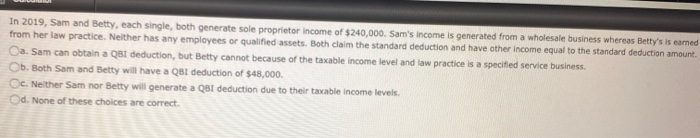

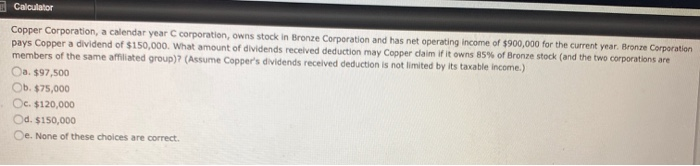

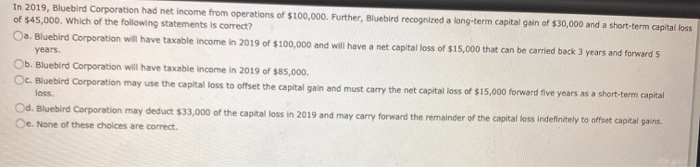

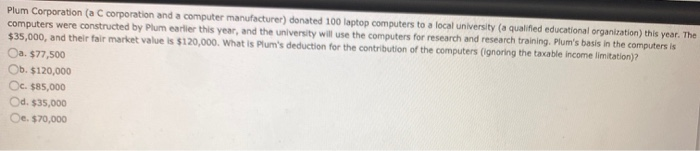

In 2019, Sam and Betty, each single, both generate sole proprietor income of $240,000. Sam's income is generated from a wholesale business whereas Betty's is earned from her law practice. Neither has any employees or qualified assets. Both claim the standard deduction and have other income equal to the standard deduction amount a. Sam can obtain a Q81 deduction, but Betty cannot because of the taxable income level and law practice is a specified service business. b. Both Sam and Betty will have a QB1 deduction of $48,000 c. Neither Sam nor Betty will generate a QB1 deduction due to their taxable income levels d. None of these choices are correct 1 Calculator Copper Corporation, a calendar year C corporation, owns stock in Bronze Corporation and has net operating income of $900,000 for the current year. Bronze Corporation pays Copper a dividend of $150,000. What amount of dividends received deduction may Copper claim if it owns 85% of Bronze stock (and the two corporations are members of the same amiated group)? (Assume Copper's dividends received deduction is not limited by its taxable income.) a. $97,500 Ob. $75,000 c. $120,000 d. $150,000 e. None of these choices are correct. In 2019, Bluebird Corporation had net income from operations of $100,000. Further, Bluebird recognized a long-term capital gain of $30,000 and a short-term capital loss of $45,000. Which of the following statements is correct? a. Bluebird Corporation will have taxable income in 2019 of $100,000 and will have a net capital loss of $15,000 that can be carried back 3 years and forward 5 years b. Bluebird Corporation will have taxable income in 2019 of $85,000. Oc. Bluebird Corporation may use the capital loss to offset the capital gain and must carry the net capital loss of $15,000 forward five years as a short-term capital loss d. Bluebird Corporation may deduct $33,000 of the capital loss in 2019 and may carry forward the remainder of the capital loss indefinitely to offset capital gains. e. None of these choices are correct. Plum Corporation (a C corporation and a computer manufacturer) donated 100 laptop computers to a local university (a qualified educational organization) this year. The computers were constructed by Plum earlier this year, and the university will use the computers for research and research training. Plum's basis in the computers is $35,000, and their fair market value is $120,000. What is Plum's deduction for the contribution of the computers (ignoring the taxable income limitation)? a $77,500 b. $120,000 c. $85,000 Od. $35,000 Oe. $70,000