Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In a double decrement model with two independent decrements (causes), assume the following distributions for the exit times due to decrements 1 and 2

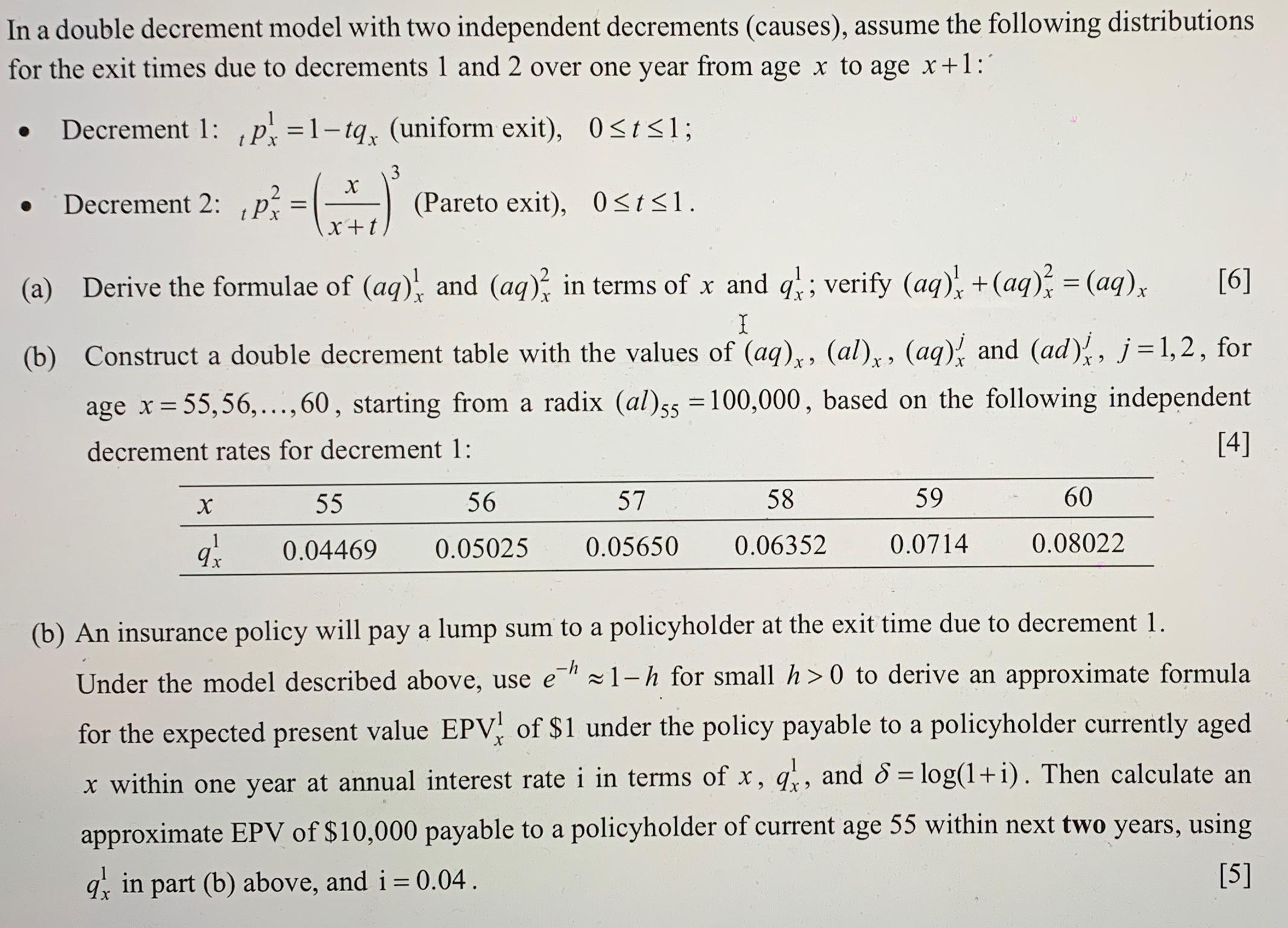

In a double decrement model with two independent decrements (causes), assume the following distributions for the exit times due to decrements 1 and 2 over one year from age x to age x+1:' Decrement 1: p=1-tq, (uniform exit), 0t1; 3 X Decrement 2: p = (-_*-_) x+t (a) Derive the formulae of (aq) and (aq) in terms of x and q; verify (aq) + (aq) = (aq) x [6] I (b) Construct a double decrement table with the values of (aq), (al)x, (aq) and (ad), j=1,2, for age x = 55,56,..., 60, starting from a radix (al) 55 = 100,000, based on the following independent decrement rates for decrement 1: [4] X 95 (Pareto exit), 0t1. 55 0.04469 56 0.05025 57 0.05650 58 0.06352 59 0.0714 60 0.08022 (b) An insurance policy will pay a lump sum to a policyholder at the exit time due to decrement 1. Under the model described above, use eh 1-h for small h> 0 to derive an approximate formula for the expected present value EPV of $1 under the policy payable to a policyholder currently aged X x within one year at annual interest rate i in terms of x, q, and 8 = log(1+i). Then calculate an approximate EPV of $10,000 payable to a policyholder of current age 55 within next two years, using q in part (b) above, and i = 0.04. [5]

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a To derive the formulae for aq and aq in terms of x and q we can use the given distributions for the exit times due to decrements 1 and 2 For Decreme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started