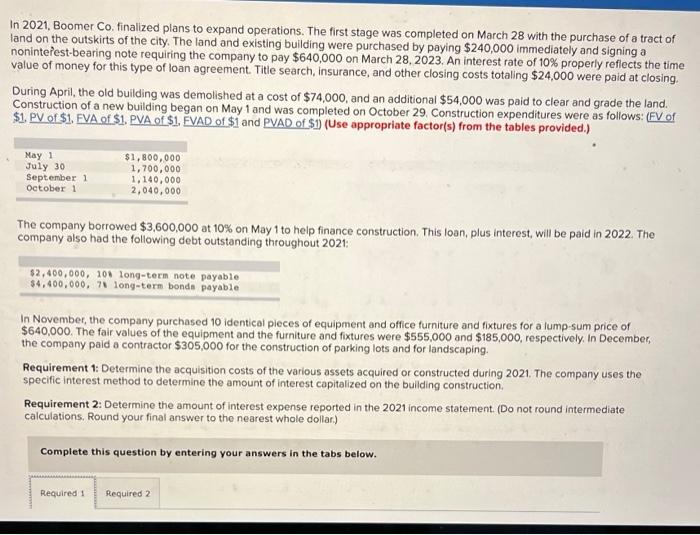

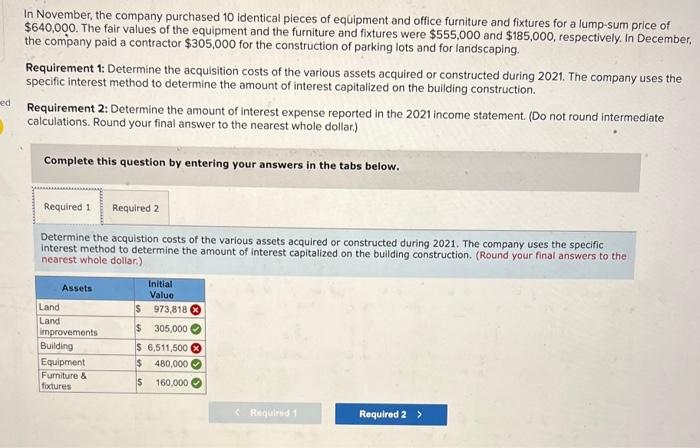

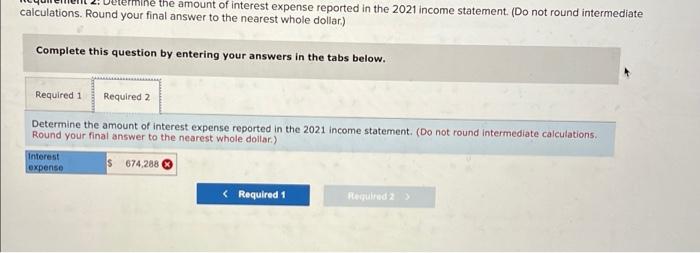

In 2021, Boomer Co, finalized plans to expand operations. The first stage was completed on March 28 with the purchase of a tract of land on the outskirts of the city. The land and existing building were purchased by paying $240,000 immediately and signing a noninterest-bearing note requiring the company to pay $640,000 on March 28, 2023. An interest rate of 10% properly reflects the time value of money for this type of loan agreement. Title search, insurance, and other closing costs totaling $24,000 were paid at closing. During April, the old building was demolished at a cost of $74,000, and an additional $54,000 was paid to clear and grade the land. Construction of a new building began on May 1 and was completed on October 29 Construction expenditures were as follows: (FV of $1. PV of $1. EVA of $1. PVA of $1. VAD of $i and PVAD of $1 (Use appropriate factor(s) from the tables provided.) May 1 July 30 September 1 October 1 $1,800,000 1,700,000 1.140,000 2,040,000 The company borrowed $3,600,000 at 10% on May 1 to help finance construction. This loan, plus interest, will be paid in 2022. The company also had the following debt outstanding throughout 2021: $2,400,000, 104 long-term note payable $4,400,000. Y long-term bonda payable In November, the company purchased 10 identical pieces of equipment and office furniture and fixtures for a lump-sum price of $640,000. The fair values of the equipment and the furniture and fixtures were $555,000 and $185,000, respectively. In December, the company paid a contractor $305,000 for the construction of parking lots and for landscaping Requirement 1: Determine the acquisition costs of the various assets acquired or constructed during 2021. The company uses the specific interest method to determine the amount of interest capitalized on the building construction Requirement 2: Determine the amount of interest expense reported in the 2021 income statement. (Do not round intermediate calculations, Round your final answer to the nearest whole dollar) Complete this question by entering your answers in the tabs below. Required! Required 2 In November, the company purchased 10 identical pieces of equipment and office furniture and fixtures for a lump sum price of $640,000. The fair values of the equipment and the furniture and fixtures were $555,000 and $185,000, respectively. In December, the company paid a contractor $305,000 for the construction of parking lots and for landscaping. Requirement 1: Determine the acquisition costs of the various assets acquired or constructed during 2021. The company uses the specific interest method to determine the amount of interest capitalized on the building construction Requirement 2: Determine the amount of Interest expense reported in the 2021 income statement. (Do not round intermediate calculations. Round your final answer to the nearest whole dollar) ed Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the acquistion costs of the various assets acquired or constructed during 2021. The company uses the specific Interest method to determine the amount of Interest capitalized on the building construction. (Round your final answers to the nearest whole dollar) Assets Initial Value $ 973,818 $ 305,000 Land Land improvements Building Equipment Furniture & fixtures $ 6,511,500 $ 480,000 $ 160,000 Required Required 2 > the amount of interest expense reported in the 2021 income statement. (Do not round intermediate calculations. Round your final answer to the nearest whole dollar) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the amount of interest expense reported in the 2021 income statement. (Do not round intermediate calculations Round your final answer to the nearest whole dollar) Interest s 674,288 expense