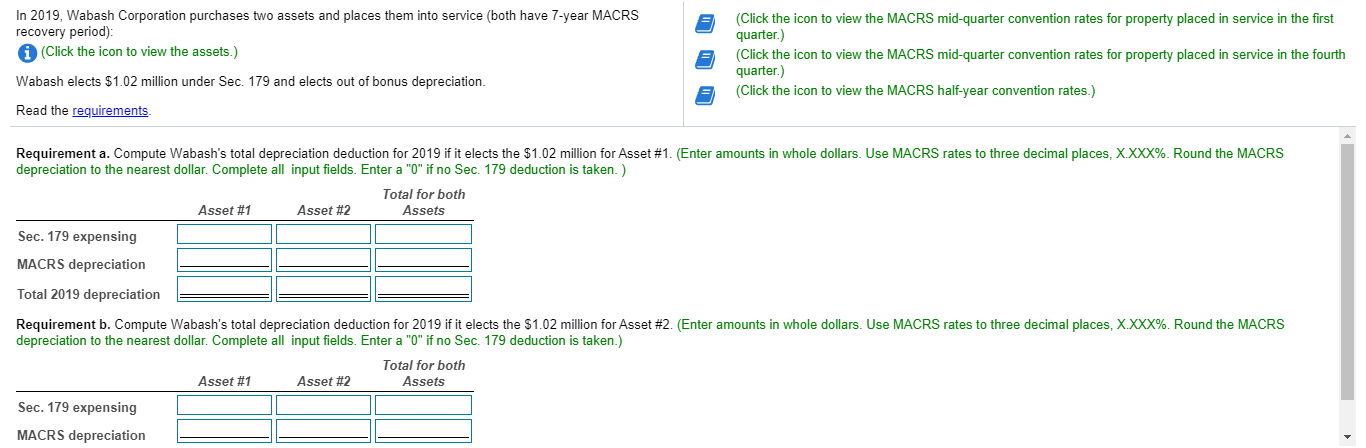

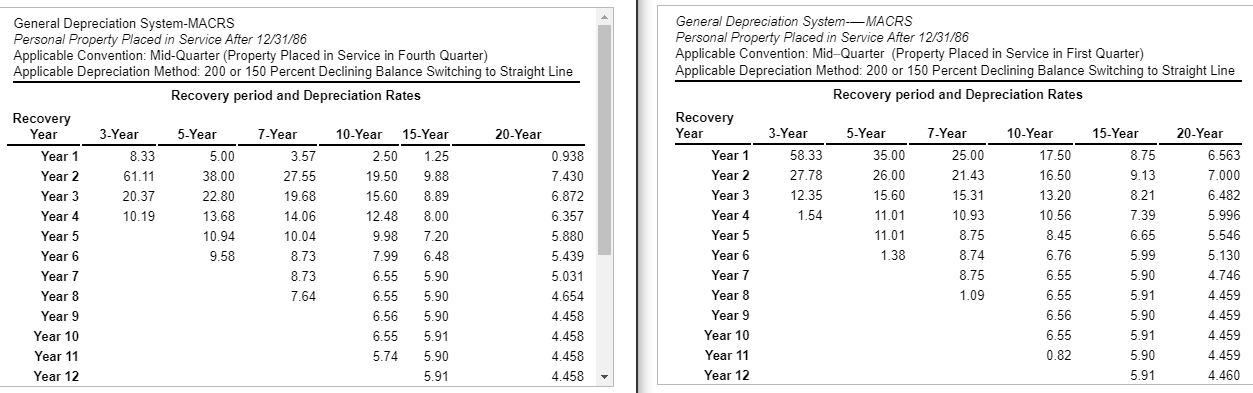

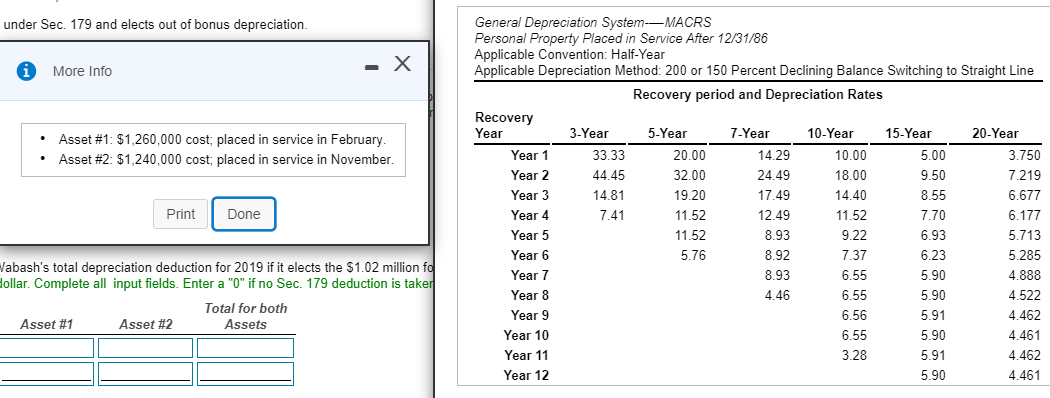

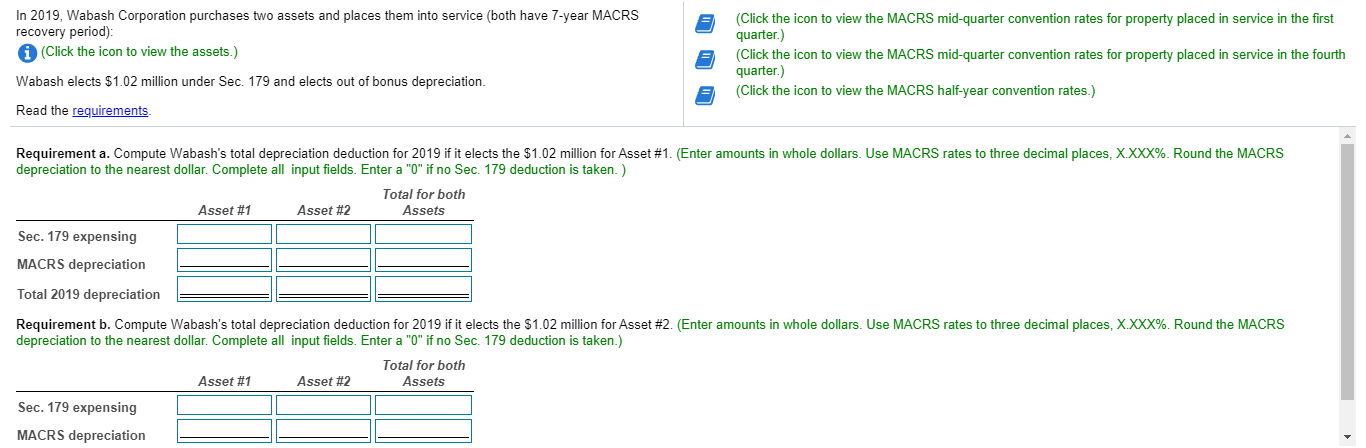

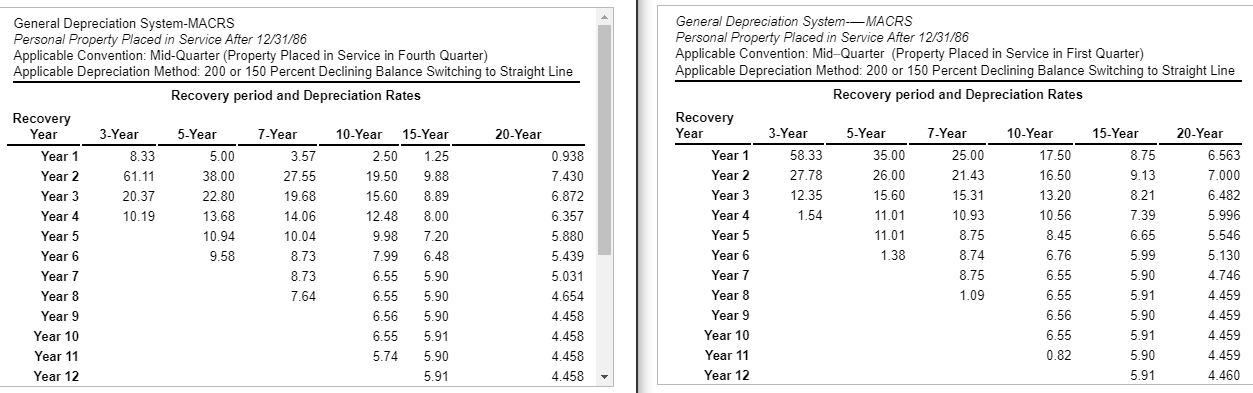

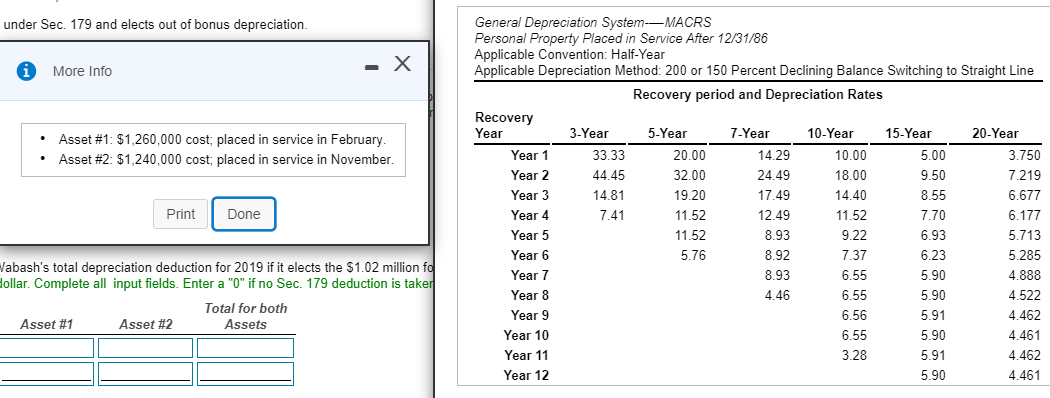

In 2019, Wabash Corporation purchases two assets and places them into service (both have 7-year MACRS recovery period): i (Click the icon to view the assets.) (Click the icon to view the MACRS mid-quarter convention rates for property placed in service in the first quarter.) (Click the icon to view the MACRS mid-quarter convention rates for property placed in service in the fourth quarter.) (Click the icon to view the MACRS half-year convention rates.) Wabash elects $1.02 million under Sec. 179 and elects out of bonus depreciation. Read the requirements. Requirement a. Compute Wabash's total depreciation deduction for 2019 if it elects the $1.02 million for Asset #1. (Enter amounts in whole dollars. Use MACRS rates to three decimal places, X.XXX%. Round the MACRS depreciation to the nearest dollar. Complete all input fields. Enter a "0" if no Sec. 179 deduction is taken.) Total for both Asset #1 Asset #2 Assets Sec. 179 expensing MACRS depreciation Total 2019 depreciation Requirement b. Compute Wabash's total depreciation deduction for 2019 if it elects the $1.02 million for Asset #2. (Enter amounts in whole dollars. Use MACRS rates to three decimal places, X.XXX%. Round the MACRS depreciation to the nearest dollar. Complete all input fields. Enter a "0" if no Sec. 179 deduction is taken.) Total for both Asset #1 Asset #2 Assets Sec. 179 expensing MACRS depreciation 8.33 8.75 9.13 General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in Fourth Quarter) Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 5.00 3.57 2.50 1.25 0.938 Year 2 61.11 38.00 27.55 19.50 9.88 7.430 Year 3 20.37 22.80 19.68 15.60 8.89 6.872 Year 4 10.19 13.68 14.06 12.48 8.00 6.357 Year 5 10.04 9.98 7.20 5.880 Year 6 9.58 8.73 7.99 6.48 5.439 Year 7 8.73 6.55 5.90 5.031 Year 8 7.64 6.55 5.90 4.654 Year 9 6.56 5.90 4.458 Year 10 6.55 5.91 4.458 Year 11 5.74 5.90 4.458 Year 12 5.91 4.458 General Depreciation System- MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in First Quarter) Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 58.33 35.00 25.00 17.50 6.563 Year 2 27.78 26.00 21.43 16.50 7.000 Year 3 12.35 15.60 15.31 13.20 8.21 6.482 Year 4 1.54 11.01 10.93 10.56 5.996 Year 5 11.01 8.75 8.45 Year 6 1.38 5.130 Year 7 5.90 4.746 Year 8 1 09 4.459 Year 9 6.56 5.90 4.459 Year 10 5.91 4.459 Year 11 0.82 4.459 Year 12 5.91 4.460 10.94 MO 5.546 8.74 6.76 o 8.75 6.55 6.55 6.55 under Sec. 179 and elects out of bonus depreciation. * More Info - X Asset #1: $1,260,000 cost; placed in service in February Asset #2: $1,240,000 cost; placed in service in November General Depreciation System- MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Half-Year Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 33.33 20.00 14.29 10.00 5.00 3.750 Year 2 44.45 32.00 24.49 18.00 9.50 7.219 Year 3 14.81 19.20 17.49 14.40 8.55 6.677 Year 4 11.52 12.49 11.52 7.70 6.177 Year 5 11.52 8.93 9.22 5.713 Year 6 5.76 8.92 7.37 5.285 Year 7 8.93 6.55 5.90 4.888 Year 8 4.46 6.55 5.90 Year 9 4.462 Year 10 4.461 Year 11 3.28 4.462 Year 12 5.90 4.461 Print Done 7.41 6.93 6.23 labash's total depreciation deduction for 2019 if it elects the $1.02 million fd lollar. Complete all input fields. Enter a "0" if no Sec. 179 deduction is taker Total for both Asset #1 Asset #2 Assets 4.522 6.56 6.55 5.91 5.90 5.91