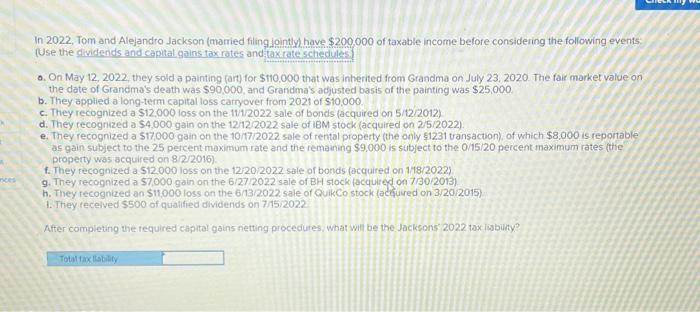

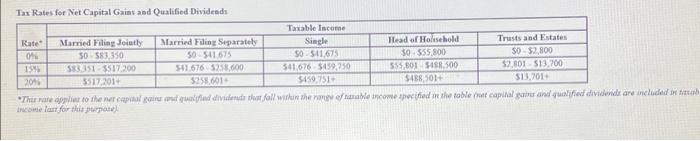

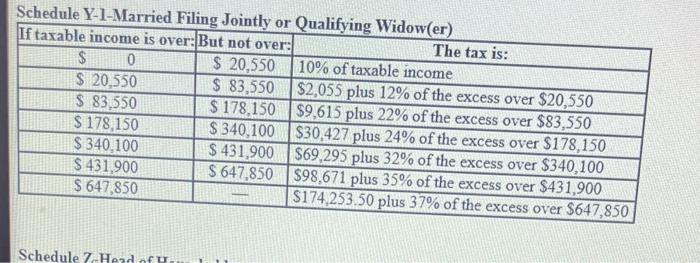

In 2022, Tom and Alejandro Jackson (mamied filing iointlul have $200.000 of taxable income before considering the following events. (Use the dividends and capital gains tax rates and 0. On May 12, 2022, they sold a painting fart) for $110,000 that was inherited from Grandma on July 23,2020 . The fair market value on the date of Grandma's death was $90,000, and Grandma's acjusted basis of the painting was $25,000 b. They applied a long-term capital loss carryover from 2021 of $10,000 c. They recognized a $12,000 loss on the 11/1/2022 sale of bonds (acquired on 5/12/2012 ) d. They recognized a 54,000 gain on the 12/12/2022 sale of 18M stock (acquired on 2/5/2022). e. They recognized a 517,000 gain on the 101712022 sale of rental property (the only 1231 tansaction), of which $8,000 is reportable as gain subject to the 25 petcent maximum rate and the remaining 99.000 is subject to the 0/15/20 percent maximum rates (the property was acquired on 3/2/2016) f. They recognized a 512.000 loss on the 12/20/2022 sale of bonds (acquired on 1/18/2022) 9. They recognized a $7,000 gain on the 6/27/2022 sale of BH stock (acquited on 7/3012013) h. They tecognized an $11,000 loss on the 6/13/2022 sale of QuikCo stock (acyuved on 3/20/2015) 1. They recelved 5500 of qualified dividends on 7/15/2022 After completing the required capital gains netting procedutes, what will be the Jacksons" 2022 tax lisbility? Tas Rates for Net Capital Gaias aed Qualified Dividesds Incowe laut for thit jtapostel Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$820,550 & 10% of taxable income \\ \hline$20,550 & $83,550 & $2,055 plus 12% of the excess over $20,550 \\ \hline$83,550 & $178,150 & $9,615 plus 22% of the excess over $83,550 \\ \hline$178,150 & $340,100 & $30,427 plus 24% of the excess over $178,150 \\ \hline$340,100 & $431,900 & $69,295 plus 32% of the excess over $340,100 \\ \hline$431,900 & $647,850 & $98,671 plus 35% of the excess over $431,900 \\ \hline$647,850 & & $174,253,50 plus 37% of the excess over $647,850 \\ \hline \end{tabular}