Answered step by step

Verified Expert Solution

Question

1 Approved Answer

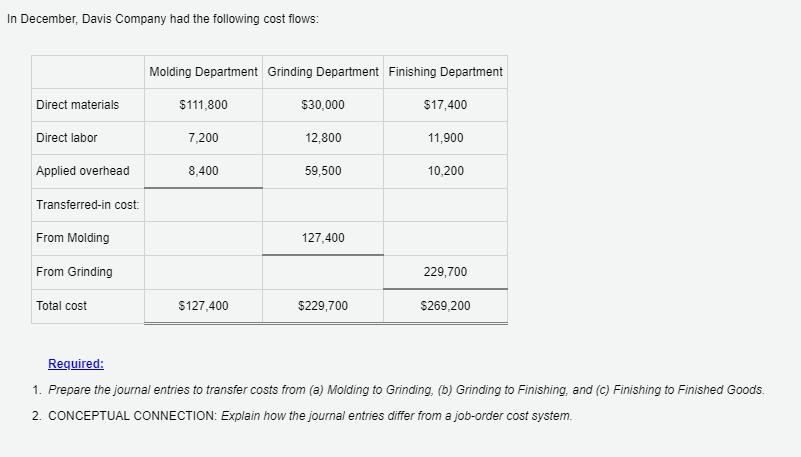

In December, Davis Company had the following cost flows: Direct materials Direct labor Applied overhead Transferred-in cost: From Molding From Grinding Total cost Molding

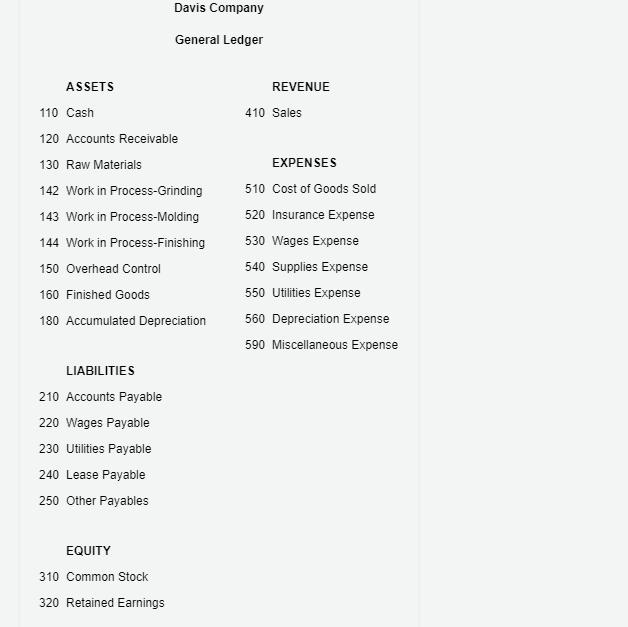

In December, Davis Company had the following cost flows: Direct materials Direct labor Applied overhead Transferred-in cost: From Molding From Grinding Total cost Molding Department Grinding Department Finishing Department $111,800 7,200 8,400 $127,400 $30,000 12,800 59,500 127,400 $229,700 $17,400 11,900 10,200 229,700 $269,200 Required: 1. Prepare the journal entries to transfer costs from (a) Molding to Grinding, (b) Grinding to Finishing, and (c) Finishing to Finished Goods. 2. CONCEPTUAL CONNECTION: Explain how the journal entries differ from a job-order cost system. ASSETS 110 Cash 120 Accounts Receivable 130 Raw Materials 142 Work in Process-Grinding 143 Work in Process-Molding 144 Work in Process-Finishing 150 Overhead Control 160 Finished Goods 180 Accumulated Depreciation LIABILITIES 210 Accounts Payable 220 Wages Payable 230 Utilities Payable 240 Lease Payable 250 Other Payables Davis Company General Ledger EQUITY 310 Common Stock 320 Retained Earnings REVENUE 410 Sales EXPENSES 510 Cost of Goods Sold 520 Insurance Expense 530 Wages Expense 540 Supplies Expense 550 Utilities Expense 560 Depreciation Expense 590 Miscellaneous Expense 1. Prepare the Dec. 31 journal entries to transfer costs from (a) Molding to Grinding, (b) Grinding to Finishing, and (c) Finishing to Finished Goods. Refer to the Chart of Accounts for the exact wording of account titles. Question not attempted. 1 2 3 4 5 6 DATE ACCOUNT GENERAL JOURNAL POST. REF. DEBIT PAGE 15 Score: 0/76 CREDIT

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Date Account Debit Credit 1 Work in processGrinding ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started