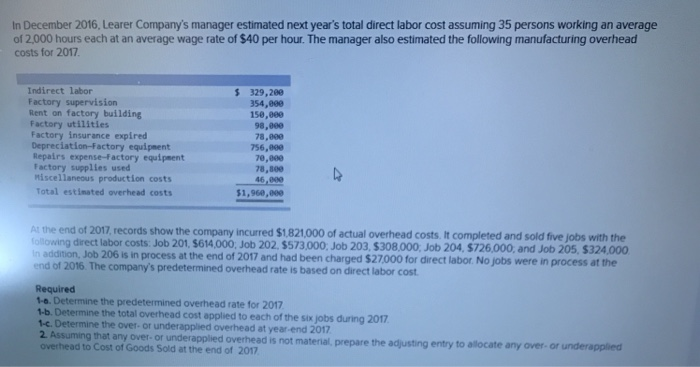

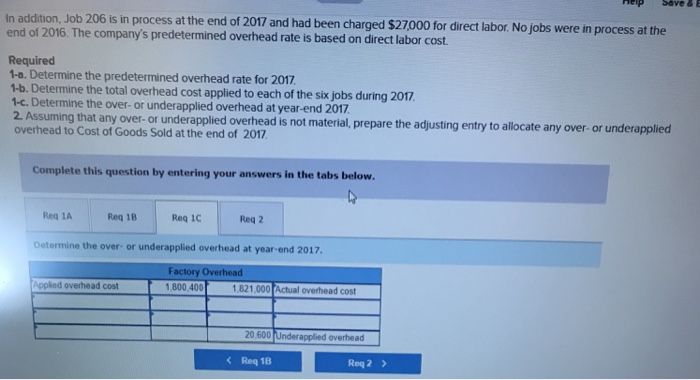

In December 2016, Learer Company's manager estimated next years total direct labor cost assuming 35 persons working an average of 2,000 hours each at an average wage rate of $40 per hour. The manager also estimated the following manufacturing overhead costs for 2017 Indirect labor Factory supervision Rent on factory building Factory utilities Factory insurance expired Depreciation-Factory equipment Repairs expense-Factory equipment Factory supplies used Miscellaneous production costs Total estimated overhead costs 329,260 354,800 150,060 98,000 8,000 756,800 70,000 78,800 51,960,000 A the end of 2017 records show the company incurred s$1821000 of actual overhead costs t completed and sold five jobs with the ollowing direct labor costs: Job 201, $614,000, Job 202, $573,000, Job 203, $308,000, Job 204, $726,000, and Job 205, $324000 in addition, Job 206 is in process at the end of 2017 and had been charged $27,000 for direct labor. No jobs were in process at the end of 2016. The company's predetermined overhead rate is based on direct labor cost Required 1-o. Determine the predetermined overhead rate for 2017 1-b. Determine the total overhead cost applied to each of the six jobs during 2017 1-c. Determine the over-or underapplied overhead at year-end 2017 2. Assuming that any over- or underapplied not overhead is not material, prepare the adjusting entry to allocate any over- or overhead to Cost of Goods Sold at the end of 2017 In addition, Job 206 is in process at the end of 2017 and had been charged $27000 for direct labor. No jobs were in process at the end of 2016. The company's predetermined overhead rate is based on direct labor cost. Required 1-a. Determine the predetermined overhead rate for 2017 1-b. Determine the total overhead cost applied to each of the six jobs during 2017 1-c. Determine the over-or underapplied overhead at year-end 2017 er- or underapplied overhead is not material, prepare the adjusting entry to allocate any over- or underapp overhead to Cost of Goods Sold at the end of 2017 Complete this question by entering your answers in the tabs below. Rea 1A Req 18 Req 1C Req 2 Determine the over- or underapplied overhead at year-end 2017 Factory Overhead 1,800,400 pplied overhead cost 1,821,000 Actual overhead cost 20,600 Underapplied overhead C Req 1B Req 2 >