Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In December 1 9 9 9 , Wilson applied for a Citibank credit card and signed an acceptance certificate in which she agreed to be

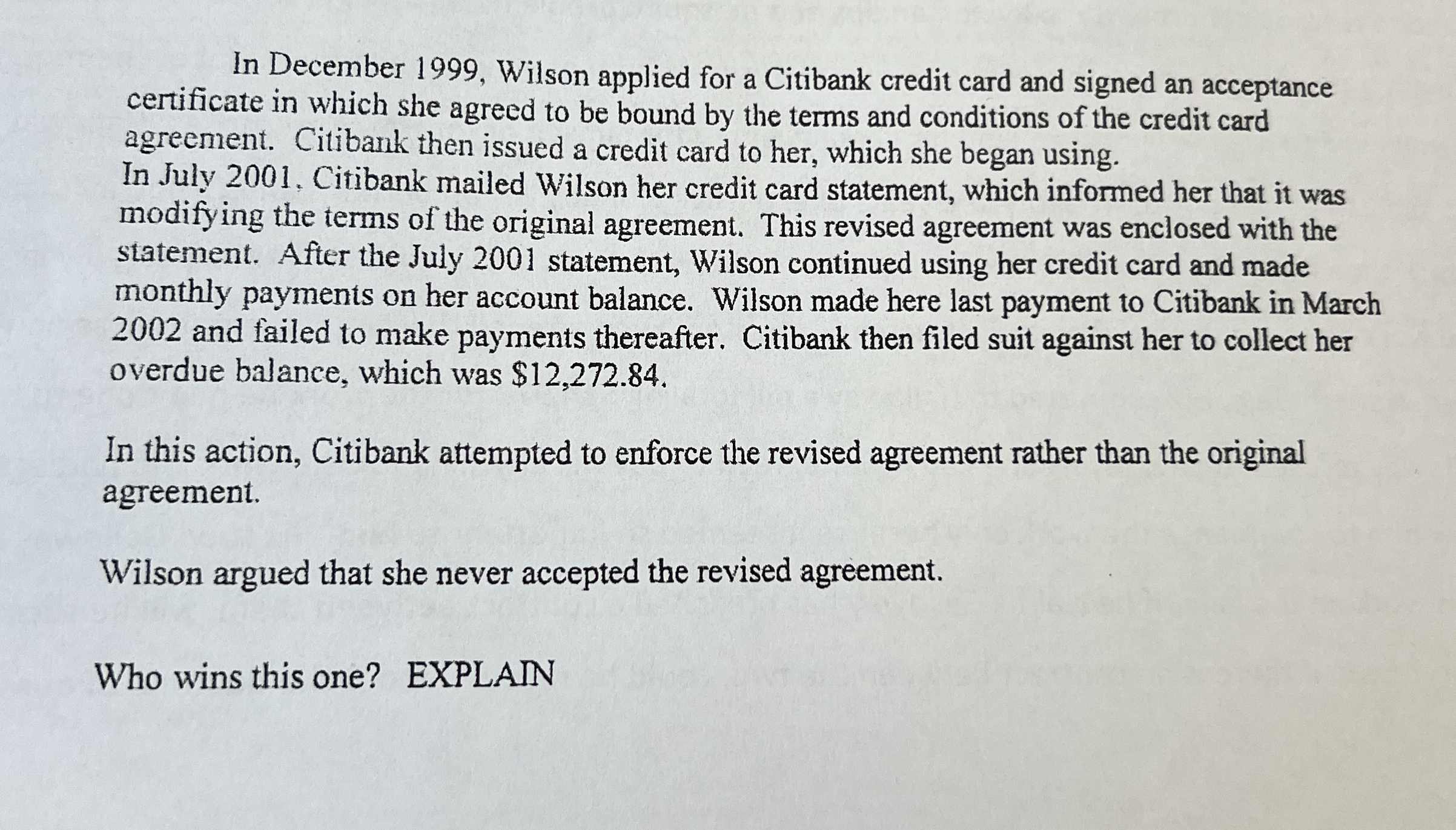

In December Wilson applied for a Citibank credit card and signed an acceptance

certificate in which she agreed to be bound by the terms and conditions of the credit card

agreement. Citibank then issued a credit card to her, which she began using.

In July Citibank mailed Wilson her credit card statement, which informed her that it was

modifying the terms of the original agreement. This revised agreement was enclosed with the

statement. After the July statement, Wilson continued using her credit card and made

monthly payments on her account balance. Wilson made here last payment to Citibank in March

and failed to make payments thereafter. Citibank then filed suit against her to collect her

overdue balance, which was $

In this action, Citibank attempted to enforce the revised agreement rather than the original

agreement.

Wilson argued that she never accepted the revised agreement.

Who wins this one? EXPLAIN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started