Answered step by step

Verified Expert Solution

Question

1 Approved Answer

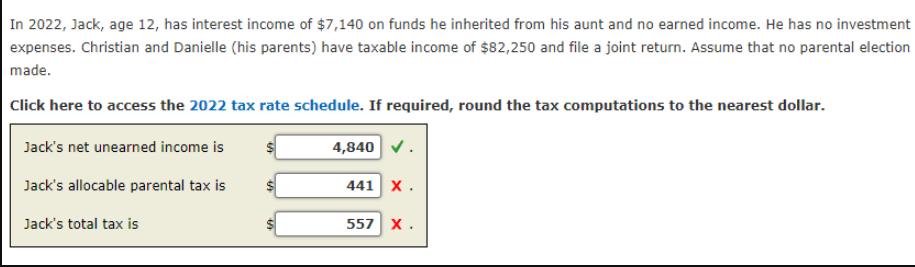

In 2022, Jack, age 12, has interest income of $7,140 on funds he inherited from his aunt and no earned income. He has no

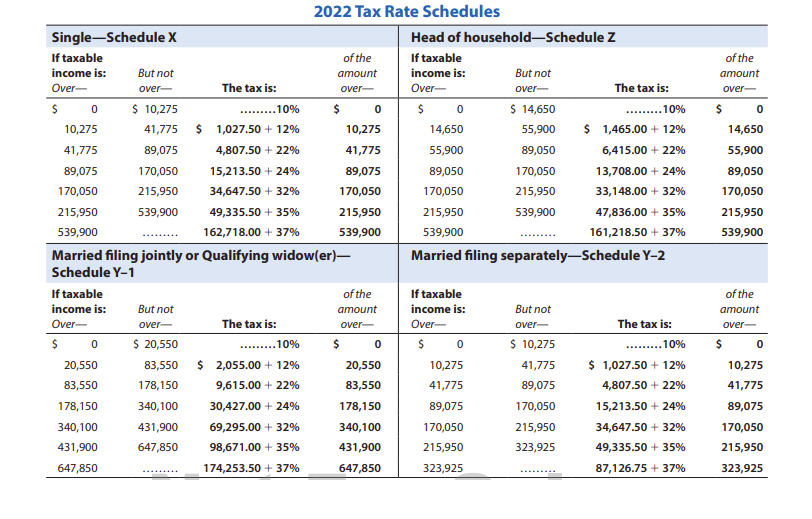

In 2022, Jack, age 12, has interest income of $7,140 on funds he inherited from his aunt and no earned income. He has no investment expenses. Christian and Danielle (his parents) have taxable income of $82,250 and file a joint return. Assume that no parental election made. Click here to access the 2022 tax rate schedule. If required, round the tax computations to the nearest dollar. Jack's net unearned income is Jack's allocable parental tax is Jack's total tax is 4,840 . 441 X. 557 X. Single-Schedule X If taxable income is: Over- $ 0 If taxable income is: Over- $ 0 20,550 83,550 178,150 But not over- 340,100 431,900 647,850 $ 10,275 41,775 89,075 170,050 215,950 539,900 The tax is: But not over- ......... 10% $ 1,027.50 +12% 4,807.50 +22% 10,275 41,775 89,075 170,050 215,950 539,900 Married filing jointly or Qualifying widow(er)- Schedule Y-1 15,213.50 +24% 34,647.50 + 32% 49,335.50 + 35% 162,718.00 + 37% The tax is: $ 20,550 83,550 178,150 340,100 431,900 69,295.00+ 32% 647,850 98,671.00 + 35% 174,253.50 +37% .........10% 2022 Tax Rate Schedules $ 2,055.00 +12% 9,615.00 +22% 30,427.00 +24% of the amount over- $ 0 10,275 41,775 89,075 170,050 215,950 539,900 of the amount over- $ 0 20,550 83,550 178,150 340,100 431,900 647,850 Head of household-Schedule Z If taxable income is: Over- $ If taxable income is: Over- $ 0 14,650 55,900 89,050 170,050 215,950 539,900 Married filing separately-Schedule Y-2 0 10,275 41,775 89,075 But not over- 170,050 215,950 323,925 $ 14,650 55,900 89,050 170,050 215,950 539,900 But not over- The tax is: ......... 10% $ 1,465.00+ 12% 6,415.00 +22% 13,708.00 +24% 33,148.00 + 32% 47,836.00 + 35% 161,218.50 +37% $ 10,275 41,775 89,075 170,050 215,950 323,925 The tax is: ......... 10% $ 1,027.50 +12% 4,807.50 +22% 15,213.50 +24% 34,647.50 +32% 49,335.50 + 35% 87,126.75 +37% of the amount over- $ 0 14,650 55,900 89,050 170,050 215,950 539,900 of the amount over- $ 0 10,275 41,775 89,075 170,050 215,950 323,925

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To determine Jacks net unearned income and his tax liability we need to refer to the tax rate schedu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started