Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nancy, an executive at a marketing company ABC Ltd., is promoted to Regional Director during the year. Information relating to her employment at ABC

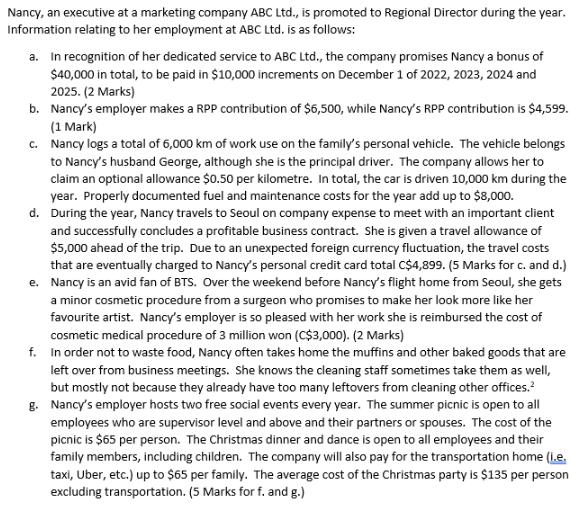

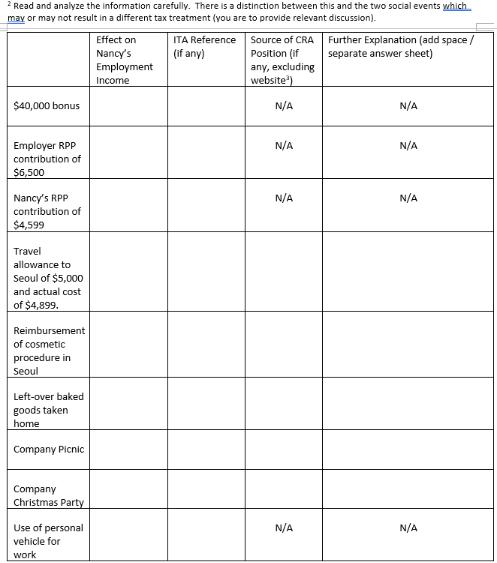

Nancy, an executive at a marketing company ABC Ltd., is promoted to Regional Director during the year. Information relating to her employment at ABC Ltd. is as follows: a. In recognition of her dedicated service to ABC Ltd., the company promises Nancy a bonus of $40,000 in total, to be paid in $10,000 increments on December 1 of 2022, 2023, 2024 and 2025. (2 Marks) b. Nancy's employer makes a RPP contribution of $6,500, while Nancy's RPP contribution is $4,599. (1 Mark) c. Nancy logs a total of 6,000 km of work use on the family's personal vehicle. The vehicle belongs to Nancy's husband George, although she is the principal driver. The company allows her to claim an optional allowance $0.50 per kilometre. In total, the car is driven 10,000 km during the year. Properly documented fuel and maintenance costs for the year add up to $8,000. d. During the year, Nancy travels to Seoul on company expense to meet with an important client and successfully concludes a profitable business contract. She is given a travel allowance of $5,000 ahead of the trip. Due to an unexpected foreign currency fluctuation, the travel costs that are eventually charged to Nancy's personal credit card total C$4,899. (5 Marks for c. and d.) e. Nancy is an avid fan of BTS. Over the weekend before Nancy's flight home from Seoul, she gets a minor cosmetic procedure from a surgeon who promises to make her look more like her favourite artist. Nancy's employer is so pleased with her work she is reimbursed the cost of cosmetic medical procedure of 3 million won (C$3,000). (2 Marks) f. In order not to waste food, Nancy often takes home the muffins and other baked goods that are left over from business meetings. She knows the cleaning staff sometimes take them as well, but mostly not because they already have too many leftovers from cleaning other offices. g. Nancy's employer hosts two free social events every year. The summer picnic is open to all employees who are supervisor level and above and their partners or spouses. The cost of the picnic is $65 per person. The Christmas dinner and dance is open to all employees and their family members, including children. The company will also pay for the transportation home (i.e. taxi, Uber, etc.) up to $65 per family. The average cost of the Christmas party is $135 per person excluding transportation. (5 Marks for f. and g.) 2 Read and analyze the information carefully. There is a distinction between this and the two social events which may or may not result in a different tax treatment (you are to provide relevant discussion). $40,000 bonus Employer RPP contribution of $6,500 Nancy's RPP contribution of $4,599 Travel allowance to Seoul of $5,000 and actual cost of $4,899. Reimbursement of cosmetic procedure in Seoul Left-over baked goods taken home Company Picnic Company Christmas Party Use of personal vehicle for work Effect on Nancy's Employment Income ITA Reference (if any) Source of CRA Position (if any, excluding website) N/A N/A N/A N/A Further Explanation (add space/ separate answer sheet) N/A N/A N/A N/A

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Effect on Nancys Employment Income 1 40000 bonus The 40000 bonus promised to Nancy is considered employment income and should be included in her taxable income in the respective years when sh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started