Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In addition to confirming accounts receivable, you are also concerned about the cut-off assertion for cash, accounts receivable, revenue, cost of sales and accounts

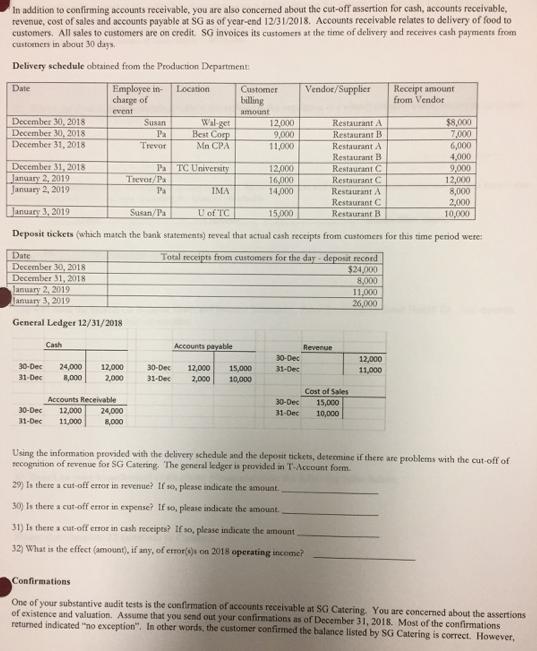

In addition to confirming accounts receivable, you are also concerned about the cut-off assertion for cash, accounts receivable, revenue, cost of sales and accounts payable at SG as of year-end 12/31/2018. Accounts receivable relates to delivery of food to customers. All sales to customers are on credit. SG invoices its customers at the time of delivery and receives cash payments from customers in about 30 days. Delivery schedule obtained from the Production Department: Date December 30, 2018 December 30, 2018 December 31, 2018 Employee in- charge of event Date December 30, 2018 December 31, 2018 January 2, 2019 January 3, 2019. General Ledger 12/31/2018 Cash 30-Dec 24,000 12,000 31-Dec 8,000 2,000 Susan Pa Trevor Accounts Receivable 30-Dec 12,000 24,000 31-Dec 11,000 8,000 Location Trevor/Pa Best Corp Mn CPA Pa TC University Pa December 31, 2018 January 2, 2019 January 2, 2019 January 3, 2019 Susan/Pa 15,000 Deposit tickets (which match the bank statements) reveal that actual cash receipts from customers for this time period were: Total receipts from customers for the day- deposit record $24,000 8,000 IMA U of TC Customer billing amount Accounts payable 12,000 9,000 11,000 30-Dec 12,000 15,000 31-Dec 2,000 10,000 12,000 16,000 14,000 30-Dec 31-Dec Vendor/Supplier 30-Dec 31-Dec Restaurant A Restaurant B Restaurant A Restaurant B Restaurant C Restaurant C Restaurant A Restaurant C Restaurant B Revenue Cost of Sales 15,000 10,000 11,000 26,000 Receipt amount from Vendor 12,000 11,000 $8,000 7,000 6,000 4,000 9,000 12,000 8,000 2,000 10,000 Using the information provided with the delivery schedule and the deposit tickets, determine if there are problems with the cut-off of recognition of revenue for SG Catering. The general ledger is provided in T-Account form. 29) Is there a cut-off error in revenue? If so, please indicate the amount. 30) Is there a cut-off error in expense? If so, please indicate the amount. 31) Is there a cut-off error in cash receipts? If so, please indicate the amount 32) What is the effect (amount), if any, of error(s)s on 2018 operating income? Confirmations One of your substantive audit tests is the confirmation of accounts receivable at SG Catering. You are concerned about the assertions of existence and valuation. Assume that you send out your confirmations as of December 31, 2018. Most of the confirmations returned indicated "no exception". In other words, the customer confirmed the balance listed by SG Catering is correct. However,

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

29 Is there a cutoff error in revenue If so please indicate the amount Yes there appears to be a cutoff error in revenue The total amount of revenue r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started