Answered step by step

Verified Expert Solution

Question

1 Approved Answer

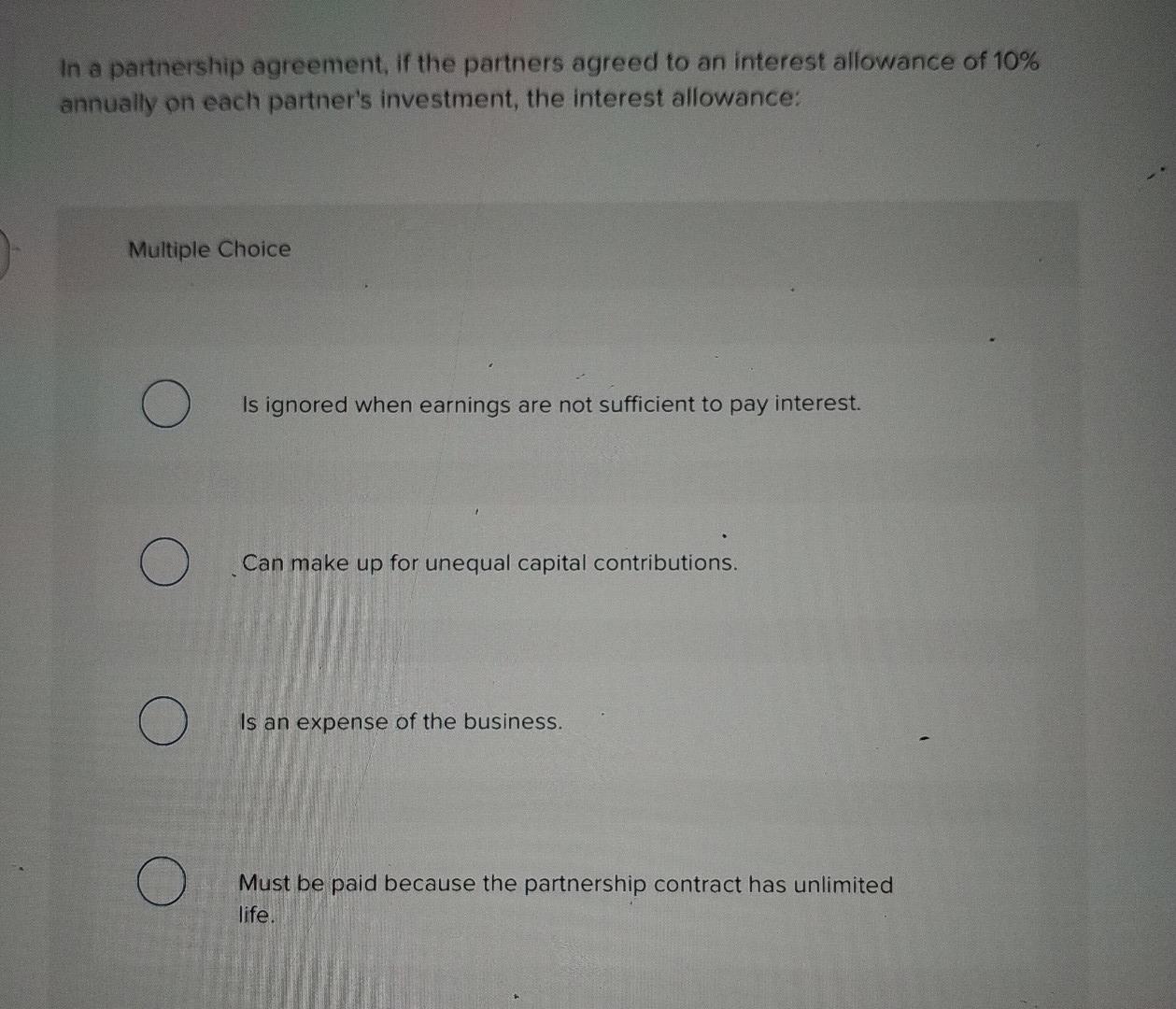

In a partnership agreement, if the partners agreed to an interest allowance of 10% annually on each partner's investment, the interest allowance: Multiple Choice Is

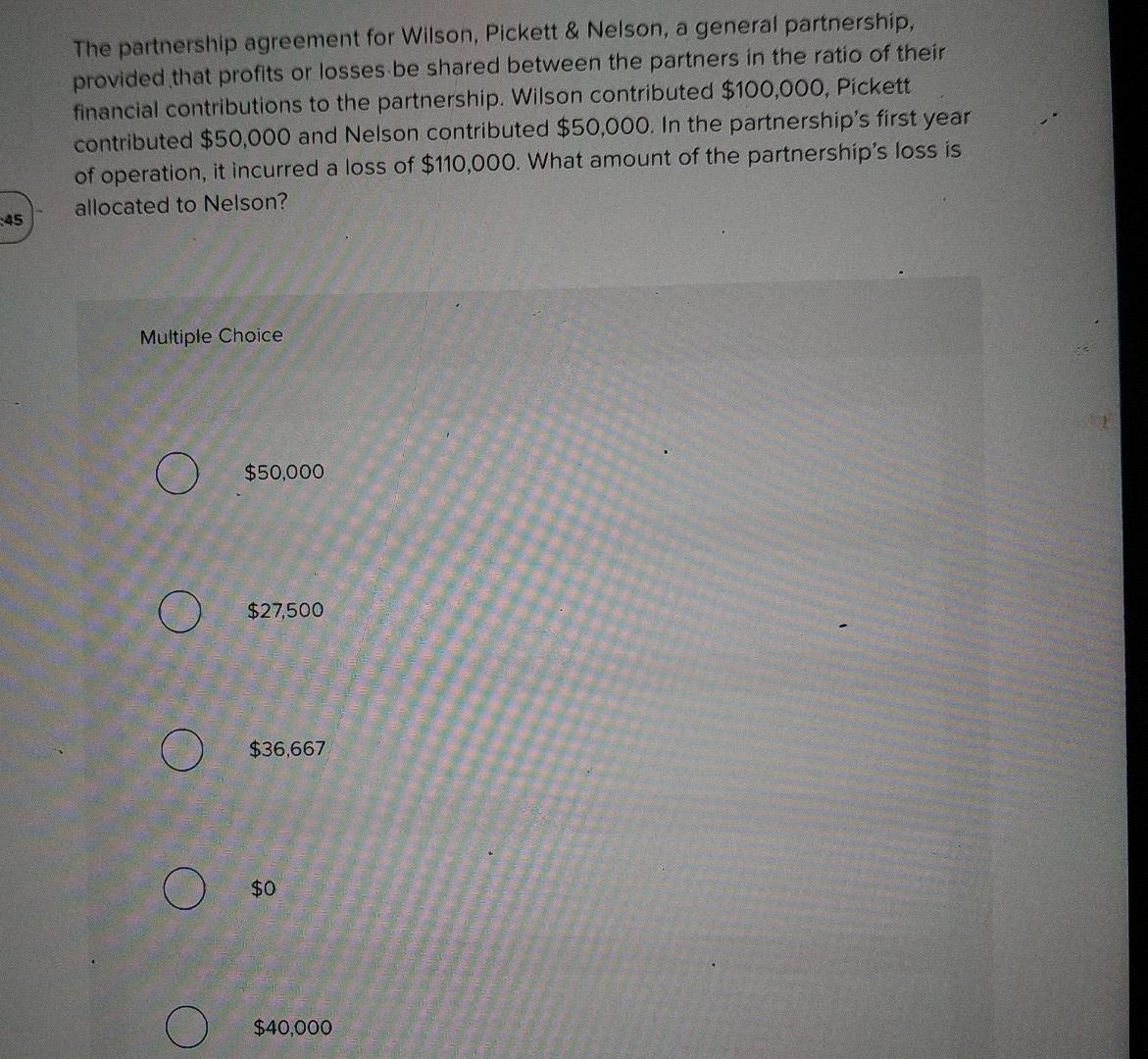

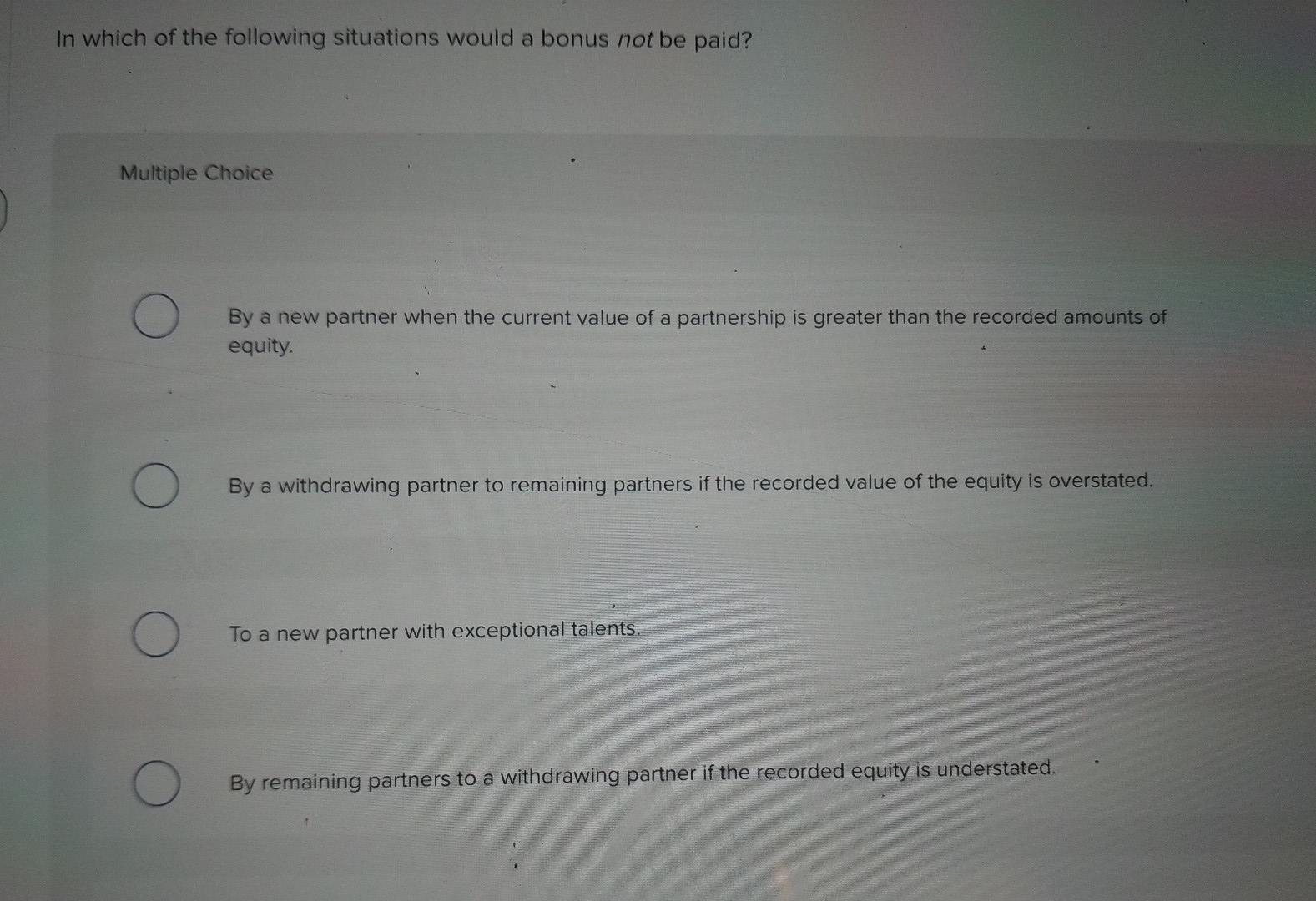

In a partnership agreement, if the partners agreed to an interest allowance of 10% annually on each partner's investment, the interest allowance: Multiple Choice Is ignored when earnings are not sufficient to pay interest. Can make up for unequal capital contributions. Is an expense of the business. Must be paid because the partnership contract has unlimited life. The partnership agreement for Wilson, Pickett & Nelson, a general partnership, provided that profits or losses be shared between the partners in the ratio of their financial contributions to the partnership. Wilson contributed $100,000, Pickett contributed $50,000 and Nelson contributed $50,000. In the partnership's first year of operation, it incurred a loss of $110,000. What amount of the partnership's loss is allocated to Nelson? 245 Multiple Choice $50,000 $27,500 $36,667 $0 O $40,000 In which of the following situations would a bonus not be paid? Multiple Choice By a new partner when the current value of a partnership is greater than the recorded amounts of equity. By a withdrawing partner to remaining partners if the recorded value of the equity is overstated. To a new partner with exceptional talents. By remaining partners to a withdrawing partner if the recorded equity is understated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started