Answered step by step

Verified Expert Solution

Question

1 Approved Answer

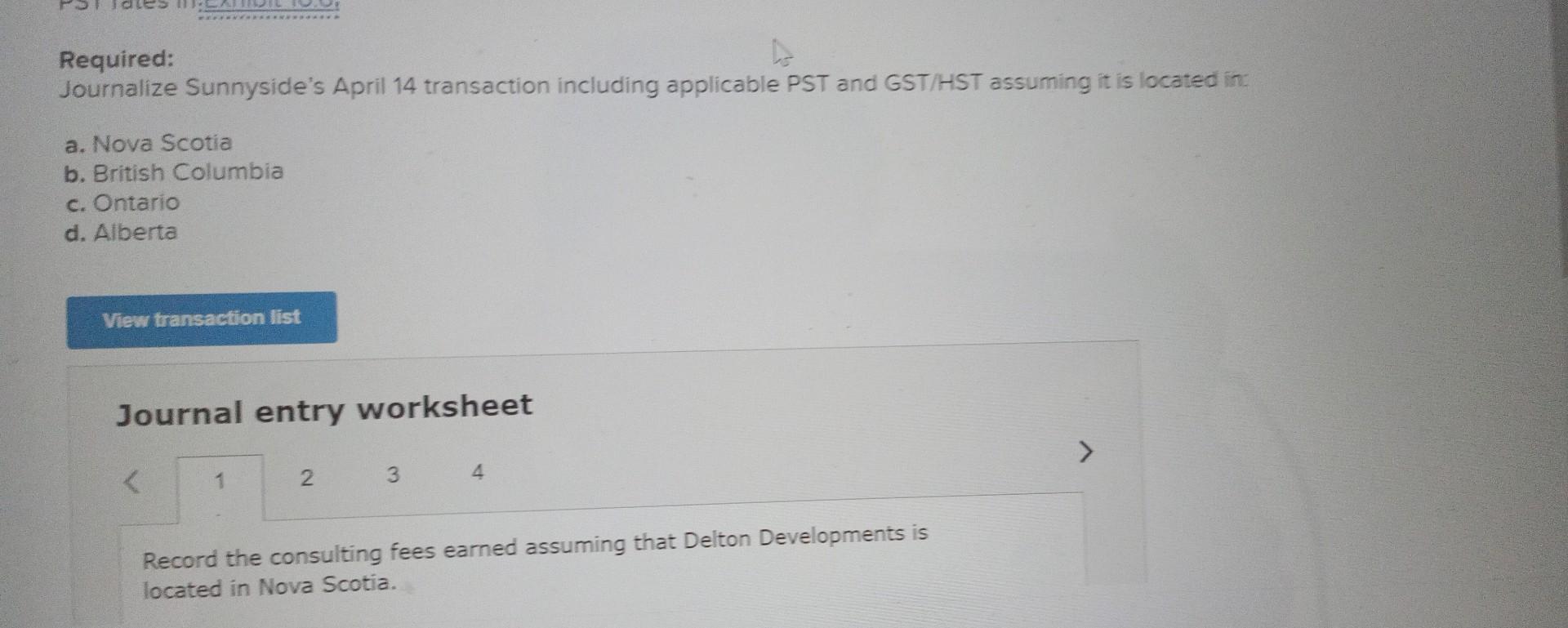

Required: Journalize Sunnyside's April 14 transaction including applicable PST and GST/HST assuming it is located in: a. Nova Scotia b. British Columbia c. Ontario d.

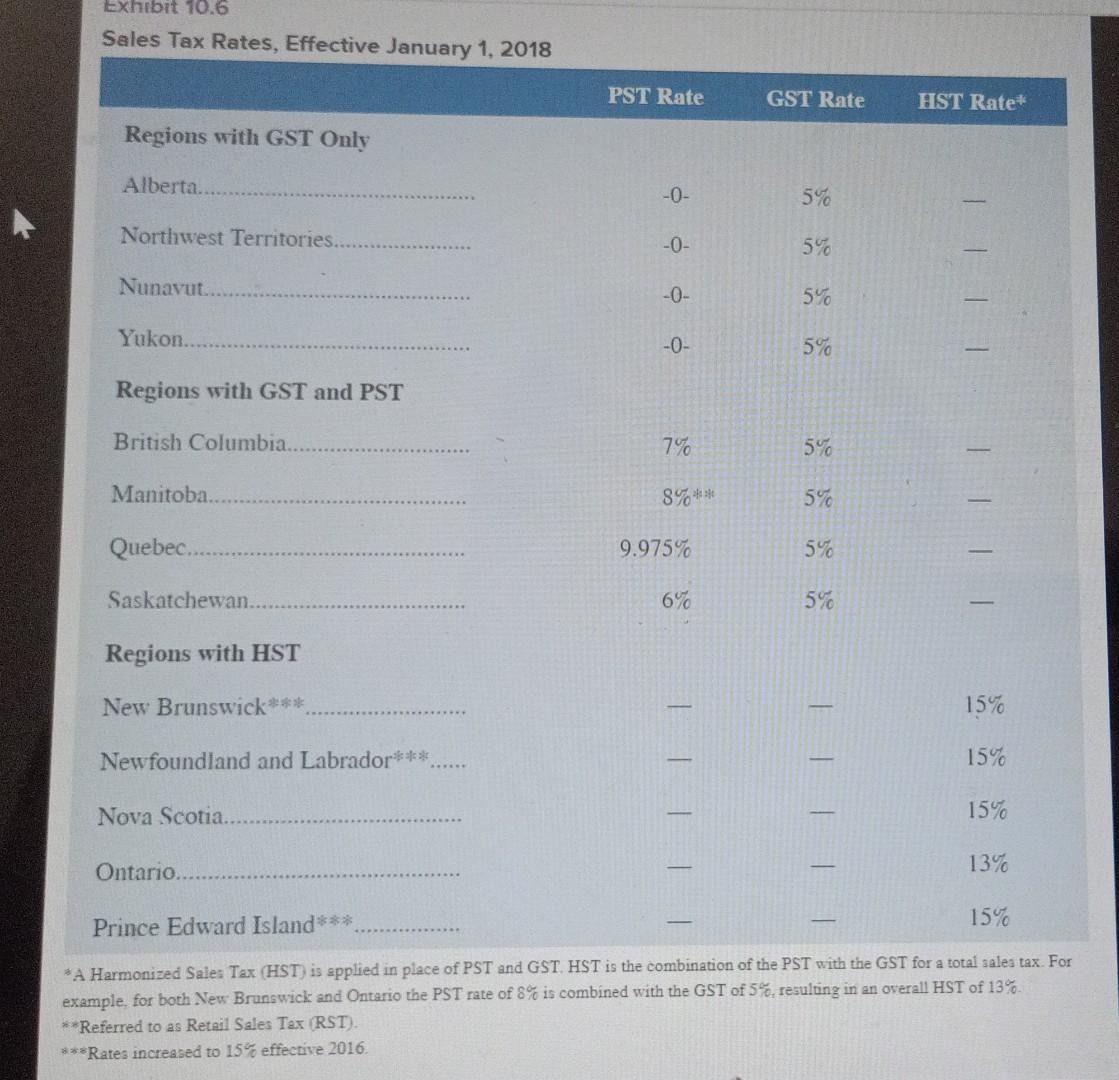

Required: Journalize Sunnyside's April 14 transaction including applicable PST and GST/HST assuming it is located in: a. Nova Scotia b. British Columbia c. Ontario d. Alberta Journal entry worksheet Record the consulting fees earned assuming that Delton Developments is located in Nova Scotia. Sales Tax Rates, Effective January 1, 2018 example, for both New Brunswick and Ontario the PST rate of 8% is combined with the GST of 5%, resulting in an overall HST of 13%. **Referred to as Retail Sales Tax (RST). Rates increased to 15% effective 2016

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started