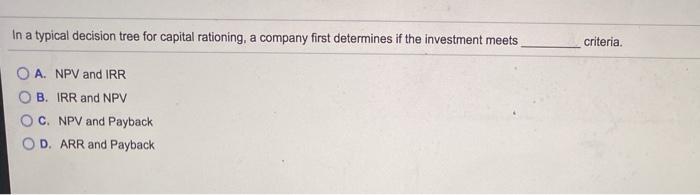

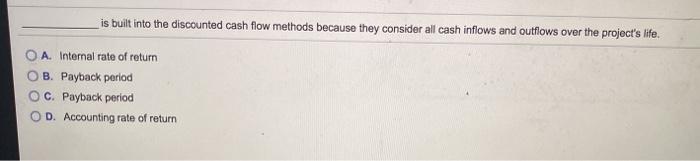

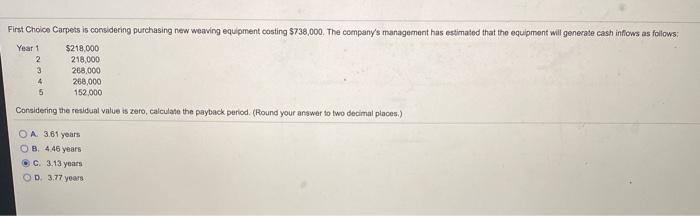

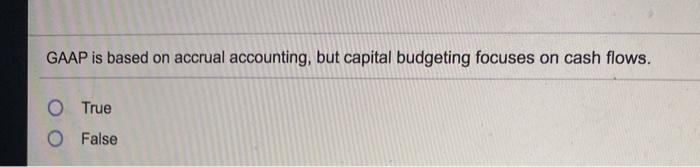

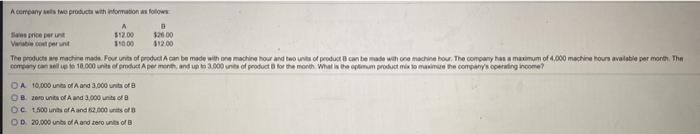

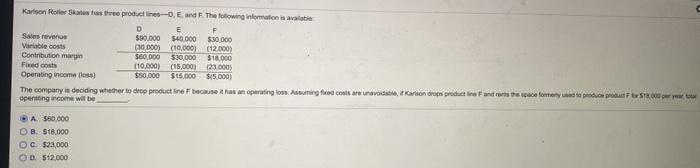

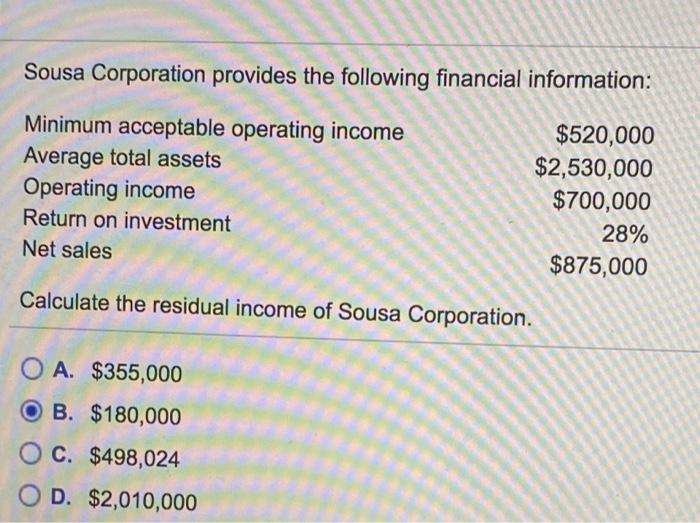

In a typical decision tree for capital rationing, a company first determines if the investment meets criteria. O A. NPV and IRR B. IRR and NPV C. NPV and Payback D. ARR and Payback is built into the discounted cash flow methods because they consider all cash inflows and outflows over the project's life. OA. Internal rate of return B. Payback period C. Payback period OD. Accounting rate of return The net present value method of evaluating capital investments suggests that an investment with discounted net cash inflows which exceed the initial cost of the investment is desirable True False First Choice Carpets is considering purchasing new weaving equipment conting $738,000. The company's management has estimated that the equipment wil generate cash inflows as follows: Year 1 $218.000 2 218,000 3 268.000 4 268,000 5 152.000 Considering the residual value is zero, calculate the payback period. (Round your answer to two decimal places) A 3.61 years OS 4.46 years C 3.13 years OD 3.77 years GAAP is based on accrual accounting, but capital budgeting focuses on cash flows. O True O False Acorar o products with Winflows rice per 52000 Veden $12.00 The product machine made Four unit of red can be made with machine hour and to its product can be made the machine hour. The company has a maximum of 4.000 machine osavalle per month The company can 10.000 units of pict Apemand 3.000 units of product for the month What is the product to use the company's operating income? DA 10,000 units of Aand 3,000 tot 8 OB 20 units of Amd 3.000 units of a Oct 500 Aand 62.000 of OD 20.000 unts of Aand seront B Karlson Rolle Sales has three producties--, and the following information is available D E F Sales revenue $90,000 $40,000 $30,000 Variable costs (30.000) (10,000 (12.000) Contribution margin 560.000 $30,000 $16000 Fed costs (10.000) (15,000)23.000) Operating income foss) $50,000 $15.000 55.000) The company is deciding whether to drop product line because it has an operating loss. Assuming food costs are av Karlson drops product in Froste como podo produtor $18.000 wew operating income will be BA 580.000 OB 518,000 OC $23,000 OD 512.000 Sousa Corporation provides the following financial information: Minimum acceptable operating income Average total assets Operating income Return on investment Net sales $520,000 $2,530,000 $700,000 28% $875,000 Calculate the residual income of Sousa Corporation. O A. $355,000 B. $180,000 O C. $498,024 OD. $2,010,000