Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In February 2019, ABC Ltd. grants Nancy options to acquire 4,000 shares of the company at an exercise price of $10. At that time,

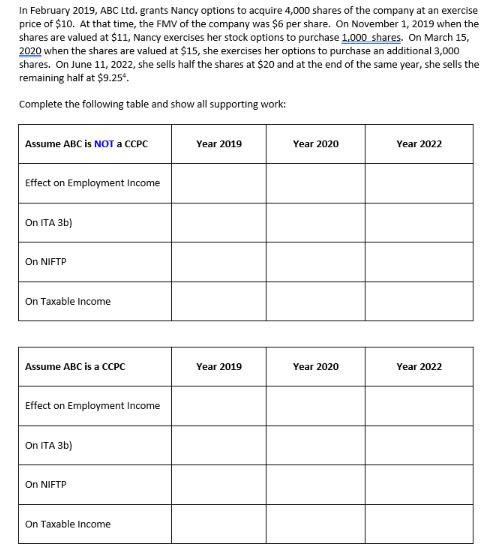

In February 2019, ABC Ltd. grants Nancy options to acquire 4,000 shares of the company at an exercise price of $10. At that time, the FMV of the company was $6 per share. On November 1, 2019 when the shares are valued at $11, Nancy exercises her stock options to purchase 1,000 shares. On March 15, 2020 when the shares are valued at $15, she exercises her options to purchase an additional 3,000 shares. On June 11, 2022, she sells half the shares at $20 and at the end of the same year, she sells the remaining half at $9.254. Complete the following table and show all supporting work: Assume ABC is NOT a CCPC Effect on Employment Income On ITA 3b) On NIFTP On Taxable Income Assume ABC is a CCPC Effect on Employment Income On ITA 3b) On NIFTP On Taxable Income Year 2019 Year 2019 Year 2020 Year 2020 Year 2022 Year 2022

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Scenario 1 ABC is not a CCPC Year 2019 Employment Income Nancy exercised 1000 shares at an exercise price of 10 each when the market price was 11 resu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started