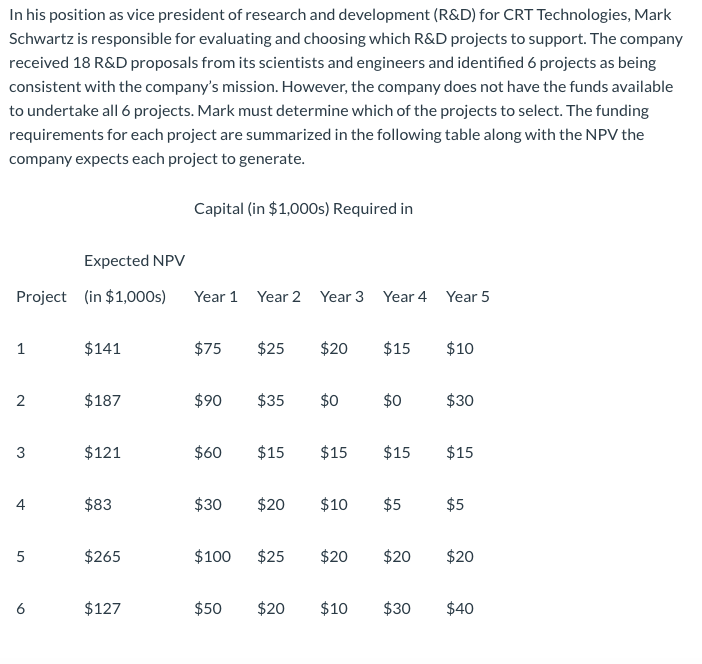

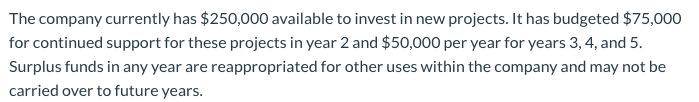

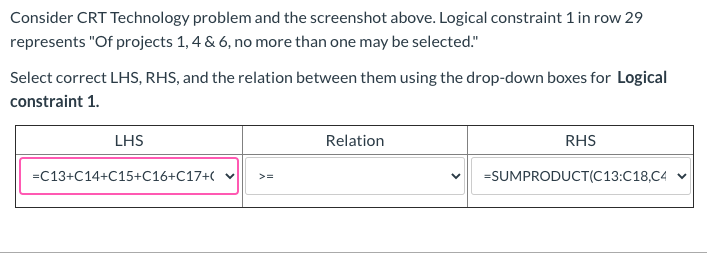

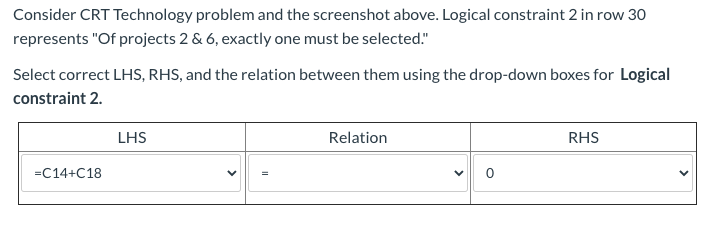

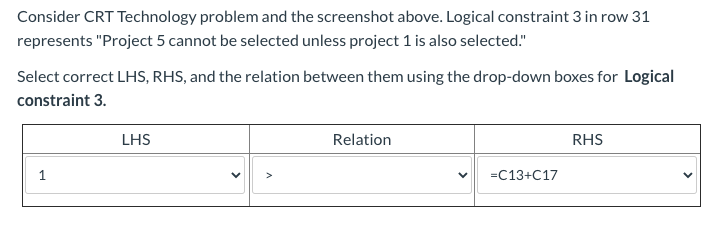

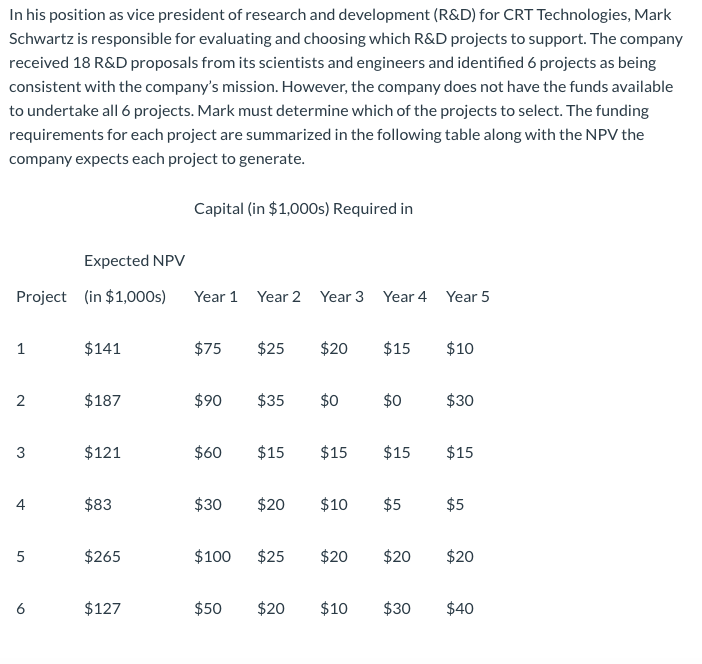

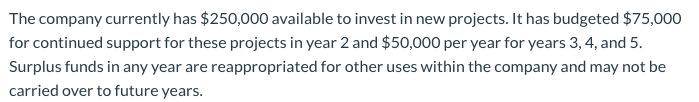

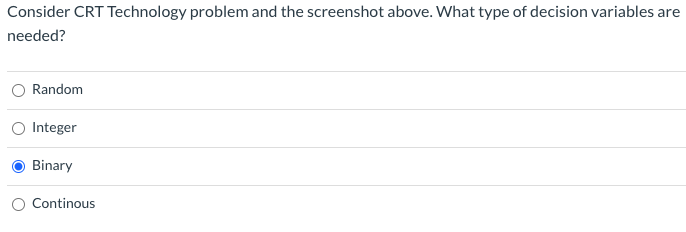

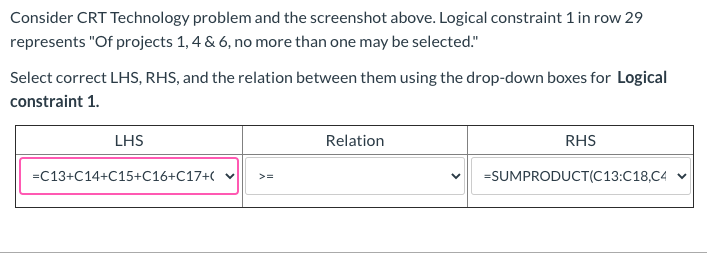

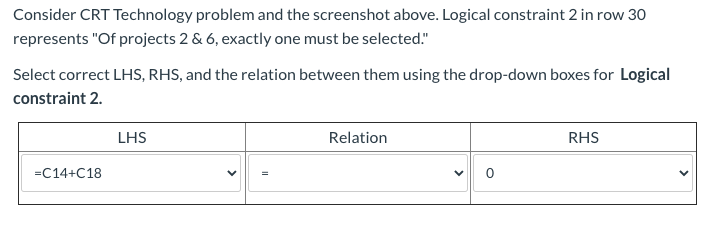

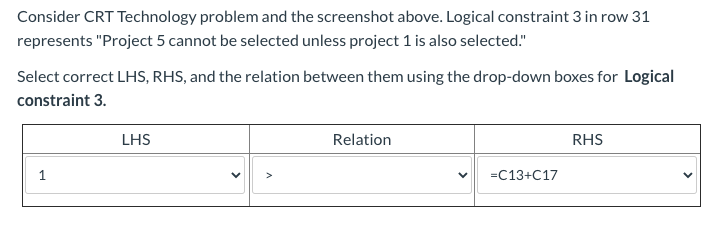

In his position as vice president of research and development (R&D) for CRT Technologies, Mark Schwartz is responsible for evaluating and choosing which R&D projects to support. The company received 18 R&D proposals from its scientists and engineers and identified 6 projects as being consistent with the company's mission. However, the company does not have the funds available to undertake all 6 projects. Mark must determine which of the projects to select. The funding requirements for each project are summarized in the following table along with the NPV the company expects each project to generate. Capital (in $1,000s) Required in Expected NPV Project (in $1,000s) Year 1 Year 2 Year 3 Year 4 Year 5 1 $141 $75 $25 $20 $15 $10 2 $187 $90 $35 $0 $0 $30 3 $121 $60 $15 $15 $15 $15 4 $83 $30 $20 $10 $5 $5 5 $265 $100 $25 $20 $20 $20 6 $127 $50 $20 $10 $30 $40 The company currently has $250,000 available to invest in new projects. It has budgeted $75,000 for continued support for these projects in year 2 and $50,000 per year for years 3, 4, and 5. Surplus funds in any year are reappropriated for other uses within the company and may not be carried over to future years. EF G H Year 1 $75 Capital Required in Year 2 Year 3 Year 4 $25 $20 $15 $35 $0 $0 $15 $15 $15 $20 $10 $5 $25 $20 $20 $20 $10 $30 $75 $50 $50 $90 $60 $30 $100 $50 $250 Year 5 $10 $30 $15 $5 $20 $40 $50 4 6 1 B 1 Input Parameters 2 3 Projects NPV 4 $141 5 2 $187 6 3 $121 7 $83 8 5 $265 9 $127 10 Budget 11 Decision Variables 12 Projects Invest or not 13 14 2 15 3 16 17 5 18 6 19 Objective 20 Total NPV 21 22 Subject to 23 LHS 24 Total Spending in Year 1 25 Total Spending in Year 2 26 Total Spending in Year 3 27 Total Spending in Year 4 28 Total Spending in Year 5 29 Logical constraint 1 30 Logical constraint 2 31 Logical constraint 3 4 RHS Consider CRT Technology problem and the screenshot above. What type of decision variables are needed? Random Integer Binary O Continous Consider CRT Technology problem and the screenshot above. Logical constraint 1 in row 29 represents "Of projects 1,4&6, no more than one may be selected." Select correct LHS, RHS, and the relation between them using the drop-down boxes for Logical constraint 1. LHS Relation RHS =C13+C14+C15+C16+C17+ V V =SUMPRODUCT(C13:C18.04 Consider CRT Technology problem and the screenshot above. Logical constraint 2 in row 30 represents "Of projects 2 & 6, exactly one must be selected." Select correct LHS, RHS, and the relation between them using the drop-down boxes for Logical constraint 2. LHS Relation RHS =C14+C18 Consider CRT Technology problem and the screenshot above. Logical constraint 3 in row 31 represents "Project 5 cannot be selected unless project 1 is also selected." Select correct LHS, RHS, and the relation between them using the drop-down boxes for Logical constraint 3. LHS Relation RHS 1 V V =C13+C17