Answered step by step

Verified Expert Solution

Question

1 Approved Answer

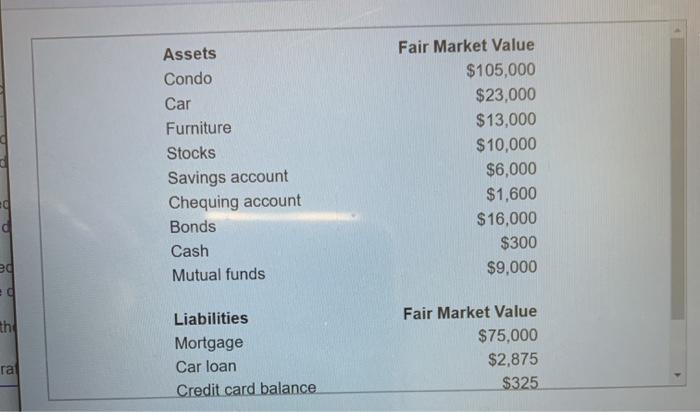

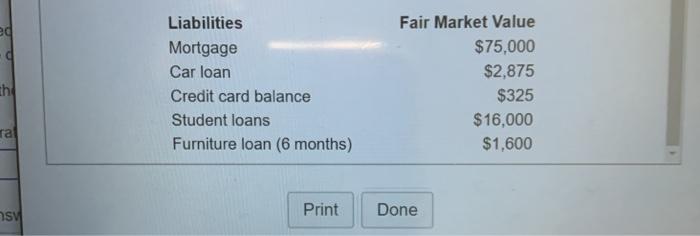

please show the working Santos and Cecilia have the assets and liabilities attached below. Assume that Santos and Cecilia have monthly living expenses of $2,000.

please show the working

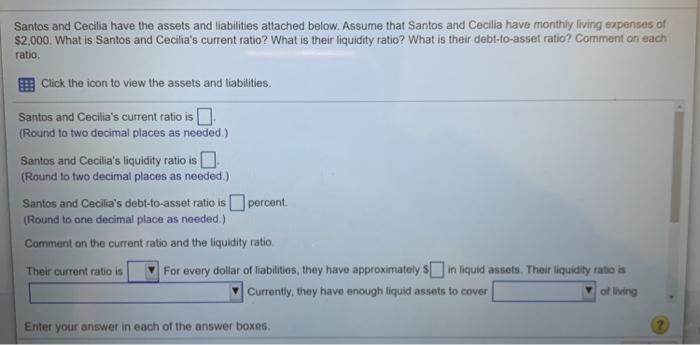

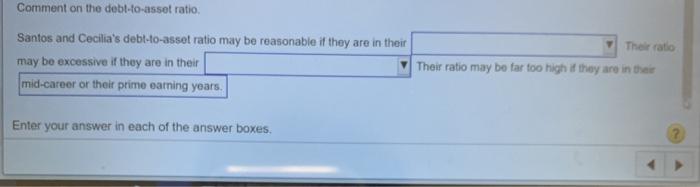

Santos and Cecilia have the assets and liabilities attached below. Assume that Santos and Cecilia have monthly living expenses of $2,000. What is Santos and Cecilia's current ratio? What is their liquidity ratio? What is their debt-to-asset ratio? Comment on each ratio. Click the icon to view the assets and liabilities. Santos and Cecilia's current ratio is. (Round to two decimal places as needed.) Santos and Cecilia's liquidity ratio isO (Round to two decimal places as needed.) Santos and Cecilia's debt-to-asset ratio is O percent. (Round to one decimal place as needed.) Comment on the current ratio and the liquidity ratio. Their current ratio is For every dollar of liabilities, they have approximately S in liquid assets. Their liquidity ratio is Currently, they have enough liquid assets to cover of living Enter your answer in each of the answer boxes.

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Current ratio Current asset Current liability 241501455 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started