Question

In C# using windows application form, create an application that uses a method to calculate the income tax owed. The method must get the income

In C# using windows application form, create an application that uses a method to calculate the income tax owed. The method must get the income from the user and return the tax owed.

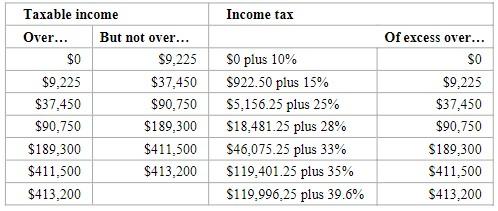

This is the 2015 table for the federal income tax on individuals that you should use for calculating the tax, if you want to research on the IRS tax site to understand better go down to schedule x for filing single after the income tables.

https://www.irs.gov/publications/p17/ar02.html

To test this code, use income values of 8700 and 35350, which should display taxable amounts of 870 and 4841.25

Income tax Taxable income Over... But not over... $0 $9,225 $9,225 $37,450 $37,450 $90.750 $90,750 $189,300 $189,300 $411,500 $411,500 $413,200 $413,200 SO plus 10% $922.50 plus 15% $5,156.25 plus 25% $18.481.25 plus 28% $46,075.25 plus 33% $119.401.25 plus 35% $119.996.25 plus 39.6% Of excess over... SO $9,225 $37,450 $90,750 $189,300 S411,500 $413,200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started