In accordance with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors, state how Softrock plc should disclose its decision to change from valuating properties classified under Property, Plant and Equipment from the historical cost model to the revaluation model as at 31 December 2X20.

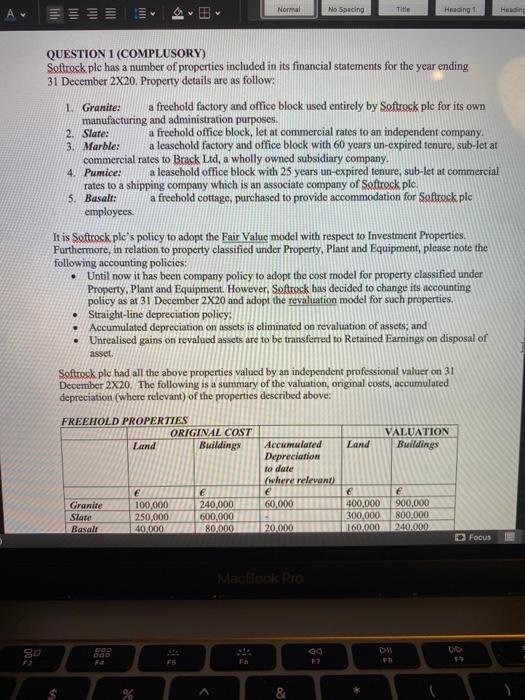

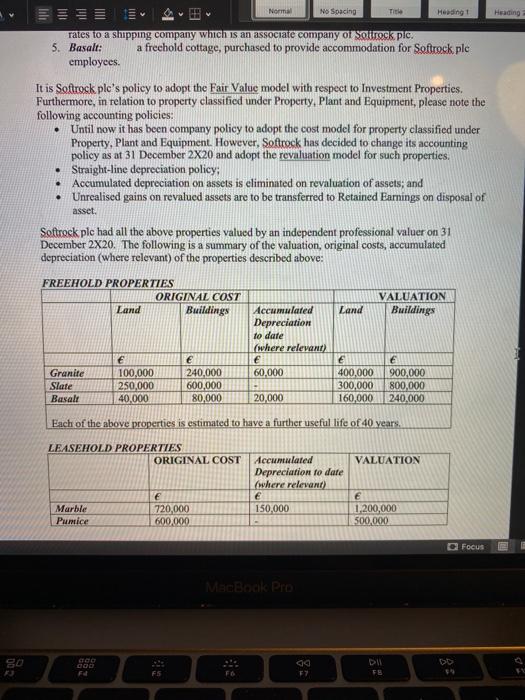

Aw Normal IIII lili Title No Spacing Heading 1 Heading QUESTION 1 (COMPLUSORY) Softrock plc has a number of properties included in its financial statements for the year ending 31 December 2X20. Property details are as follow: Granite: a freehold factory and office block used entirely by Softrock plc for its own manufacturing and administration purposes. 2. Slate: a frechold office block, let at commercial rates to an independent company. 3. Marble: a leasehold factory and office block with 60 years un-expired tenure, sub-let at commercial rates to Brack Ltd, a wholly owned subsidiary company. 4. Pumice: a leasehold office block with 25 years un-expired tenure, sub-let at commercial rates to a shipping company which is an associate company of Softrock ple 5. Basalt: a freehold cottage, purchased to provide accommodation for Softrock plc employees. . It is Softrock ple's policy to adopt the Fair Value model with respect to Investment Properties Furthermore, in relation to property classified under Property, Plant and Equipment, please note the following accounting policies: Until now it has been company policy to adopt the cost model for property classified under Property, Plant and Equipment. However, Softrock has decided to change its accounting policy as at 31 December 2X20 and adopt the revaluation model for such properties. Straight-line depreciation policy: Accumulated depreciation on assets is eliminated on revaluation of assets, and Unrealised gains on revalued assets are to be transferred to Retained Earnings on disposal of asset. Softrock plc had all the above properties valued by an independent professional valuer on 31 December 2X20. The following is a summary of the valuation, original costs, accumulated depreciation (where relevant) of the properties described above: . FREEHOLD PROPERTIES ORIGINAL COST Land Buildings Land VALUATION Buildings Accumulated Depreciation to date (where relevant) 60,000 Granite Slate Basalt 100,000 250,000 40.000 240,000 600,000 80.000 400,000 300,000 160.000 900,000 800.000 240.000 20,000 Focus MacBook Pro 000 00 DI FB A Norma No Spacing Title Heading Heading rates to a shipping company which is an associate company or Sourck pic. 5. Basalt: a freehold cottage, purchased to provide accommodation for Softrock ple employees. . It is Softrock ple's policy to adopt the Fair Value model with respect to Investment Properties. Furthermore, in relation to property classified under Property, Plant and Equipment, please note the following accounting policies: Until now it has been company policy to adopt the cost model for property classified under Property. Plant and Equipment. However, Softrock has decided to change its accounting policy as at 31 December 2X20 and adopt the revaluation model for such properties. Straight-line depreciation policy: Accumulated depreciation on assets is eliminated on revaluation of assets; and Unrealised gains on revalued assets are to be transferred to Retained Earnings on disposal of asset. Softrock plc had all the above properties valued by an independent professional valuer on 31 December 2X20. The following is a summary of the valuation, original costs, accumulated depreciation (where relevant) of the properties described above: FREEHOLD PROPERTIES ORIGINAL COST Land Buildings VALUATION Accumulated Land Buildings Depreciation to date (where relevant) E 6 60,000 400,000 900,000 300,000 800,000 20,000 160,000 240.000 Granite Slate Basalt 100,000 250,000 40,000 E 240,000 600,000 80,000 Each of the above properties is estimated to have a further useful life of 40 years. LEASEHOLD PROPERTIES ORIGINAL COST VALUATION Accumulated Depreciation to date (where relevant) 150,000 Marble Puntice 720,000 600,000 1.200,000 500,000 Focus MacBook Pro DO F FS FY FE