In FIFO Method!!

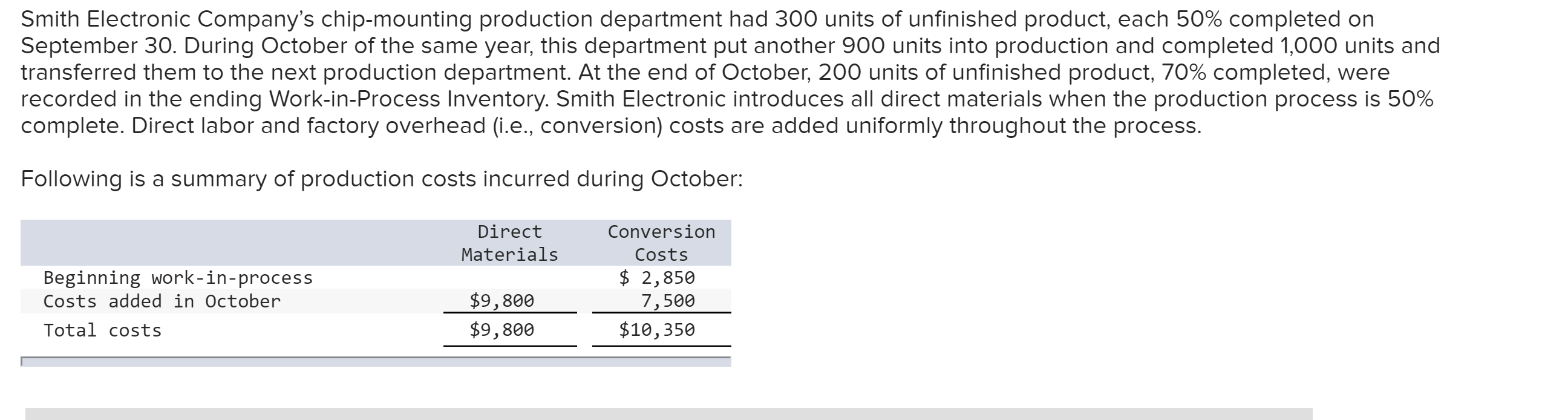

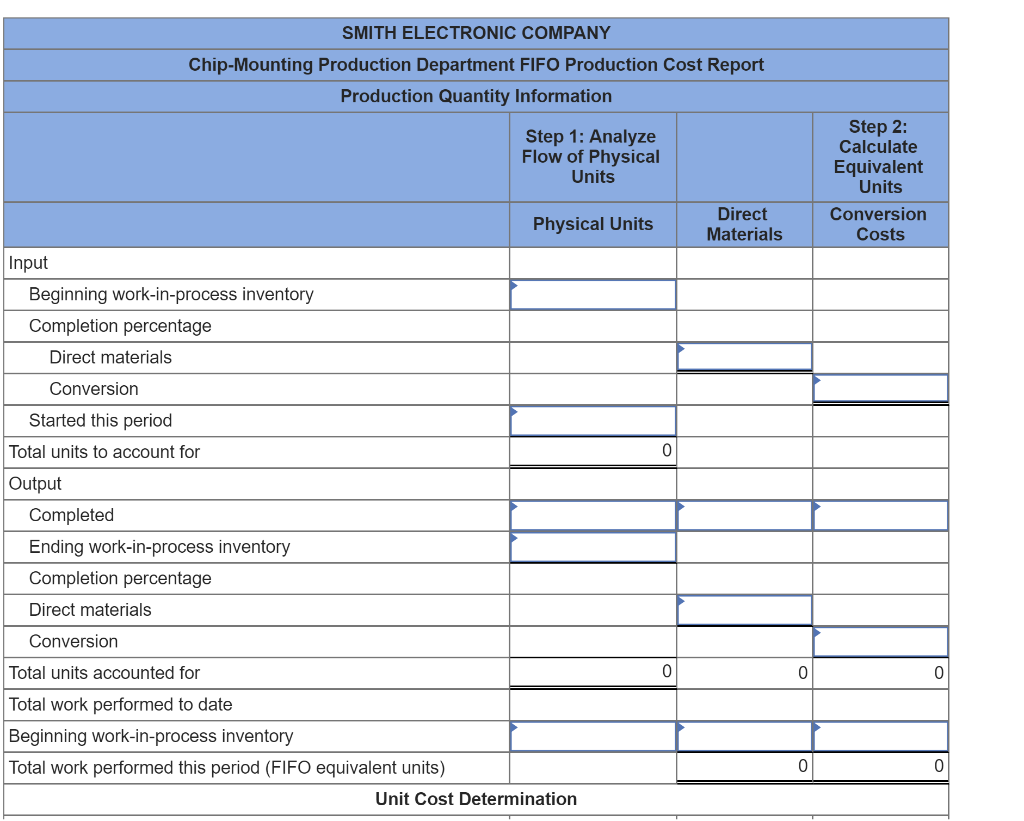

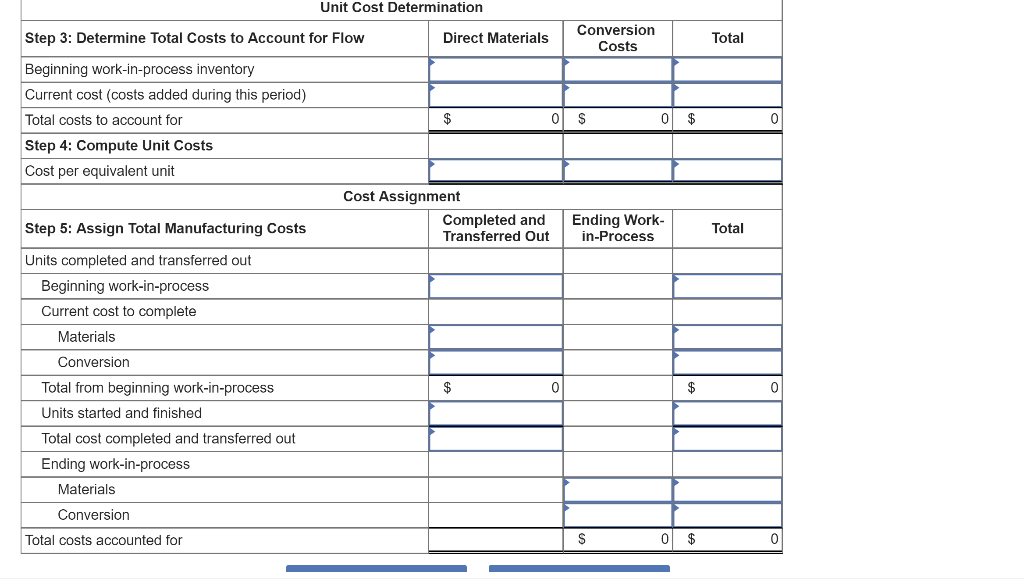

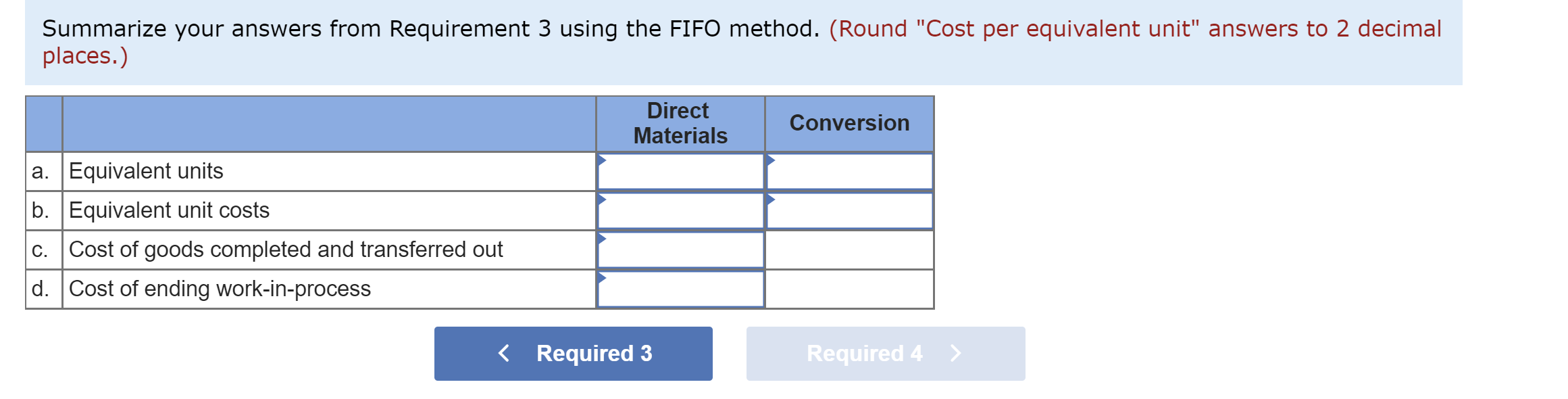

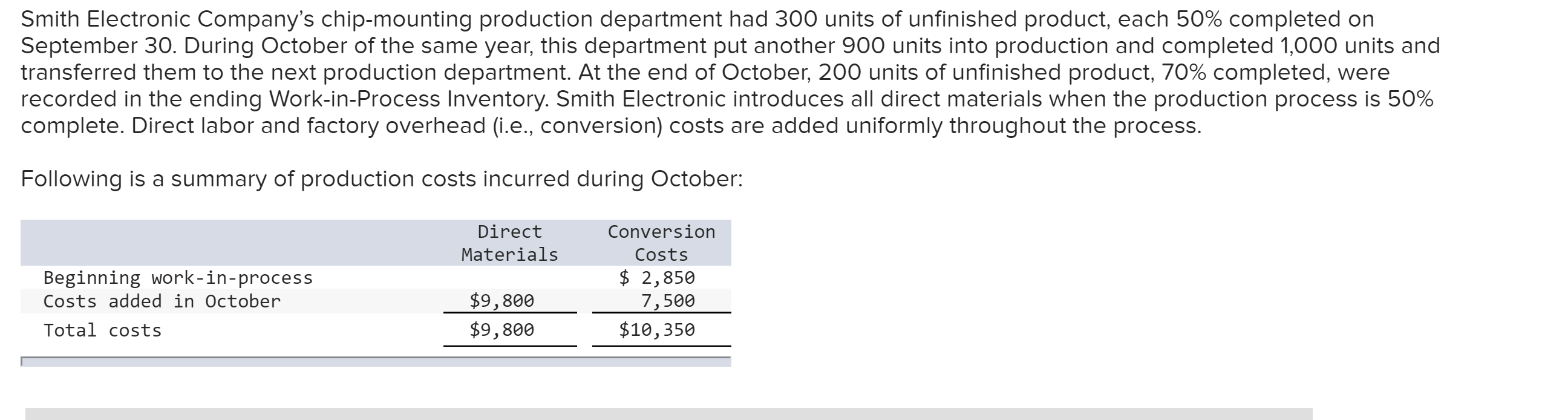

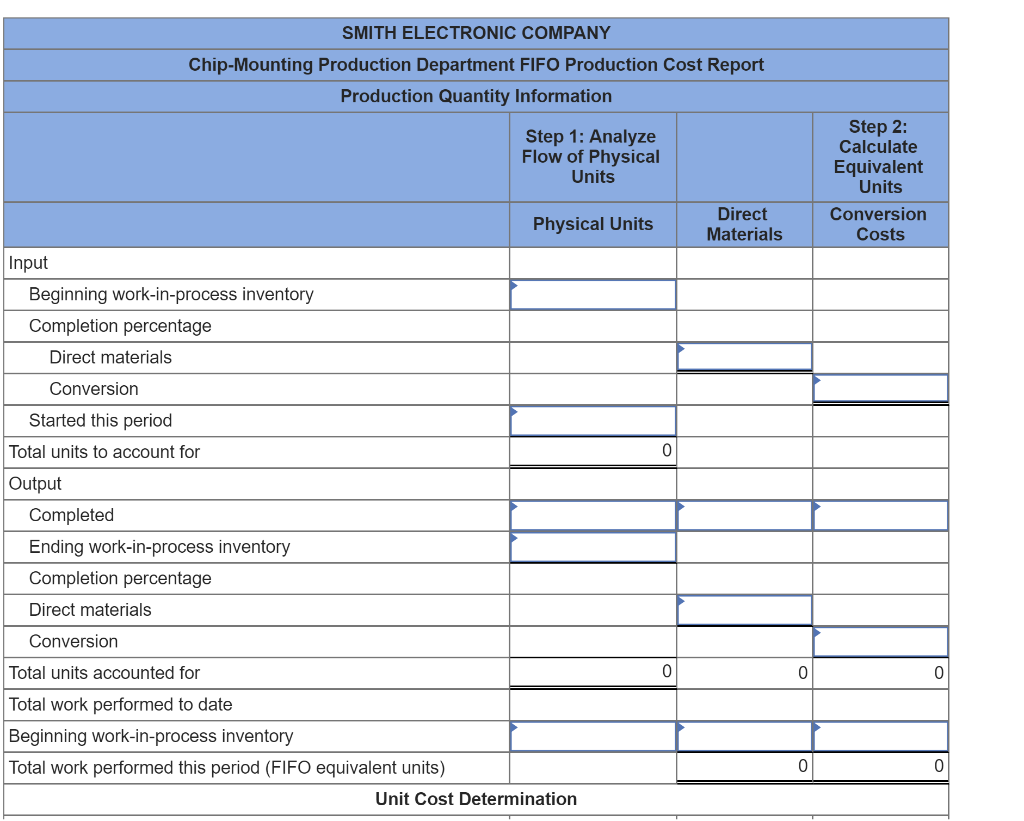

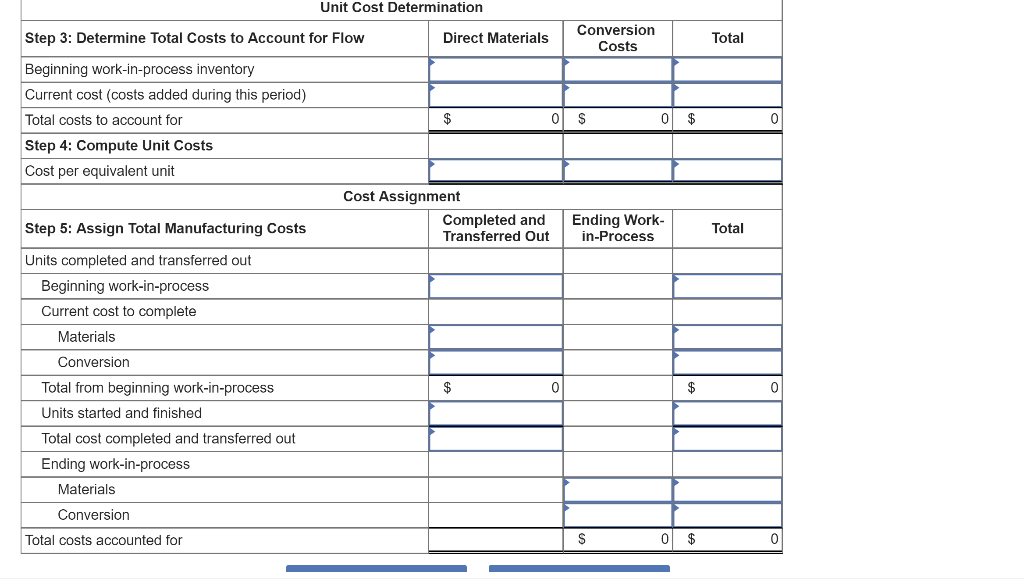

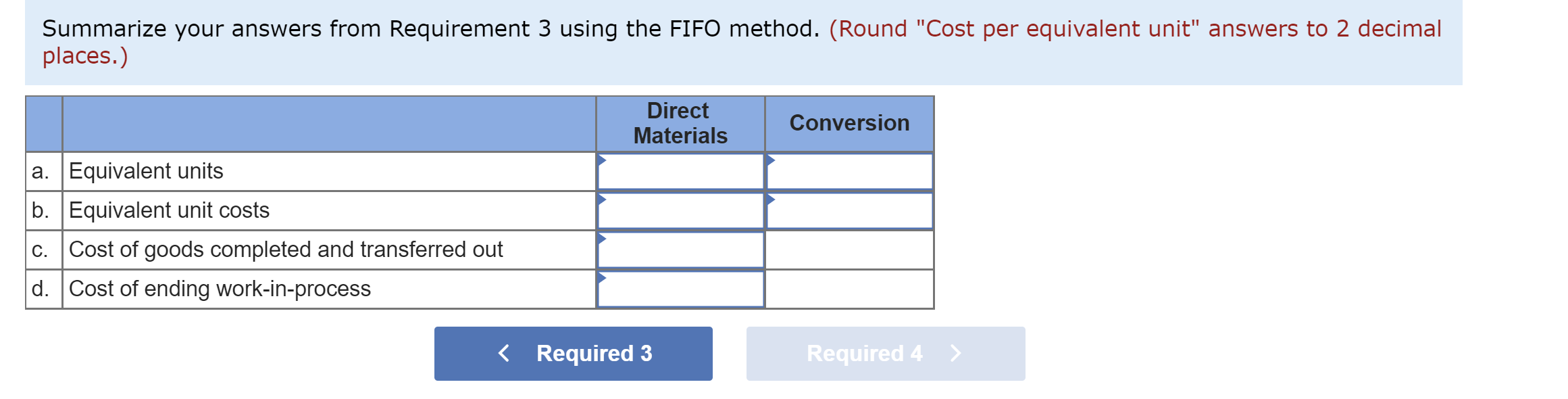

Smith Electronic Company's chip-mounting production department had 300 units of unfinished product, each 50% completed on September 30. During October of the same year, this department put another 900 units into production and completed 1,000 units and transferred them to the next production department. At the end of October, 200 units of unfinished product, 70% completed, were recorded in the ending Work-in-Process Inventory. Smith Electronic introduces all direct materials when the production process is 50% complete. Direct labor and factory overhead (i.e., conversion) costs are added uniformly throughout the process. Following is a summary of production costs incurred during October: Direct Materials Beginning work-in-process Costs added in October Conversion Costs $ 2,850 7,500 $10,350 $9,800 $9,800 Total costs SMITH ELECTRONIC COMPANY Chip-Mounting Production Department FIFO Production Cost Report Production Quantity Information Step 1: Analyze Flow of Physical Units Step 2: Calculate Equivalent Units Conversion Costs Physical Units Direct Materials Input Beginning work-in-process inventory Completion percentage Direct materials Conversion Started this period 0 Total units to account for Output Completed Ending work-in-process inventory Completion percentage Direct materials Conversion Total units accounted for 0 0 0 Total work performed to date Beginning work-in-process inventory Total work performed this period (FIFO equivalent units) Unit Cost Determination 0 0 Unit Cost Determination Step 3: Determine Total Costs to Account for Flow Direct Materials Conversion Costs Total Beginning work-in-process inventory Current cost (costs added during this period) Total costs to account for Step 4: Compute Unit Costs Cost per equivalent unit $ 0 $ 0 $ 0 Cost Assignment Completed and Transferred Out Step 5: Assign Total Manufacturing Costs Ending Work- in-Process Total Units completed and transferred out Beginning work-in-process Current cost to complete Materials Conversion Total from beginning work-in-process Units started and finished Total cost completed and transferred out Ending work-in-process Materials $ 0 $ 0 Conversion Total costs accounted for S 0 $ 0 Summarize your answers from Requirement 3 using the FIFO method. (Round "Cost per equivalent unit" answers to 2 decimal places.) Direct Materials Conversion a. Equivalent units b. Equivalent unit costs Cost of goods completed and transferred out d. Cost of ending work-in-process C.