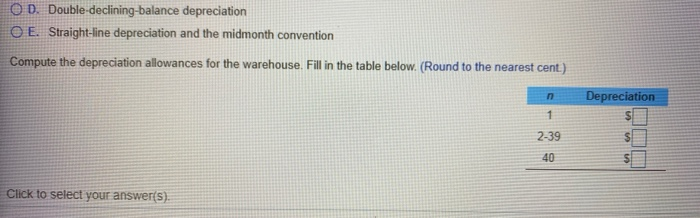

In 2018, three assets were purchased and placed in service by a firm: Date Placed in Service March 23 MACRS Property Class Asset Type Machine tools CNC machine Warehouse Cost Base $4,500 $112,500 $334,000 May 25 3 years 7 years 39 years June 13 Click the icon to view the MACRS depreciation schedules for personal property Click the icon to view the MACRS percentages for nonresidential real property. Identify the depreciation method used to compute the depreciation allowances for machine tools. Choose the correct answer below. O A. Straight-line depreciation and the midmonth convention OB. MACRS three-year depreciation with the half-year convention O C. Double-declining balance depreciation OD. MACRS seven-year depreciation with the half-year convention Compute the depreciation allowances for machine tools. Fill in the table below. (Round to the nearest cent.) n Depreciation 1 5 $ 2 3 4 5 Identify the depreciation method used to compute the depreciation allowances for the CNC machine. Choose the correct answer below. A. Double-declining-balance depreciation OB. MACRS three-year depreciation with the half-year convention O C. MACRS seven-year depreciation with the half-year convention O D. DDB with conversion to straight-line depreciation O E. Straight-line depreciation and the midmonth convention operty Compute the depreciation allowances for the CNC machine. Fill in the table below. (Round to the nearest cent) Depreciation n 1 N $ ( Identify the depreciation method used to compute the depreciation allowances for the warehouse. Choose the correct answer below. O A. DDB with conversion to straight-line depreciation OB. MACRS seven-year depreciation with the half-year convention O C. MACRS three-year depreciation with the half-year convention OD. Double-declining balance depreciation O E. Straight-line depreciation and the midmonth convention Compute the depreciation allowances for the warehouse. Fill in the table below. (Round to the nearest cent.) OD. Double-declining-balance depreciation O E. Straight-line depreciation and the midmonth convention Compute the depreciation allowances for the warehouse. Fill in the table below. (Round to the nearest cent.) n Depreciation 1 2-39 40 Click to select your answers). In 2018, three assets were purchased and placed in service by a firm: Date Placed in Service March 23 MACRS Property Class Asset Type Machine tools CNC machine Warehouse Cost Base $4,500 $112,500 $334,000 May 25 3 years 7 years 39 years June 13 Click the icon to view the MACRS depreciation schedules for personal property Click the icon to view the MACRS percentages for nonresidential real property. Identify the depreciation method used to compute the depreciation allowances for machine tools. Choose the correct answer below. O A. Straight-line depreciation and the midmonth convention OB. MACRS three-year depreciation with the half-year convention O C. Double-declining balance depreciation OD. MACRS seven-year depreciation with the half-year convention Compute the depreciation allowances for machine tools. Fill in the table below. (Round to the nearest cent.) n Depreciation 1 5 $ 2 3 4 5 Identify the depreciation method used to compute the depreciation allowances for the CNC machine. Choose the correct answer below. A. Double-declining-balance depreciation OB. MACRS three-year depreciation with the half-year convention O C. MACRS seven-year depreciation with the half-year convention O D. DDB with conversion to straight-line depreciation O E. Straight-line depreciation and the midmonth convention operty Compute the depreciation allowances for the CNC machine. Fill in the table below. (Round to the nearest cent) Depreciation n 1 N $ ( Identify the depreciation method used to compute the depreciation allowances for the warehouse. Choose the correct answer below. O A. DDB with conversion to straight-line depreciation OB. MACRS seven-year depreciation with the half-year convention O C. MACRS three-year depreciation with the half-year convention OD. Double-declining balance depreciation O E. Straight-line depreciation and the midmonth convention Compute the depreciation allowances for the warehouse. Fill in the table below. (Round to the nearest cent.) OD. Double-declining-balance depreciation O E. Straight-line depreciation and the midmonth convention Compute the depreciation allowances for the warehouse. Fill in the table below. (Round to the nearest cent.) n Depreciation 1 2-39 40 Click to select your answers)