Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In each of the following cases indicate the correct filing status and number of qualifying dependents for tax year 2 0 2 3 . Provide

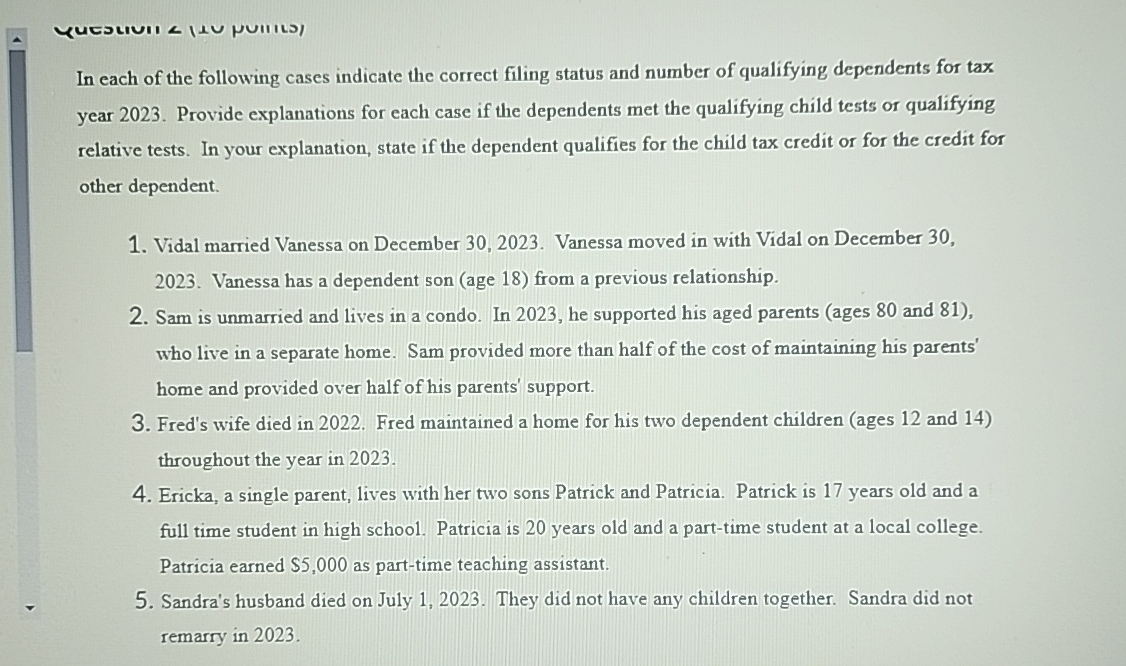

In each of the following cases indicate the correct filing status and number of qualifying dependents for tax year Provide explanations for each case if the dependents met the qualifying child tests or qualifying relative tests. In your explanation, state if the dependent qualifies for the child tax credit or for the credit for other dependent.

Vidal married Vanessa on December Vanessa moved in with Vidal on December Vanessa has a dependent son age from a previous relationship.

Sam is unmarried and lives in a condo. In he supported his aged parents ages and who live in a separate home. Sam provided more than half of the cost of maintaining his parents' home and provided over half of his parents' support.

Fred's wife died in Fred maintained a home for his two dependent children ages and throughout the year in

Ericka, a single parent, lives with her two sons Patrick and Patricia. Patrick is years old and a full time student in high school. Patricia is years old and a parttime student at a local college. Patricia earned $ as parttime teaching assistant.

Sandra's husband died on July They did not have any children together. Sandra did not remarry in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started