Question

In early January 2010, you purchased $44,000 worth of some high-grade corporate bonds. The bonds carried a coupon of 9 6/8% and mature in 2024.

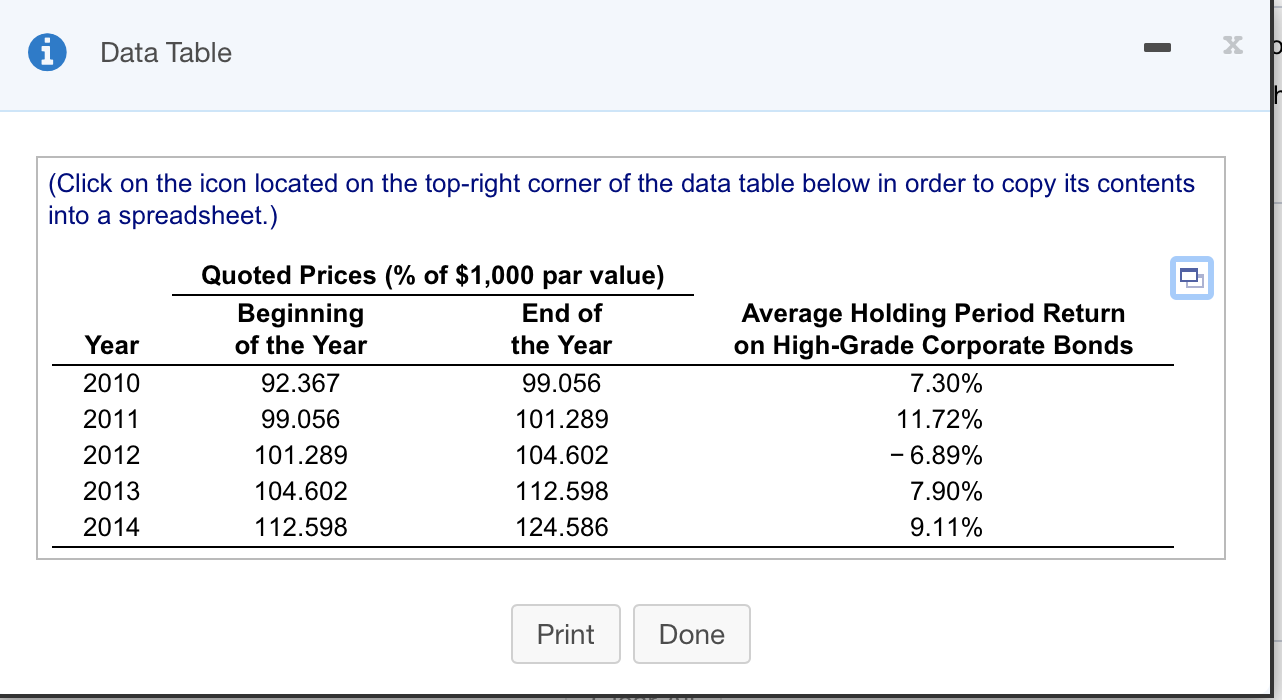

In early January 2010, you purchased $44,000 worth of some high-grade corporate bonds. The bonds carried a coupon of 9 6/8% and mature in 2024. You paid 92.367 when you bought the bonds. Over the five years from 2010 through 2014, the bonds were priced in the market as follows:

Coupon payments were made on schedule throughout the 5-year period.

a. Find the annual holding period returns for

2010

2011

2012

2013

2014.

b. Use the average return information in the given table to evaluate the investment performance of this bond. How do you think it stacks up against the market? Explain.

i Data Table X (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Year 2010 2011 2012 2013 2014 Quoted Prices (% of $1,000 par value) Beginning End of of the Year the Year 92.367 99.056 99.056 101.289 101.289 104.602 104.602 112.598 112.598 124.586 Average Holding Period Return on High-Grade Corporate Bonds 7.30% 11.72% -6.89% 7.90% 9.11% Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started