Question

In an earlier worksheet we discussed the difference between yield to maturity and yield to call. There is another yield that is commonly quoted, the

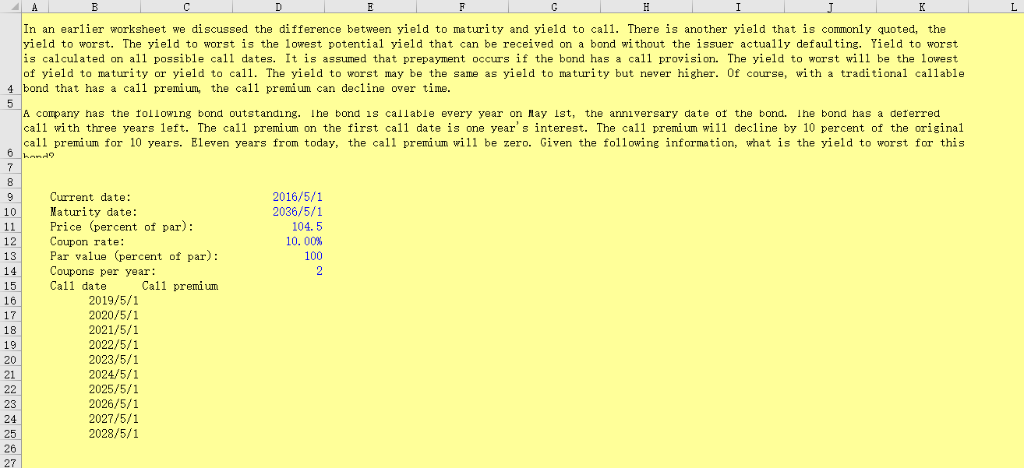

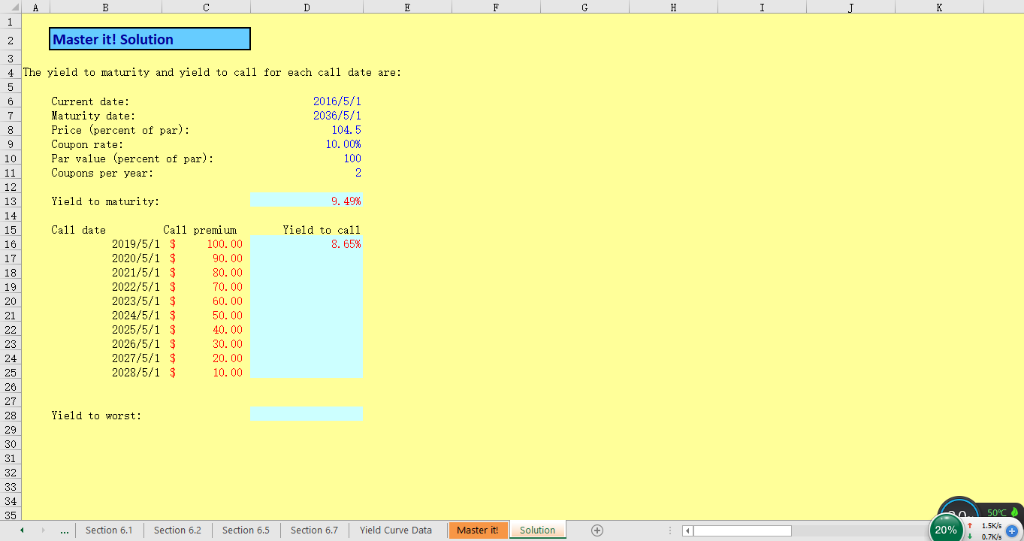

In an earlier worksheet we discussed the difference between yield to maturity and yield to call. There is another yield that is commonly quoted, the yield to worst. The yield to worst is the lowest potential yield that can be received on a bond without the issuer actually defaulting. Yield to worst is calculated on all possible call dates. It is assumed that prepayment occurs if the bond has a call provision. The yield to worst will be the lowest of yield to maturity or yield to call. The yield to worst may be the same as yield to maturity but never higher. Of course, with a traditional callable bond that has a call premium, the call premium can decline over time.

A company has the following bond outstanding. The bond is callable every year on May 1st, the anniversary date of the bond. The bond has a deferred call with three years left. The call premium on the first call date is one year's interest. The call premium will decline by 10 percent of the original call premium for 10 years. Eleven years from today, the call premium will be zero. Given the following information, what is the yield to worst for this bond?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started