Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2020 Boston Corporation a calendar year C corporation holds an $80,000 charitable contribution carryover from a gift made in 2015. Boston is contemplating

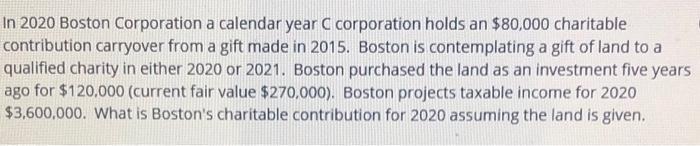

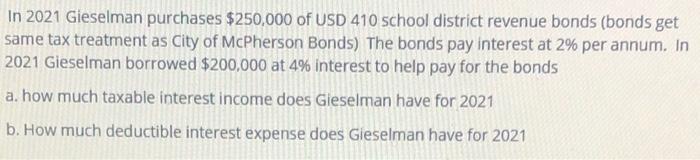

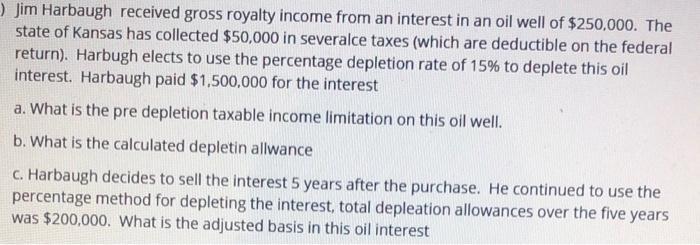

In 2020 Boston Corporation a calendar year C corporation holds an $80,000 charitable contribution carryover from a gift made in 2015. Boston is contemplating a gift of land to a qualified charity in either 2020 or 2021. Boston purchased the land as an investment five years ago for $120,000 (current fair value $270,000). Boston projects taxable income for 2020 $3,600,000. What is Boston's charitable contribution for 2020 assuming the land is given. In 2021 Gieselman purchases $250,000 of USD 410 school district revenue bonds (bonds get same tax treatment as City of McPherson Bonds) The bonds pay interest at 2% per annum. In 2021 Gieselman borrowed $200,000 at 4% interest to help pay for the bonds a. how much taxable interest income does Gieselman have for 2021 b. How much deductible interest expense does Gieselman have for 2021 ) Jim Harbaugh received gross royalty income from an interest in an oil well of $250,000. The state of Kansas has collected $50,000 in severalce taxes (which are deductible on the federal return). Harbugh elects to use the percentage depletion rate of 15% to deplete this oil interest. Harbaugh paid $1,500,000 for the interest a. What is the pre depletion taxable income limitation on this oil well. b. What is the calculated depletin allwance C. Harbaugh decides to sell the interest 5 years after the purchase. He continued to use the percentage method for depleting the interest, total depleation allowances over the five years was $200,000. What is the adjusted basis in this oil interest

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 iGieselman taxable interest income for 2021 2500002 5000 iiGieselman dedu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started