Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In assessing the validity of a prior court decision, indicate the significance of the following court decisions for the taxpayer: For each situation, select either

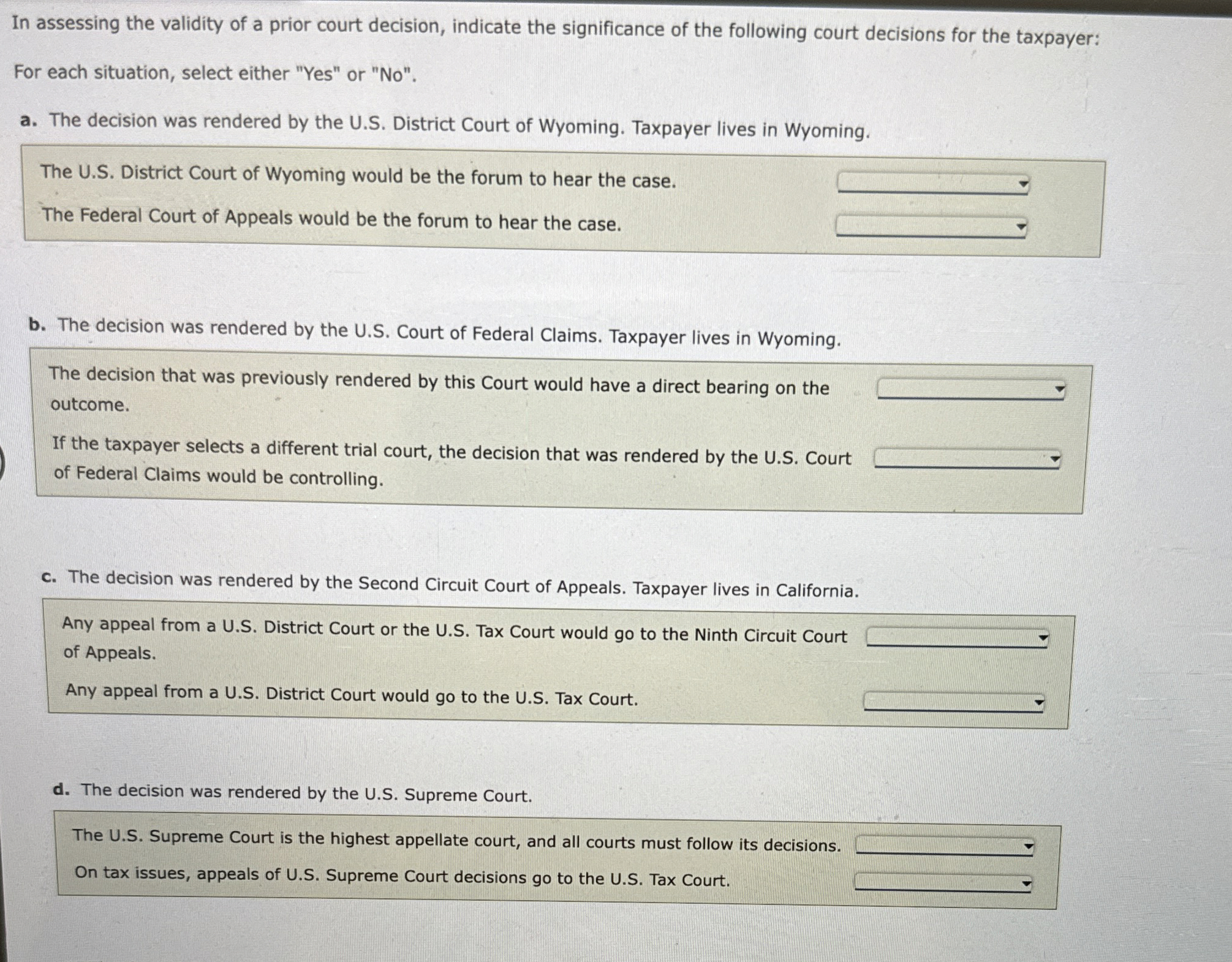

In assessing the validity of a prior court decision, indicate the significance of the following court decisions for the taxpayer:

For each situation, select either "Yes" or No

a The decision was rendered by the US District Court of Wyoming. Taxpayer lives in Wyoming.

The US District Court of Wyoming would be the forum to hear the case.

The Federal Court of Appeals would be the forum to hear the case.

b The decision was rendered by the US Court of Federal Claims. Taxpayer lives in Wyoming.

The decision that was previously rendered by this Court would have a direct bearing on the outcome.

If the taxpayer selects a different trial court, the decision that was rendered by the US Court of Federal Claims would be controlling.

c The decision was rendered by the Second Circuit Court of Appeals. Taxpayer lives in California.

Any appeal from a US District Court or the US Tax Court would go to the Ninth Circuit Court of Appeals.

Any appeal from a US District Court would go to the US Tax Court.

d The decision was rendered by the US Supreme Court.

The US Supreme Court is the highest appellate court, and all courts must follow its decisions.

On tax issues, appeals of US Supreme Court decisions go to the US Tax Court.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started