Question

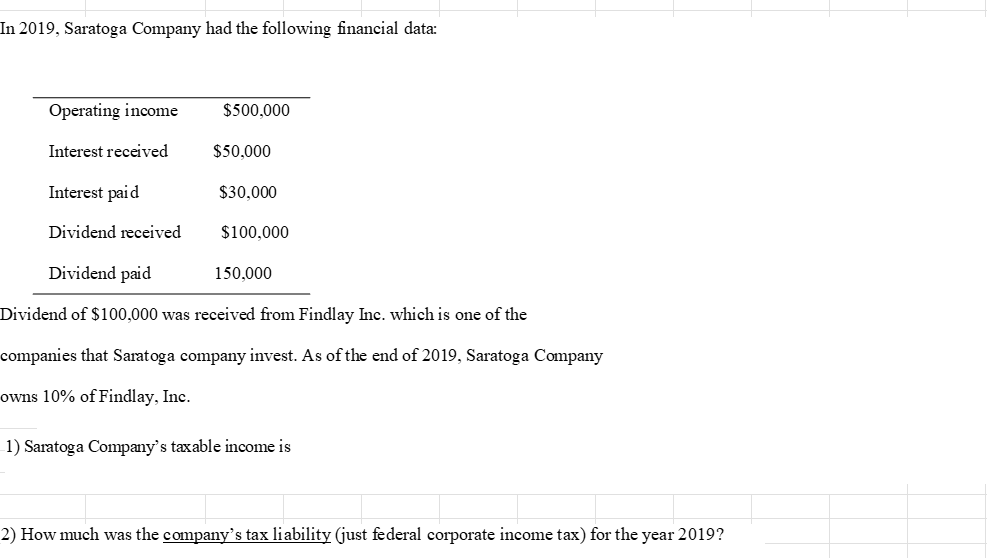

In 2019, Saratoga Company had the following financial data: Operating income Interest received Interest paid Dividend received $500,000 $50,000 $30,000 $100,000 Dividend paid Dividend

In 2019, Saratoga Company had the following financial data: Operating income Interest received Interest paid Dividend received $500,000 $50,000 $30,000 $100,000 Dividend paid Dividend of $100,000 was received from Findlay Inc. which is one of the companies that Saratoga company invest. As of the end of 2019, Saratoga Company owns 10% of Findlay, Inc. 1) Saratoga Company's taxable income is 150,000 2) How much was the company's tax liability (just federal corporate income tax) for the year 2019?

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 Taxable Income Operating Income 500000 Add Interest Rece...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng

12th edition

1305084853, 978-1305464803, 130546480X, 978-1305799448, 978-1305084858

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App