Question

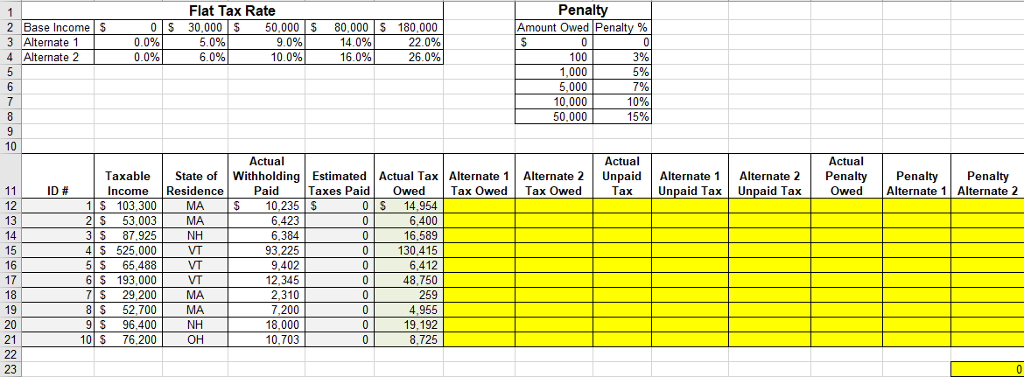

In cell G12, write a formula to calculate the total tax amount for Alternate 1 on the income in cell B12. Use the HLOOKUP function

In cell G12, write a formula to calculate the total tax amount for Alternate 1 on the income in cell B12. Use the HLOOKUP function to determine the Alternate 1 flat tax rate for the income in cell B12 and then multiply by the income to get the dollar amount owed. If done properly the result in G12 should be 14,462.

Make sure you have used absolute references appropriately and then autofill down.

In cell H12, write a formula to calculate the total tax amount for alternate 2 on the income in cell B12. Use the HLOOKUP function to determine the Alternate 2 flat tax rate for the income in cell B12 and then multiply by the income to get the dollar amount owed. If done properly the result in H12 should be 16,528.

Make sure you have used absolute references appropriately and then autofill down.

In cell I12, write a formula to calculate the amount of unpaid taxes based on the Actual Tax Owed (column F) and the Actual Withholding Paid (column D). This is simply the difference between column F and column D. If done properly the result in I12 should be 4,719. Autofill down.

In cell J12, write a formula to calculate the amount of unpaid taxes based on the Alternate 1 Tax Owed (column G) and the Actual Withholding Paid (column D). This is simply the difference between column G and column D. If done properly the result in J12 should be 4,227. Autofill down.

In cell K12, write a formula to calculate the amount of unpaid taxes based on the Alternate 2 Tax Owed (column H) and the Actual Withholding Paid (column D). This is simply the difference between column H and column D. If done properly the result in K12 should be 6,293. Autofill down.

In cell L12, write a formula to calculate the Actual penalty owed IF the Actual unpaid tax in I12 is >0. You can LOOKUP the penalty rate in cells H3:I8. You will need to use IF, VLOOKUP and then multiplication. If done properly the result in L12 should be 236.

If necessary, modify your original formula in cell L12 with the appropriate absolute references so that you could have copied it across to column M and N and down to row 21.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started